EU Faces Pushback from APPLE Over Digital Market Regulations

On 25 September 2025, Apple formally asked the European Union to repeal its Digital Markets Act (DMA). The DMA is meant to curb the power of Big Tech and force dominant firms to open parts of their platforms. Yet Apple says the law is hurting innovation, delaying features, and raising security concerns.

We follow this clash closely because it may reshape how digital markets work around the world. The EU says it wants fairer competition and more choice for users. Apple claims the rules will break the ecosystem that users love and trust. Right now, the fight is about more than rules; it’s about who controls the digital future.

Let’s explore what the DMA requires, why Apple is pushing back, how regulators respond, and what all of this might mean for developers, consumers, and tech policy everywhere.

Background: What does the DMA require?

The Digital Markets Act (DMA) aims to stop a few big platforms from blocking rivals. It sets clear rules for so-called “gatekeepers.” These are very large tech firms that control core services like app stores and operating systems. The DMA forces gatekeepers to open parts of their systems. It bans self-preferencing. It requires safe ways for users to install apps outside the main store. The law became enforceable in stages from 2023, with key compliance deadlines through 2024. The EU can fine firms up to 10% of their global turnover for breaches.

Apple’s Objections and Specific Claims

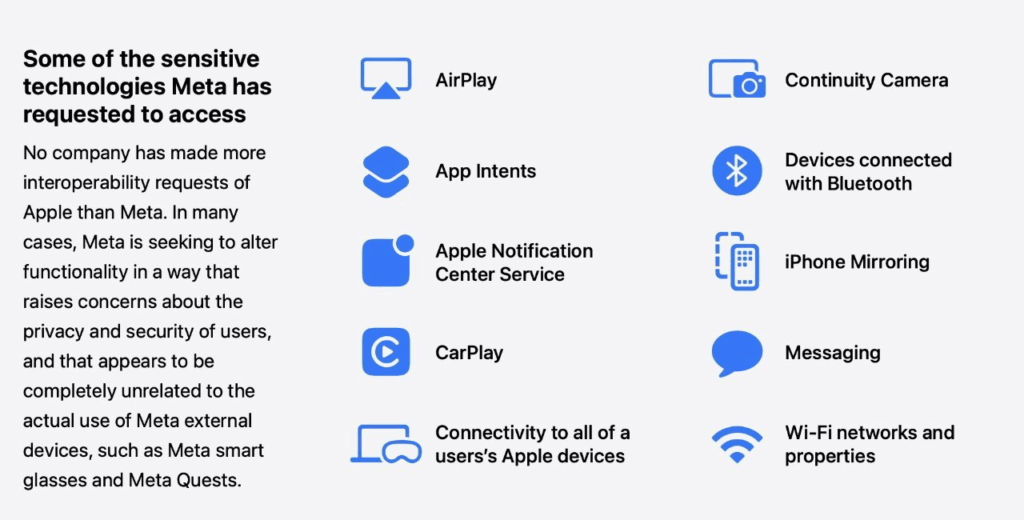

On 25 September 2025, Apple asked the EU to repeal the DMA. The company said the rules have slowed or blocked features in Europe. Apple gave examples such as live translation in AirPods and iPhone screen mirroring. Apple warned that forcing sideloading and third-party marketplaces raises security risks.

The firm said some DMA demands clash with strong privacy safeguards built into iOS. Apple also argued that compliance costs and technical complexity hurt product quality for all users. These claims appeared in Apple’s own statement and were reported widely by news outlets.

The EU View and Enforcement Tools

The European Commission says the DMA protects competition and user choice. Regulators argue that gatekeepers have long set the rules. This shuts out rivals and raises costs for smaller developers. The DMA’s rules aim to let alternative app stores and payment systems exist on big platforms. The commission has already used other tools and fines to push major tech firms to change. The DMA adds a new layer of enforceable duties and stronger penalties. Regulators say companies must adapt instead of seeking repeal.

How Developers and the Market are Reacting?

Developer opinions are mixed. Some app makers welcome lower fees and fewer restrictions. They expect more ways to reach users and more flexible payment terms. Other developers worry that many small users may download unsafe apps if sideloading spreads. Security experts point to past cases on other platforms where malware and fake apps caused harm.

Investors watch closely. Big regulatory fights can change profit margins. Market analysts note that Apple’s business model in Europe could shift if the company must allow rival app stores and external payments.

Technical and Security Trade-offs

Opening a closed ecosystem has real engineering costs. Apple says its tight control lets it build strong privacy protections. The company warns that third-party marketplaces may lack those protections. Regulators counter that companies can meet both openness and security with proper rules. Security researchers say the risk is not zero.

But they add that careful design and vetting can limit harm. The debate centers on whether regulators should trust industry to build safe options or keep stricter control to prevent known threats. Recent legal filings show both sides believe safety arguments will influence judges and public opinion.

Trade and Political Ripple Effects

The DMA has become more than a tech rule. It now shapes trade and diplomacy. U.S. politicians and industry groups see the DMA as a challenge to U.S. tech firms. Some warn of retaliation or calls for reciprocal rules. Other countries watch the EU as a policy lab. Several governments are studying DMA-style laws.

The result could be a patchwork of regional rules instead of one global standard. Companies must decide whether to build region-specific versions of services or to create a single global product that meets the strictest rules. Either path carries cost and risk.

Legal and Commercial Outcomes that Could Follow

Several broad outcomes are possible. Apple could change products for Europe only. This would let the company keep its global model elsewhere. Apple could also try to win in court. Litigation would delay final results and add legal costs.

Regulators could impose fines or require fixes. In a worst-case standoff, some services or devices might be too costly to sell in the EU. That would hurt consumers and developers who rely on European users. The scale of fines up to double-digit percentages of global turnover gives the EU big leverage.

Broader Impact on the Tech Ecosystem

If the DMA sticks, platform power may shrink over time. New marketplaces and payment players could grow. Small developers might gain room to compete. On the other hand, fragmented rules could raise costs for all firms. Consumers could see more choice, but also more complexity. The fight also highlights a new factor in investment choices. Tools such as an AI stock research analysis tool will start to include regulatory risk scores when valuing tech firms. Investors will track compliance timelines and legal outcomes closely.

What to Watch Next?

Key dates and triggers will shape the next phase. The formal EU review of the DMA and any regulator response to Apple’s letter will be crucial. Courts may hear challenges if Apple pursues litigation. Watch for enforcement actions and fines that regulators announce. Also, watch product roadmaps from Apple and app-store changes that may appear in early 2026. Each development will affect users, developers, and markets. Accurate timelines will matter for business plans and investor models.

Conclusion: A Regulatory Tug of War with Global Stakes

The clash between Apple and the EU is about control, safety, and market power. Regulators want open markets. Apple wants to protect its ecosystem. The outcome will affect which rules govern app stores, payments, and device features worldwide. It will also set a tone for how governments regulate tech giants after 2025. The next moves will come from legal filings, commission replies, and product updates. Each will reveal whether the DMA reshapes digital markets or if major platforms can push back.

Frequently Asked Questions (FAQs)

The DMA, active since 2023, makes big platforms open up. Apple says rules harm user safety, slow down features, and weaken its ecosystem.

If Apple ignores DMA, the EU may fine up to 10% of global revenue. Legal fights or blocked services could follow after September 2025.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.