Pidilite Industries share price dips as stock adjusts for 1:1 bonus issue

On September 23, 2025, Pidilite Industries, the company behind Fevicol, announced a 1:1 bonus share issue. This means each shareholder received one extra share for every share they owned, free of cost. The move is usually seen as positive, signaling confidence in the company’s growth.

However, the stock price fell sharply by over 50% on the same day. Many investors were alarmed by this sudden drop. It is important to note that this decline is normal after a bonus issue. The fall reflects the doubling of shares in the market, not a decrease in the company’s value.

This article explains why Pidilite issued bonus shares, how stock prices adjust afterward, and what this means for investors. By reading further, you will understand how corporate actions like bonus issues can affect stock prices and investor sentiment without changing the company’s actual worth.

What is a Bonus Issue?

A bonus issue occurs when a company gives extra shares to its existing shareholders at no cost. In a 1:1 bonus issue, shareholders receive one new share for every share they already own. This move does not increase the total value of an investor’s holdings. Instead, it raises the number of shares in the market, which lowers the share price proportionally.

Companies often announce bonus issues to reward loyal investors, improve stock liquidity, and make shares more affordable to a wider group. Even though the number of shares rises, the company’s total market capitalization remains the same.

Pidilite Industries announced its 1:1 bonus issue on August 6, 2025, its first in 15 years. The record date was set for September 23, 2025. Only shareholders holding shares on this date were eligible to receive the additional shares.

Price Adjustment Mechanism

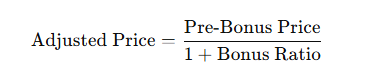

Following a bonus issue, the share price undergoes an automatic adjustment to account for the increased number of shares. This adjustment is necessary to maintain the proportional value of a shareholder’s investment. The formula for calculating the adjusted share price is:

For instance, if Pidilite’s share price was ₹3,037.75 before the bonus issue, the adjusted price would be:

This adjustment ensures that the total value of an investor’s holdings remains consistent, despite the increase in the number of shares. It’s important to understand that this price change is a mechanical adjustment and not an indication of the company’s financial health.

Market Reaction to Pidilite’s Bonus Issue

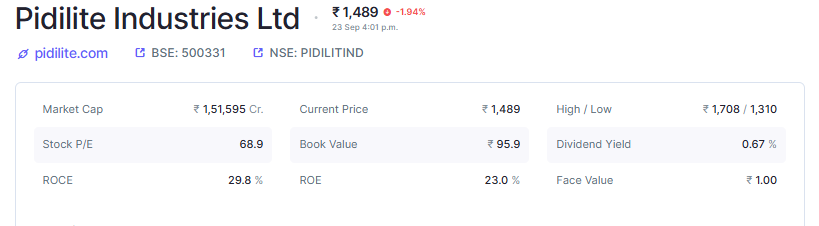

On September 23, 2025, the ex-bonus date for Pidilite Industries, the stock opened at ₹1,534.00. During the day, it fluctuated and hit an intraday low of ₹1,493.35. This drop reflects the automatic adjustment after the bonus issue.

Such movements are normal for stocks after a bonus issue. The fall in price matches the increase in the number of shares. This keeps the total value of an investor’s holdings unchanged. Even though the percentage drop looks large, it does not indicate any loss in the company’s overall market value.

Benefits for Shareholders

Bonus issues provide several benefits for shareholders. They increase the number of shares held, which can improve liquidity and make the stock easier to trade. The lower per-share price after the adjustment can also attract more retail investors, boosting demand.

Additionally, bonus issues often signal a company’s confidence in its financial health and future growth. By giving extra shares, the company shows that it is strong enough to reward its shareholders. This can enhance investor trust and create positive market sentiment.

Pidilite’s Financial and Market Outlook

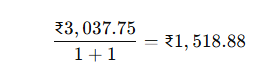

Pidilite Industries has shown strong financial performance in recent quarters. In Q1 2025, the company’s profit after tax rose by 18.7% year-on-year. Revenue also grew by 10.5%, reflecting steady business growth.

The company maintains a solid market position, with products like Fevicol and Dr. Fixit leading their segments. The 1:1 bonus issue is expected to boost shareholder value by improving stock liquidity and attracting more investors.

Analysts believe the bonus issue will support positive investor sentiment. This could increase trading volumes and may lead to higher stock valuations over time. The move shows the company’s commitment to rewarding shareholders while strengthening its market presence.

Investor Takeaways

For investors, it is important to understand that a bonus issue does not change the company’s actual value. The share price adjusts to account for the extra shares, but the total value of an investment remains the same. Investors should focus on the company’s long-term fundamentals rather than short-term price changes.

It is also wise to keep an eye on the company’s performance after the bonus issue. The higher liquidity and wider investor base can influence stock activity and may affect its performance in the market over time.

Final Words

Pidilite Industries’ 1:1 bonus issue is a strategic step to reward shareholders and improve stock liquidity. The initial drop in share price is normal and reflects the increased number of shares. Investors should see this as a chance to evaluate the company’s long-term potential.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.