Alibaba Emerges as Leading China Tech Stock with AI Push

On September 24, 2025, Alibaba dropped a bombshell: it plans to raise its AI investment well above the already ambitious $53 billion mark. This move lit up markets and sent its stock soaring. We now see more clearly why Alibaba is emerging as China’s top tech stock.

For years, Alibaba was known mainly as an e-commerce powerhouse. But in 2025, it is reshaping that image with a bold AI pivot. We face a new narrative, one where Alibaba utilizes artificial intelligence across cloud, logistics, and digital services.

Let’s explore how Alibaba’s AI strategy is transforming investor views. We will dig into the strength of its technology, compare it with rivals, and examine risks like regulation and geopolitics. Finally, we will look ahead: can Alibaba lead globally in AI?

Alibaba’s Market Position in China Tech

Alibaba once ruled online shopping in China. The company faced heavy regulatory pressure in 2020-2021. Growth slowed for its core e-commerce business. Investors grew wary. In 2024-2025, the story began to change. Alibaba shifted focus to cloud computing and AI. That shift helped calm markets and restore confidence.

By September 2025, Alibaba looked less like a pure retailer and more like a full tech platform. Its broad data assets and huge user base give it scale. Those assets now feed new AI services and cloud offerings. This shift is central to Alibaba’s case as a top Chinese tech stock.

The AI Push: Core Developments

Alibaba has rolled out multiple AI models and cloud tools. The Tongyi Qianwen family first gained attention in 2023 with models such as Qwen-72B. Alibaba Cloud followed with specialized industry models and developer tools. In 2025, the company unveiled Qwen3-Max, a large language model reported on September 24, 2025.

Alibaba also announced plans to increase spending beyond the previous $53 billion cloud/AI pledge and to expand global data centers. The firm announced partnerships and moves to support robotics and advanced AI workloads, including closer technical ties with chip and tool vendors. These steps aim to build an AI stack from models to chips to services.

Financial Performance and Stock Market Impact

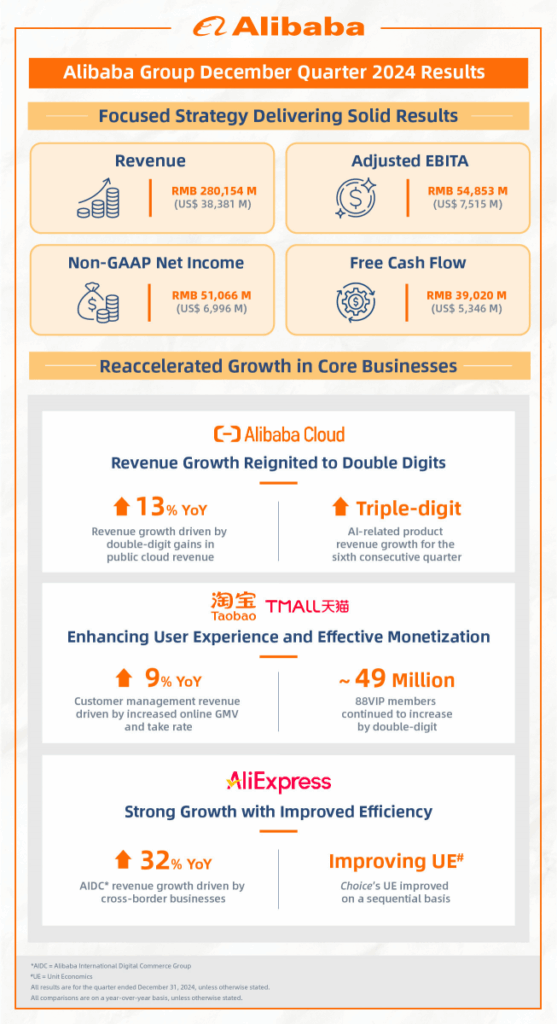

The AI push triggered clear market reactions in September 2025. Shares climbed sharply after the AI spending news and model launch. Year-to-date gains for Alibaba were large by late September. Cloud revenue has been a bright spot. Alibaba Cloud posted consistent double-digit growth in recent quarters and now leads China’s cloud market by share. Investors see cloud plus AI as the main re-rating engine.

Analysts warn that heavy upfront AI investment can lower free cash flow in the near term. Still, many expect faster revenue growth if AI products monetize well. For active investors, using an AI stock research analysis tool may help track model releases, cloud bookings, and capital intensity.

Competitive Arena: Alibaba vs Rivals

The China AI race is crowded. Baidu focuses on AI search and vertical LLMs, notably Ernie. Tencent leans into social and gaming AI. Huawei builds chips and cloud hardware. ByteDance and other cloud players push niche services. Alibaba’s edge lies in scale. The cloud reach, e-commerce data, and logistics network form a deep moat.

