Gold Hits Record High on Fed Rates Outlook, Shutdown Concerns

On September 29, 2025, gold pierced the $3,800 mark for the first time, setting a fresh all-time high. This striking move reflects more than a passing trend. It underscores mounting bets that the U.S. Federal Reserve will begin easing interest rates and rising fears that a federal government shutdown could roil markets.

We often view gold as a safe harbor when the economy feels shaky. Today, it’s drawing fresh attention as investors grapple with uncertainty. As rate cuts loom, fixed-income yields may weaken, nudging more money toward non-yielding assets like gold. At the same time, political risk, especially the possibility of a shutdown, adds fuel to demand for stability.

Let’s explore how these two powerful drivers, expectations around Fed policy and political turmoil in Washington, are converging to push gold into new territory. We’ll also examine whether this rally can last, and what conditions might reverse it.

Gold’s Recent Rally

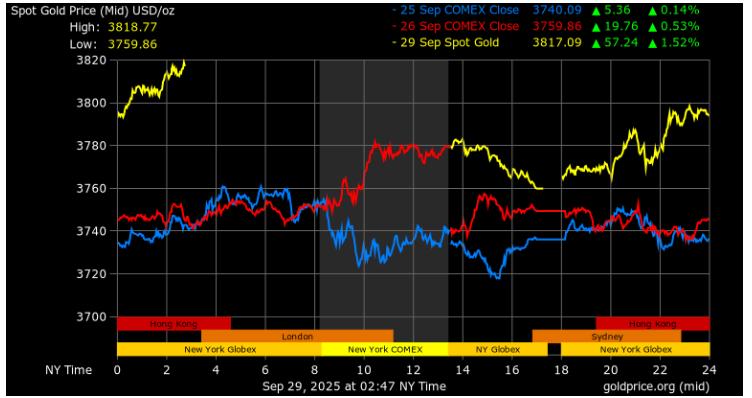

On September 29, 2025, gold prices surged to a record high, surpassing $3,800 per ounce. This marked a significant milestone, driven by investor anticipation of U.S. Federal Reserve interest rate cuts and concerns over a potential U.S. government shutdown. Spot gold rose 1.1% to $3,801.88, while December futures climbed 0.6% to $3,831.90.

The U.S. dollar index dropped 0.2%, making gold more attractive to foreign buyers. Inflation data from August showed a 0.3% rise in the PCE Price Index, matching forecasts and fueling speculation of Fed rate cuts in October and December. Traders are pricing in a 90% chance of a cut in October and 65% for December.

Gold typically benefits from lower interest rates and economic uncertainty. Meanwhile, silver increased 2.4% to $47.08, platinum jumped 3.4% to $1,622.04, and palladium rose 2.2% to $1,297.67. SPDR Gold Trust, the largest gold ETF, also reported an increase in holdings to 1,005.72 metric tons. Investors remain cautious about a potential U.S. government shutdown and await further economic data for insights into the economy’s health.

Fed Rates Outlook and Its Impact

The Federal Reserve’s monetary policy plays a crucial role in influencing gold prices. When the Fed cuts interest rates, the opportunity cost of holding non-yielding assets like gold decreases, making gold more appealing to investors. Additionally, lower interest rates can lead to a weaker U.S. dollar, further boosting gold’s attractiveness. Recent economic data, including inflation reports, have led traders to anticipate rate cuts in the coming months.

As of late September 2025, markets are pricing in a 90% chance of a rate cut in October and a 65% probability for December. These expectations have contributed to the upward momentum in gold prices.

U.S. Government Shutdown Concerns

The possibility of a U.S. government shutdown has added to market uncertainty. This prompts investors to seek safe-haven assets like gold. A government shutdown could delay the release of key economic data, including the nonfarm payrolls report, and disrupt economic activity if prolonged.

The last partial government shutdown occurred from late 2018 to early 2019 and lasted for 35 days, during which time the Congressional Budget Office estimated a reduction in GDP by about $11 billion. The current deadlock in Congress over a funding bill has heightened concerns about a potential shutdown, further driving demand for gold as a protective investment.

Broader Economic Drivers

Several broader economic factors are influencing gold prices. Global inflation trends and central banks’ policies are key drivers. Rising inflation erodes the purchasing power of fiat currencies, making gold an attractive hedge. Central banks, particularly in emerging markets, have been increasing their gold reserves, which signals confidence in the metal’s value.

Additionally, geopolitical tensions and economic uncertainties contribute to gold’s appeal as a safe-haven asset. The combination of these factors has created a favorable environment for gold, supporting its recent rally.

Market Reactions

The surge in gold prices has had ripple effects across financial markets. Stock markets have experienced volatility, with investors reallocating portfolios to include more gold and other precious metals. Exchange-Traded Funds (ETFs) backed by gold have seen increased inflows, reflecting growing investor interest. The VanEck Gold Miners ETF (GDX) and the VanEck Junior Gold Miners ETF (GDXJ) have both experienced price increases, indicating a positive outlook for gold-related investments. These market reactions underscore the broader impact of gold’s rise on global financial markets.

Risks and Counterarguments

Despite the bullish outlook, several risks could impact gold prices. Unexpected changes in Federal Reserve policy, such as a decision to raise interest rates, could diminish gold’s appeal. A stronger U.S. dollar, resulting from improved economic data or shifts in investor sentiment, might also pressure gold prices downward.

Additionally, a resolution to the government shutdown impasse could alleviate some market uncertainties, reducing demand for gold as a safe-haven asset. Investors should remain vigilant and consider these factors when evaluating gold’s investment potential.

Outlook for Gold Prices

Analysts have mixed views on gold’s future trajectory. Some forecast continued gains, citing persistent inflation concerns, potential further rate cuts, and ongoing geopolitical tensions. Others caution that gold may face headwinds if economic conditions stabilize, leading to stronger confidence in riskier assets.

Technical analysis suggests that gold has broken through key resistance levels, but the sustainability of this upward trend will depend on forthcoming economic data and Federal Reserve actions. Investors should monitor these developments closely to assess gold’s potential for sustained growth.

Wrap Up

Gold’s ascent to record highs reflects a confluence of factors, including expectations of Federal Reserve rate cuts, concerns over a U.S. government shutdown, and broader economic uncertainties. While the current environment supports gold’s bullish momentum, potential risks warrant careful consideration. Investors should stay informed about economic indicators and central bank policies to navigate the evolving landscape and make informed decisions regarding gold investments.

Frequently Asked Questions (FAQs)

Gold reached over $3,800 on September 29, 2025. Investors bought it as a safe option due to expected Fed rate cuts and worries about a possible U.S. government shutdown.

When the Fed cuts interest rates, gold becomes more attractive. Lower rates weaken the dollar and reduce returns on savings, so investors often buy gold as a safe option.

A U.S. government shutdown can create uncertainty. Investors often buy gold to protect their money. On September 29, 2025, fears of a shutdown helped push gold to record levels.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.