BYD Forecasts Export Growth, Aiming for 20% of 2025 Revenue

In 2024, BYD became the world’s top-selling electric car maker, briefly overtaking Tesla in the last quarter of the year. The company is not slowing down. It has set a bold goal for 2025: to earn 20% of its revenue from exports. This is a clear signal. BYD wants to move from being a Chinese giant to a global leader.

Right now, most of its sales still come from China. But global markets are opening fast. Europe is pushing stricter emission rules. Southeast Asia is growing its middle class. Latin America and the Middle East are exploring EV options. BYD sees these regions as its next big wins.

We can look at this as more than a sales target. It shows how BYD is reshaping the auto industry. Cheaper batteries, local factories, and smarter supply chains give it an edge. The 2025 export target is not just about numbers. It is about brand, trust, and long-term survival in a highly competitive EV market.

BYD’s Current Position in the Global Market

BYD is now a major force in electric vehicles. In 2024, the company sold millions of cars and grew fast. Global demand helped that rise. BYD’s models cover low-cost to premium segments. The firm keeps costs down by making its own batteries and key parts. This vertical setup cuts dependence on outside suppliers. BYD also runs one of the world’s largest fleets of car-carrier ships. That has helped move cars to overseas markets more quickly.

The 2025 Export Target

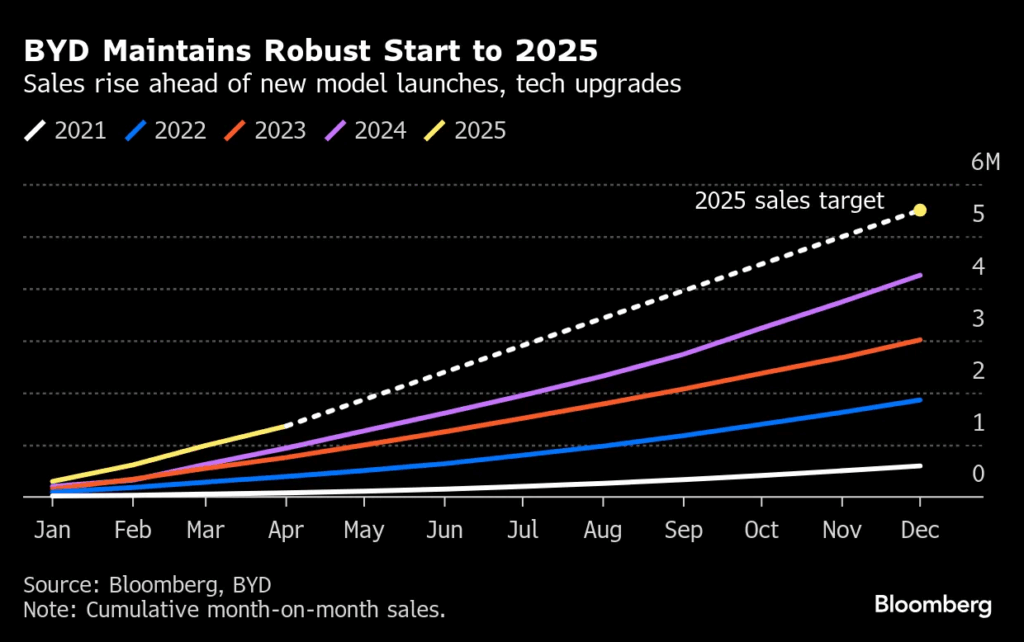

BYD projects exports will make up about 20% of its vehicle sales in 2025. The figure means roughly 800,000 to 1,000,000 cars shipped outside mainland China, based on a total sales target near 4.6 million units. This is a big jump from 2024, when overseas deliveries were below 10% of total sales. The company trimmed its total 2025 sales target earlier in September 2025, but still kept a strong focus on boosting exports. The export push is tied to new model launches and improved logistics.