This makes it easier to deploy AI across payments, retail search, and logistics. Rivals match strengths in specific areas, Baidu for search, Huawei for hardware, but Alibaba’s cross-business integration helps it monetize AI widely. Market share data show Alibaba Cloud well ahead of many domestic rivals as of September 2025.

Regulatory and Geopolitical Challenges

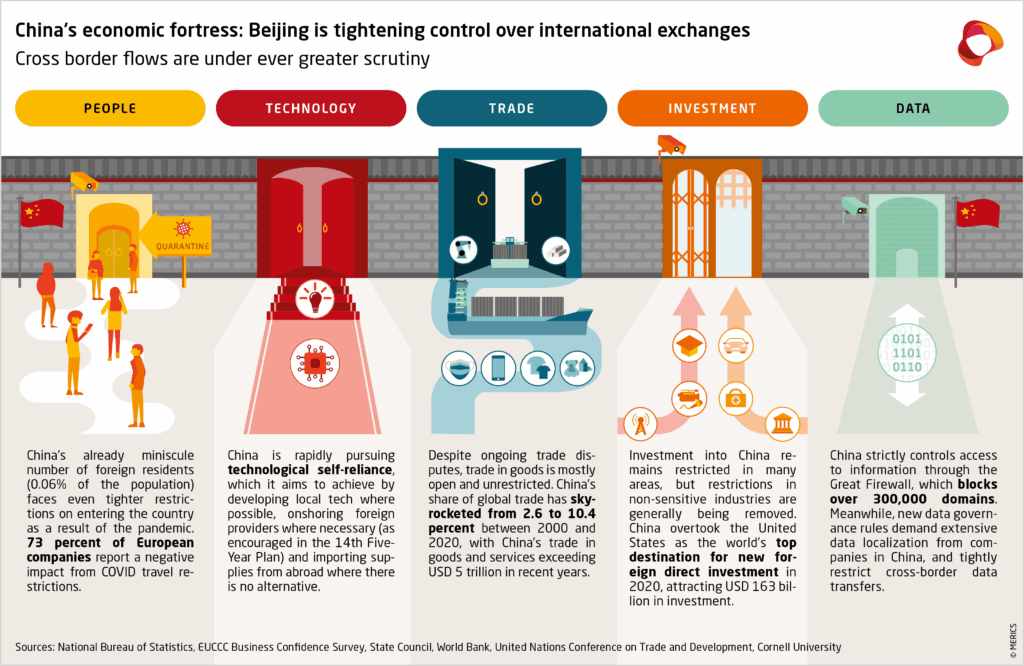

Regulation remains a key risk. China tightened tech rules after 2020. That era eased somewhat by 2024-2025, but the state still closely watches data and AI use. New rules may affect how models train on user data and how AI tools get deployed. On geopolitics, U.S. export controls on advanced chips and equipment have shaped the supply picture.

Restrictions pushed Chinese firms to build domestic chip capacity. Policy shifts in 2025 created mixed signals; some curbs remained in place, while other rules were adjusted. These moves can slow training of the largest models or raise costs. They also motivate China’s drive for local semiconductors and cloud infrastructure. Alibaba must balance compliance with an urgent push for self-reliance.

Global Expansion and Future Outlook

Alibaba is not only focused on China. The company plans to build more cloud data centers overseas. In 2025, announcements included new facilities and services aimed at Brazil, France, and the Netherlands. Expanding abroad helps diversify revenue and attract international cloud customers.

Long-term, success will depend on commercial AI products. Areas with clear revenue potential include logistics optimization, AI-driven merchant tools, and cloud AI platforms for enterprises. If Alibaba converts model breakthroughs into paid services, growth could accelerate. On the other hand, high capital needs and tougher-than-expected regulations could slow progress. Market watchers will focus on cloud bookings, margins for AI services, and the pace of model commercialization.

Conclusion: Opportunity and Risk

Alibaba has moved from e-commerce stalwart to AI and cloud heavyweight. Recent model launches and a bigger AI spend plan changed the market narrative on September 24, 2025. The company now faces both big chances and big tests. The chance is to turn data and scale into durable AI revenue in the China tech stock.

The test is to do that while managing regulation and chip supply limits. Investors should watch cloud growth, AI monetization, and capital intensity. Clear wins on those fronts could cement Alibaba’s place as a leading China tech stock. If hurdles persist, the story may take longer to play out. Either way, Alibaba remains a central player in China’s AI push.

Frequently Asked Questions (FAQs)

Alibaba announced major AI investments on September 24, 2025, and launched its new Qwen3-Max model, boosting investor confidence.

Alibaba is integrating AI into cloud services, e-commerce, and logistics to improve efficiency, attract global clients, and increase revenue.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.