Accenture Share Price Impact: TCS, Infosys & IT Stocks Extend 6-Day Fall

Accenture’s recent market move has caught everyone’s eye. On September 25, 2025, the company’s share price slipped after weak earnings guidance shook investor confidence. This fall did not stay limited to global markets. It quickly spread to India’s top IT players, including TCS, Infosys, Wipro, and HCL Tech. For six straight trading sessions, the Nifty IT Index has been under pressure. We see a ripple effect that shows how closely Indian IT is tied to global peers.

Why is this important? Accenture is often seen as a trend-setter in global IT. When it reports weak growth or signals lower demand, we can expect similar challenges for Indian IT firms. Most of their revenue comes from clients in the US and Europe. If spending slows there, the impact here is direct.

We now stand at a point where investor trust is shaky. The question is whether this is a short-term dip or a sign of deeper trouble. Let’s explore Accenture’s fall, its impact on Indian IT giants.

Accenture’s Share Price Movement

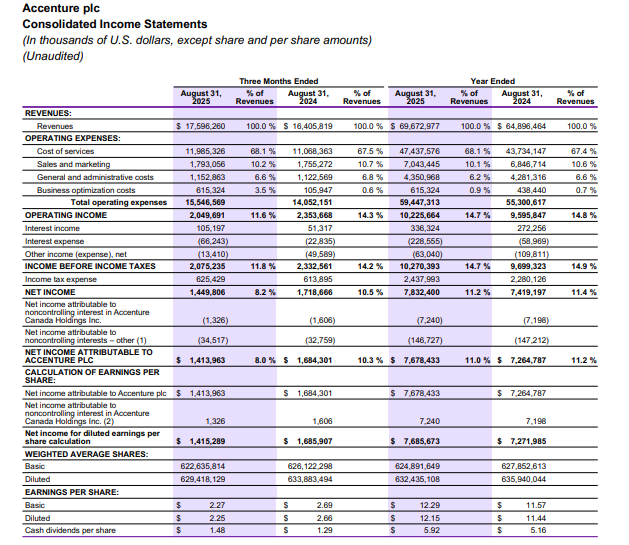

Accenture reported fourth-quarter and full-year fiscal 2025 results on September 25, 2025. The company posted revenue of $17.6 billion and strong AI-related bookings. Yet the firm gave a full-year growth outlook of 2-5% for fiscal 2026. That guidance came below some market hopes. Investors focused on the cautious growth range. Shares slipped on the day after the report. The stock drop reflected concern about slower client spending and costs tied to a large restructuring announced by the company.

Global IT Market Sentiment

The global tech spending backdrop looks mixed. Big customers in the US and Europe have tightened budgets in some areas. Rising interest rates and slower economic growth are part of the story. At the same time, demand for generative AI work is rising. Accenture saw growth in AI bookings, but investors weighed that against slower overall growth. The split signal, strong AI demand, but cautious revenue guidance, created uncertainty across the sector.

Impact on Indian IT Giants

Indian IT leaders reacted quickly. TCS, Infosys, Wipro, HCLTech, and Tech Mahindra saw losses after Accenture’s guidance. The Nifty IT Index extended a six-day decline into September 26, 2025. Local traders linked the drop to worries about lower client spend in the West. Indian firms earn a large share of their revenue from US and European clients. Any sign of weakness abroad often shows up in Indian stock moves. Analysts also cited concerns over visa policy shifts and higher H-1B fees as extra pressure on margins and hiring.

Sector-Wide Stock Market Trends

The selling was broad. On September 26, 2025, benchmark indices in India fell for a sixth straight day. The Sensex and Nifty both closed lower, dragging down market caps. Foreign institutional investors pulled back from some IT names during the session. Short-term traders focused on momentum and exited positions. Meanwhile, some long-term holders viewed the decline as a valuation reset. The net result was a sharp, sentiment-led move across the IT space.

Expert & Analyst Insights

Brokerages noted two main points. First, Accenture’s AI bookings and revenue beat estimates. Second, the company’s medium-term growth guide surprised investors by being conservative. Analysts said margins may face pressure from restructuring costs and higher investments in talent. Some experts argued the market reaction was overdone, calling it a short-term pullback. Others warned that demand normalization could take quarters, not weeks. Investors watching valuations and order-backlog metrics got mixed signals from different broker reports.

Broader Implications for Investors

For traders, the current phase means higher volatility. Short-term plays can profit from sharp swings. For long-term investors, the price change may offer buying chances in fundamentally strong companies. It is important to check client concentration, order books, and margin trends. Use an AI stock research analysis tool cautiously to screen names and track fresh booking data. Also, monitor policy moves like visa fee changes that can affect staffing costs. Clear facts and dates matter when making allocation calls.

Bottom Line

Accenture’s September 25, 2025, results and guidance set off a global re-rating of IT stocks. The report showed real strength in AI demand. At the same time, the modest growth outlook raised flags. Indian IT names felt the spillover and saw a multi-day slide through September 26, 2025. The next few quarters will reveal whether the pain is short-lived or structural. Investors should track bookings, client spending patterns, and margin guidance from the next set of earnings. For now, caution and data-driven choices are key.

Frequently Asked Questions (FAQs)

Accenture’s fourth-quarter results beat expectations, especially in AI bookings. However, its guidance for fiscal 2026 was conservative (growth of 2-5 %), which disappointed some investors. Also, uncertainty about client spending and macro slowdowns weighed on sentiment.

Indian IT firms depend heavily on clients in the US and Europe. When Accenture signals slower growth abroad, investors fear lower demand globally. That fear spills over to Indian IT names, causing stock declines. Also, policy moves (e.g., H-1B visa fee changes) add to investor caution.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.