Global Expansion Strategies

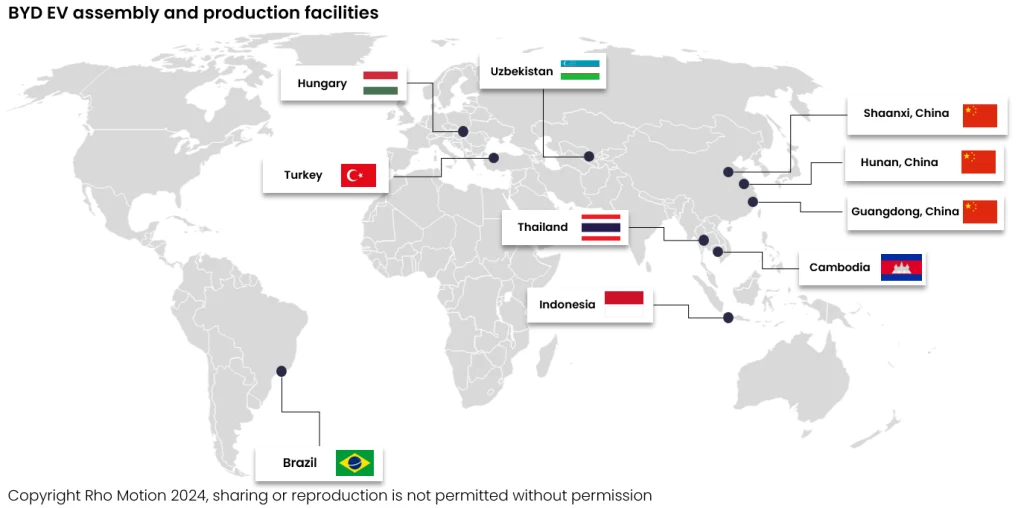

BYD plans a mix of exports, local assembly, and factory builds. The company is adding showrooms and service networks in Europe and Southeast Asia. It aims to double showroom presence in some regions by 2026. Local production helps avoid trade barriers and cuts shipping costs. BYD prefers full ownership of new plants rather than joint ventures. That gives tight control over design and quality. The firm also invests in fast charging and after-sales service to win customer trust.

Key Growth Markets

Europe is a priority. Strong green rules and high EV adoption make it attractive. BYD already sells several models there and is scaling up. The company plans local production in Hungary and possibly Turkey, though some projects face delays. These plants would serve nearby EU markets.

Southeast Asia shows fast demand growth. Rising income and government incentives push buyers toward EVs. BYD has expanded sales networks in Thailand and neighboring countries. Local partners and regional distribution help reduce lead times.

Latin America and the Middle East are emerging targets. These markets have slower EV adoption now. But interest is rising as charging grows and fuel costs stay high. BYD’s affordable models may find strong demand in these regions.

Challenges to BYD’s Export Ambition

Trade rules and tariffs could hinder growth. The EU and the U.S. watch Chinese carmakers closely. New duties or content rules may raise costs. Geopolitics adds risk. Tensions between China and Western states could lead to stricter checks. High competition is another issue. Global brands like Tesla, Volkswagen, and Hyundai still push in Europe and other markets. Local rivals also compete on price and service.

Supply chain strains can slow deliveries. Building new plants takes time. The planned Hungary factory faced delays, with mass production pushed into 2026. That slows the path to local output in the EU. Brand trust matters too. Consumers often prefer known names. BYD must keep quality high and avoid recalls or service failures.

Financial and Strategic Implications

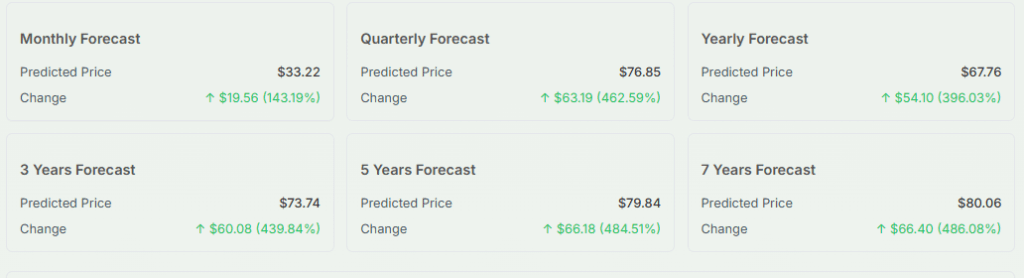

If exports hit 20% of sales in 2025, BYD’s revenue mix will shift noticeably. More overseas sales can raise margins if local prices and incentives are favorable. But costs are rising too. Factory builds, shipping, and dealer networks require capital. Investors may watch closely for profit impact. Some analysts use models and tools such as an AI stock research analysis tool to test scenarios for revenue and margins. That helps show where risks and gains may appear.

A stronger export share also balances BYD’s exposure to China’s market swings. Slower growth at home has already pushed the company to diversify. International success will help BYD claim more influence in global auto supply chains.

Future Outlook

If BYD meets the 2025 export goal, the firm could become a top global EV seller by volume. Local factories in Europe and Southeast Asia would lower shipping time and boost market fit. Yet hitting the goal is not guaranteed. Market shifts, tariffs, and execution risks remain. The company may scale more slowly in some countries. Still, BYD’s heavy investment in logistics, models, and service shows a clear intent to globalize.

Long-term, BYD has public targets that extend beyond 2025. The firm has spoken about raising overseas sales further by 2030. This plan ties to battery innovation, cost control, and deeper dealer networks. How well BYD adapts to local rules and local tastes will decide its success.

Bottom Line

The 20% export target for 2025 is both bold and plausible. BYD has strengths in scale, vertical supply, and shipping. The company also faces real barriers. Trade rules, plant delays, and tough rivals can slow the push. Still, the move signals a clear aim to go global. How quickly BYD can convert shipments into loyal customers will shape the next chapter in the EV race. As of September 29, 2025, the company is pushing hard to make exports a major slice of its sales.

Frequently Asked Questions (FAQs)

BYD expects approximately 20% of its 2025 revenue to come from exports, equivalent to nearly one million cars sold overseas, as stated on September 29, 2025.

BYD targets Europe, Southeast Asia, Latin America, and the Middle East in 2025. These regions show rising EV demand, government support, and new charging networks.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.