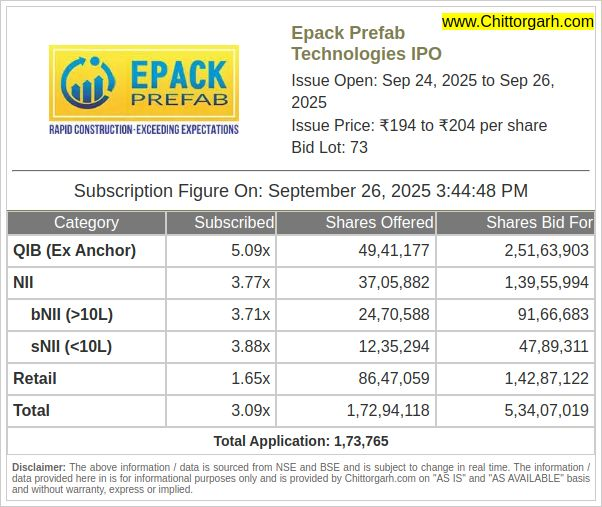

Investors Track Epack Prefab IPO GMP Trends & Day 2 Subscriptions

On September 24, 2025, Epack Prefab Technologies launched its IPO in India with wide interest across investor circles. The offer is priced between ₹194 and ₹204 per share. We are closely watching two key signals, the grey market premium (GMP) and the Day 2 subscription numbers, because they often hint at how the stock might perform once it lists.

GMP reflects how much investors are willing to pay above the issue price in the unlisted market. Day 2 subscription data shows whether demand is building momentum or fading. Together, these help us gauge market sentiment and possible listing gains.

Let’s explore the GMP trends so far, track how Day 2 saw fresh bids, and compare this IPO’s behavior with similar issues in the sector. We also weigh what these signals mean for both short-term traders and long-term investors.

Company Background: Epack Prefab

Epack Prefab Technologies makes insulated panels and prefab structures. The firm serves construction and packaging markets. Revenue rose strongly in the last financial year. The company held a large order book that supports near-term revenue. Expansion plans include new capacity at Andhra Pradesh and Rajasthan sites. These moves aim to scale sandwich panel output and prefab manufacturing. Such growth shows why investors are watching this IPO closely.

IPO Details

The IPO opened on September 24, 2025, and closed on September 26, 2025. The price band was ₹194-₹204 per share. The issue size was about ₹504 crore, including a ₹300 crore fresh issue and an offer-for-sale portion. The lot size was 73 shares. Listing was planned on the NSE and BSE. The funds were earmarked for capacity expansion and working capital. These formal details frame how much capital the company seeks and why.

Day 1 vs Day 2 Subscription Status

Demand on Day 1 was modest. By September 25, the IPO was 0.59 times subscribed at the end of the day. Retail interest showed up, but institutional bids lagged early on. By Day 3 (final day), subscription picked up further but did not skyrocket. The steady build in demand suggested selective buying rather than a broad rush. Market timers watched retail and HNI trends to sense final allotment pressure. Exact exchange figures were published daily during the subscription window.

GMP (Grey Market Premium) Trends

Grey Market Premium (GMP) moved in a narrow positive range during the issue. On September 26, some market trackers showed GMP between ₹11 and ₹15 per share. This placed the implied listing price near ₹215 based on the upper band. GMP rose as the issue neared close, but the gains were modest compared with hotter IPOs. Traders used GMP as a quick gauge of short-term listing expectation. Still, GMP can change fast and is not an official measure.

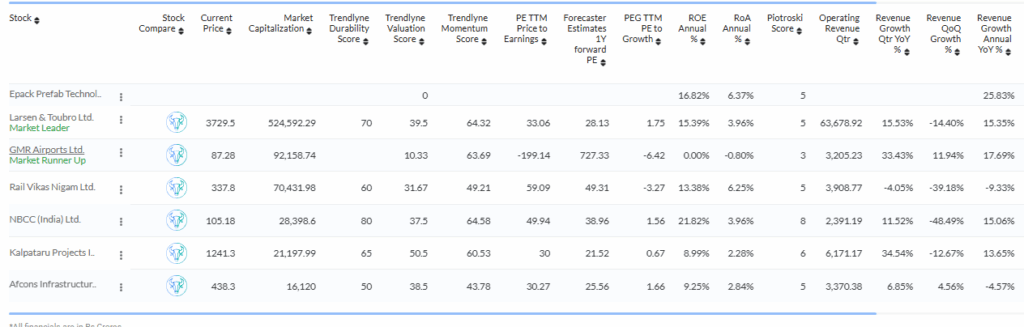

Peer Comparison & Industry Context

Epack operates in a niche that blends EPS packaging and sandwich panels. The company claims a mid-single-digit share in domestic EPS packaging and a strong prefab order book above ₹900 crore. Competitors in the prefab segment have shown mixed listing performance. Past listings in the sector sometimes saw strong first-day pops when order books and margins looked sustainable. The broader infrastructure and affordable housing push in India adds a favourable tailwind. However, raw material cost swings and project timing can hit margins.

Analysts’ Take & Market Sentiment

Analysts gave a mixed review. Strengths cited include rapid revenue growth and a large order pipeline. Brokers flagged pricey valuations as a concern. The combination of solid business metrics and higher multiples led many to call the IPO a long-term play. Short-term traders focused on GMP and listing arbitrage. Institutional appetite could have been higher if the offer had been priced more conservatively. Broker notes and research pieces stressed the need to weigh order book visibility against valuation.

Investor Strategy: Short Term vs Long Term

Short-term investors may chase listing gains if GMP holds near ₹10-15 on September 26, 2025. That implied a potential listing premium of about 4-6% from the upper band. For short trades, timing and exit discipline matter. Long-term investors should study margins, return on capital, and execution risk on large projects. If capacity additions lift volume without margin erosion, long-term returns look plausible. Use an AI stock research analysis tool to compare valuation multiples against peers before committing. Diversify exposure and avoid over-allocating a large portion of the portfolio to a single IPO.

Risk Factors to Note

Key risks include raw material inflation, execution delays on new plants, and concentrated customer exposure. The company’s growth hinges on scaling production smoothly. Any large project delay can push out revenue recognition. Valuations at listing may leave less room for immediate upside if market sentiment cools. GMP reflects sentiment but not fundamentals. Investors should check audited financials and merchant banker reports before subscribing.

Bottom Line

The Epack Prefab IPO closed on September 26, 2025, with mixed demand. GMP indicated modest listing optimism. The company’s strong order book and growth plans present long-term upside if execution is steady. Short-term gains are possible but not assured, given valuation and subscription patterns. Careful due diligence is essential. Monitor official allotment and listing updates after September 29, 2025, for final clarity on performance.

Frequently Asked Questions (FAQs)

The Epack Prefab IPO GMP on September 26, 2025, is about ₹11-15 per share. It shows mild investor interest but does not guarantee listing gains.

On September 25, 2025, the Epack Prefab IPO was subscribed around 0.59 times. Retail bids were active, while institutional and HNI demand built more slowly.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.