Cipla Shares Drop 1.83%; Among Top Nifty 50 Losers Today

On Friday, September 26, 2025, Cipla shares fell 1.83%, making it one of the top losers on the Nifty 50. This decline follows recent fluctuations and highlights challenges in the pharmaceutical sector.

Despite steady revenue and profit growth, Cipla’s stock has faced pressure. For June 2025, consolidated revenue rose to ₹6,957.47 crore from ₹6,693.94 crore in June 2024. Net profit increased to ₹1,292.05 crore, and earnings per share rose from ₹14.58 to ₹16.07.

Positive financials have not protected the stock from broader market trends. Regulatory hurdles and global economic uncertainty have added to volatility. Investors are watching closely. Cipla’s ability to manage these challenges will shape its stock performance and investor confidence.

This article explores the reasons behind Cipla’s decline, its position in the Nifty 50, and what it means for investors.

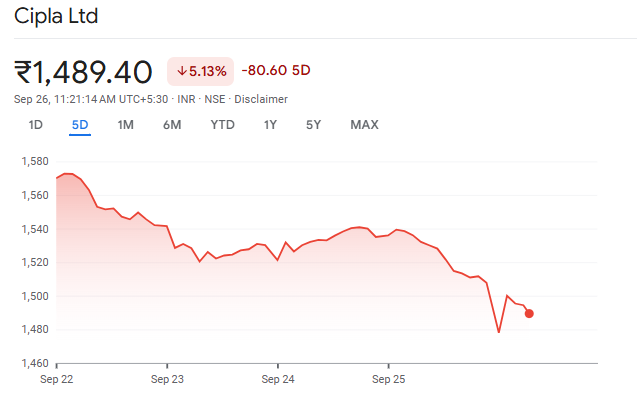

Cipla Shares Performance Overview

On Friday, September 26, 2025, Cipla’s stock closed at ₹1,478.00, marking a decline of 2.05% from the previous day. This drop places Cipla among the top losers on the Nifty 50 index, highlighting investor concerns amid a broader market downturn.

Over the past week, Cipla’s stock has fallen by 4.34%, indicating a challenging market environment for the company. Despite recent positive financial results, the stock’s performance reflects broader market trends and investor sentiment.

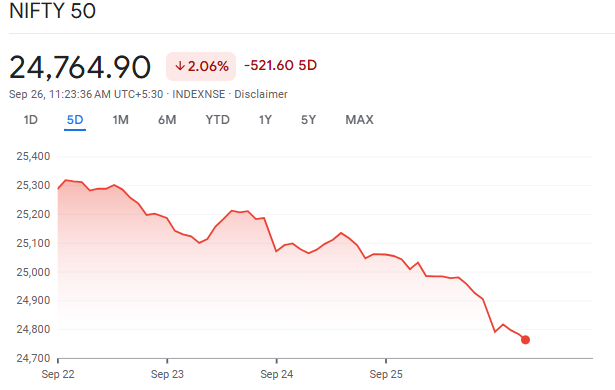

Nifty 50 Index Context

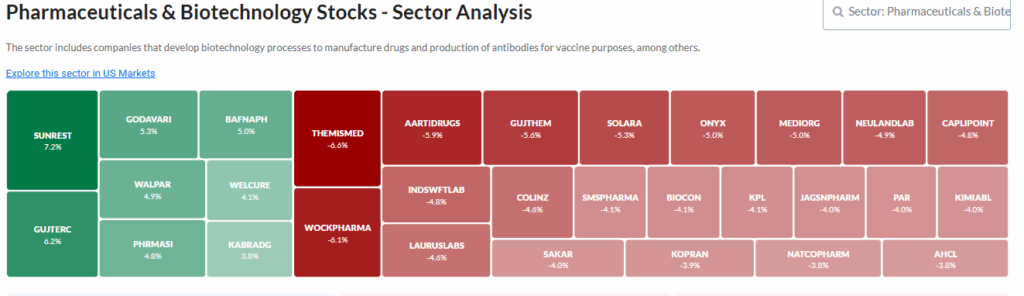

The Nifty 50 index closed at 24,805 on September 26, 2025, down 0.47% for the day. This marks the sixth consecutive session of losses, with 15 of 16 major sectors trading lower. The pharmaceutical sector was hit hardest, sliding 2.4%, following U.S. President Donald Trump’s announcement of a 100% tariff on branded and patented drugs, raising uncertainty about the future of Indian drug exports to the U.S.

Within this context, Cipla’s performance stands out, reflecting both sector-specific challenges and broader market dynamics.

Possible Reasons Behind the Drop

Several factors have contributed to Cipla’s recent stock decline:

President Trump’s threat to impose a 100% tariff on branded drug imports starting October 1 has significantly impacted pharmaceutical stocks. While Indian manufacturers primarily produce generic drugs, the announcement has created uncertainty about future exports to the U.S., which accounts for over a third of India’s drug exports.

Cipla faces ongoing challenges with U.S. FDA approvals, which can delay product launches and affect revenue streams. Additionally, currency volatility and global economic uncertainties pose risks to its international operations.

The broader market downturn, with the Nifty 50 and Sensex both experiencing declines, has led to widespread selling pressure, affecting stocks across sectors, including pharmaceuticals.

Impact on Investors

Cipla’s recent stock performance has implications for investors:

- Short-Term Volatility: The stock’s decline reflects short-term market volatility, influenced by external factors such as tariff announcements and regulatory challenges.

- Long-Term Prospects: Despite current challenges, Cipla’s strong presence in key markets and consistent financial performance suggest potential for recovery. Investors may consider this as part of a long-term investment strategy, keeping in mind the inherent risks.

Cipla’s Future Outlook

Analysts project a cautious outlook for Cipla in the near term, with expectations of continued pressure from regulatory and market challenges. However, the company’s diversified portfolio and strong market position provide a foundation for potential growth. Investors are advised to monitor developments closely, particularly regarding U.S. trade policies and regulatory approvals, which will be crucial in shaping Cipla’s future performance.

Final Words

Cipla’s recent stock decline underscores the challenges faced by the pharmaceutical sector amid changing global trade dynamics and regulatory hurdles. While short-term volatility may persist, the company’s robust fundamentals and strategic initiatives position it for potential long-term growth. Investors should remain informed and consider both the risks and opportunities associated with investing in Cipla.

Frequently Asked Questions (FAQs)

Cipla shares fell 1.83% on September 26, 2025, due to market volatility, pharma sector challenges, and concerns over global trade and regulatory changes affecting investor confidence.

Cipla is part of the Nifty 50 index. Its decline on September 26, 2025, slightly lowered the index and signaled caution for investors in pharma and large-cap stocks.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.