BYD Tops Tesla in EU Sales for Second Straight Month

The electric vehicle (EV) market in Europe is growing fast. More people want cars that run on batteries or use plugs. Governments push this by offering incentives, strict emission rules, and bans on new petrol/diesel car sales in the coming decades. In August 2025, the EU auto market grew 5.3 % year over year. Electrified vehicles (battery EVs, hybrids, plug-in hybrids) made up 62.2 % of all registrations.

Major names compete here: Tesla, BYD, Volkswagen, BMW, Stellantis, Hyundai-Kia, and more. But recently, how consumers think about EVs is shifting. They care not only about prestige but also about affordability, range, and total cost of ownership.

BYD’s Rise in the European Market

BYD entered the European stage with a bold plan. It brought not just full EVs, but also plug-in hybrids (PHEVs). This mix helps it reach buyers who worry about charging infrastructure.

It launched in many countries across Europe, from Germany and France to Eastern Europe. To cut tariffs and logistics costs, BYD is building factories in Hungary (to start operations late 2025) and in Turkey (2026) to locally make cars and batteries.

Its models are resonating. The Atto 3 (compact SUV) and Seal (sedan) are among the more visible ones. The lower-cost models help BYD compete on price without sacrificing too much in tech or range.

BYD also practices vertical integration: it makes its own batteries, controls supply chains, and reduces reliance on outside suppliers. This helps it cut costs and be more flexible.

Tesla’s Struggles in the EU

For years, Tesla held a strong position in Europe thanks to its brand image, high performance, and early lead in EV adoption. But lately, cracks are showing.

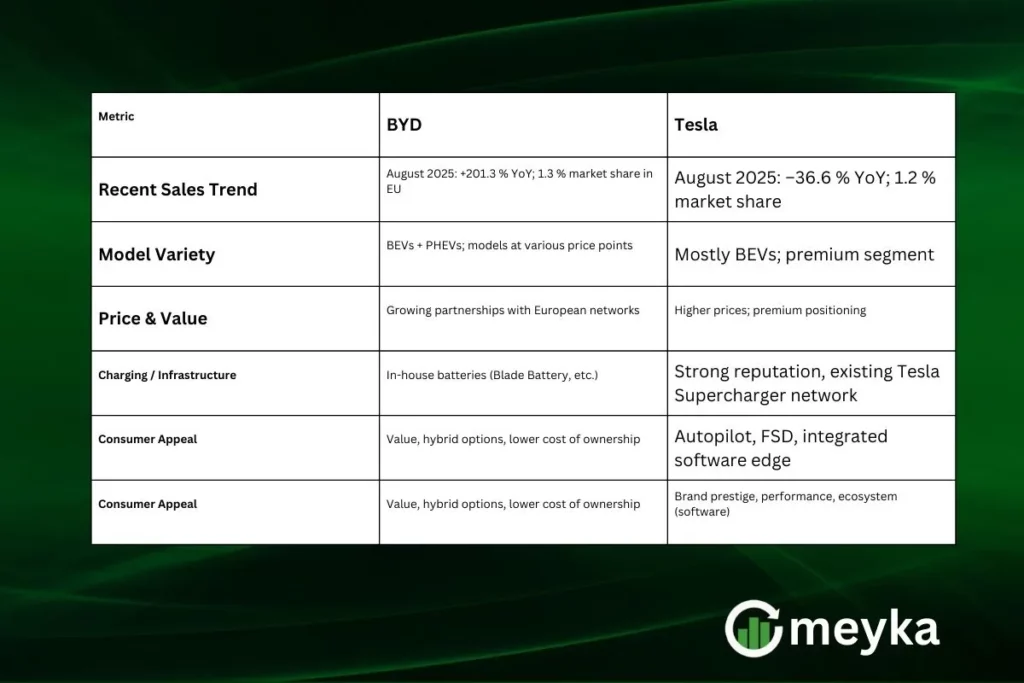

In August 2025, Tesla’s sales in the EU dropped by 36.6 % year over year. Its market share shrank from 2.0 % to about 1.2 %. Meanwhile, BYD rose to a 1.3 % share by the same metric.

Tesla’s product range in Europe is narrower (mainly Model 3 and Model Y). Its cars are also priced higher, making it harder to attract cost-conscious buyers. Add to that operational or supply challenges, and Tesla is feeling pressure.

Moreover, some buyers may be rethinking the brand’s image, especially amid controversies or debates about leadership, politics, and consistency.

Comparative Analysis: BYD vs. Tesla

Let’s look side by side at key dimensions:

BYD’s mix of PHEVs helps it in parts of Europe where charging infrastructure is weak. Tesla’s strength is still in performance, software, brand loyalty, and its Supercharger network.

Reactions from the Industry

European automakers are watching closely. Brands like Volkswagen, BMW, and Stellantis are doubling down on EV lines. Some form alliances, push new platforms, and sharpen their cost structures to defend market share.

Policymakers are cautious. Some are raising concerns about Chinese subsidies and market dominance. There are talks about tariffs or anti-dumping measures. But others see opportunity: BYD plans to localize production, which aligns with EU goals of local manufacturing.

Analysts note that BYD’s success could reshape expectations. If Chinese EVs can compete on cost and performance, it forces incumbents to adapt faster. Investors see value in companies nimble enough to respond.

Broader Implications for the Global EV Race

BYD overtaking Tesla in Europe isn’t just a regional blip. It signals a shift in where power may lie in EVs globally. Chinese automakers, long strong in their home market, are now challenging in the West.

This competition can push prices down, innovation up, and options up for the consumer. Tesla must respond, not only in Europe, but in other markets (Asia, U.S.).

For global automakers, the message is clear: you can’t rest. The next decade will likely belong to those who combine efficiency, strong supply chains, local presence, and tech edge.

Conclusion

When BYD outpaced Tesla in EU sales for the second straight month, it was more than a headline: it’s a sign of change. We’re watching a shift in how EV leadership will be defined. Consumers stand to gain from more options, better prices, and faster innovation. But for Tesla, the challenge is to fight back, not just with features, but with strategy, cost, and localization.

Will BYD keep the edge? Will Tesla reinvent? The European EV battlefield might tell us how the global EV race plays out next.

FAQS:

Yes, BYD beat Tesla in Europe. In August 2025, BYD sold more cars than Tesla for the second month, showing strong growth and demand.

The Tesla Model Y is still Europe’s best-selling EV overall. It remains popular across many countries, even as BYD gains ground with cheaper models.

Tesla is more popular worldwide, with strong brand value and global reach. BYD is rising fast, especially in Europe, because of affordable pricing and wide EV options.

Disclaimer:

This content is for informational purposes only and is not financial advice. Always conduct your research.