US Inflation Data Lifts Sentiment Across Asian Markets

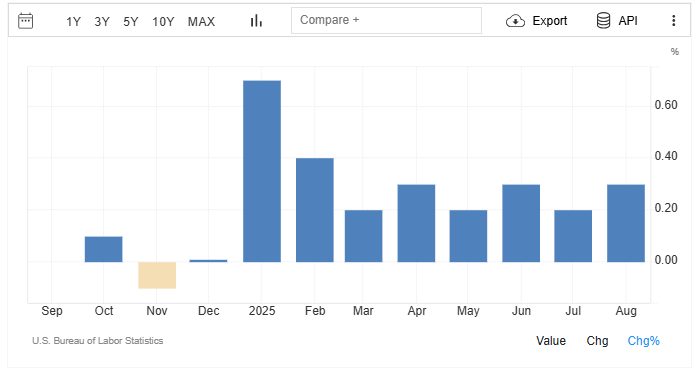

On September 11, 2025, the U.S. Bureau of Labor Statistics reported that consumer prices rose by 0.4 percent in August, pushing the annual inflation rate to 2.9 percent. That data surprised markets modestly but also offered some relief: inflation is not spiraling out of control. In Asia, investors greeted the news with renewed optimism.

We saw equity indices rally across Tokyo, Shanghai, and Mumbai. Local currencies gained ground versus the dollar. The mood shifted from cautious to hopeful. Why? The U.S. inflation reading raised the chances the Federal Reserve might ease policy soon. If interest rates in the U.S. start to ease, capital could flow back into riskier markets, which would help Asia.

Let’s explore how Asian stocks, currencies, and bonds responded. We will examine trends by country and sector. And we will ask: Is this sentiment sustainable or just a short-lived boost?

Overview of US Inflation Data

The U.S. Consumer Price Index for August rose 0.4 percent from July 2025. Annual inflation stood at 2.9 percent for the 12 months to August. Core inflation, which strips out food and energy, rose 0.3 percent for the month and 3.1 percent year-on-year. These readings came on September 11, 2025, and fed directly into interest-rate expectations. The numbers were not wildly above forecasts. Markets saw the data as mild enough to keep hopes of future Fed rate cuts alive.

Immediate Global Market Reactions

U.S. stocks rose after the inflation print. Bond yields eased in short-term maturities. The dollar slipped from recent highs. Commodities such as gold and oil moved less sharply than in prior months. Traders read the report as confirming slower inflation momentum. This pushed traders to price in a greater chance of the Federal Reserve easing later in the year. Such shifts in the U.S. quickly passed through to the Asian market hours.

Impact on Asian Equity Markets

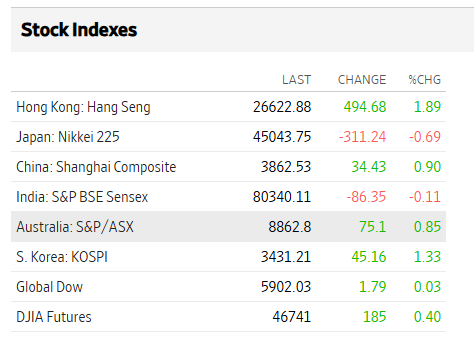

Asian stock markets reacted with a broad rally. Tokyo saw gains as exporters and tech names climbed. Hong Kong’s Hang Seng made a notable jump, led by financials and property-related stocks. Mainland Chinese indices also rose, with Shenzhen and Shanghai showing strength in small- and mid-cap names. India’s benchmark indexes recovered some losses as confidence returned to cyclical and banking sectors.

The lift came because lower U.S. yields make foreign equities more attractive. That draws fresh capital into Asian shares and supports higher price-to-earnings multiples. Reuters and regional market reports captured these moves across trading sessions.

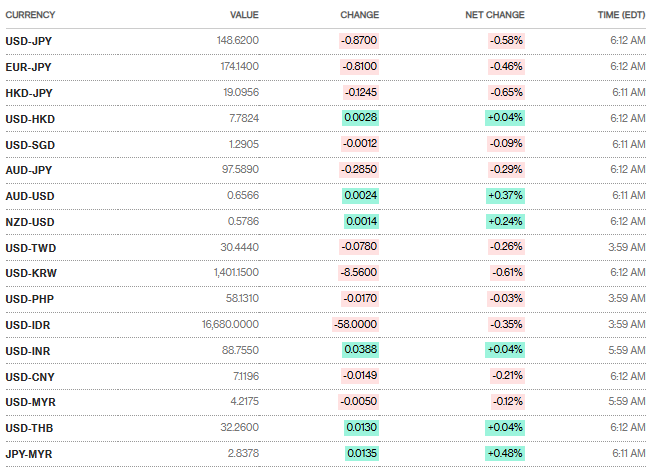

Currency Market Movements in Asia

Major Asian currencies strengthened against the dollar after the U.S. inflation news. The yen and the Korean won gained some ground. The Indian rupee showed room for a small rebound after recent weakness, at least in morning trade on September 29, 2025. A softer dollar tends to ease imported inflation pressures in many Asian markets. It also reduces local central bank urgency to tighten policy. That can help both equity and bond markets in the region.

Bond and Commodity Market Reactions

Asian government bond yields mostly drifted lower. Japan’s yields stayed close to policy anchors, while yields in India and South Korea fell modestly with rate-cut hopes. Lower U.S. yields make carry trades more attractive, which often supports Asian bonds and local currency funding. Commodity prices behaved unevenly. Brent crude eased on weaker growth fears, while gold held steady as a hedge against policy uncertainty. These moves reflect a mix of global signals and local risk factors.

Investor Sentiment and Risk Appetite

Lower-than-feared U.S. inflation shifts sentiment toward risk. Investors moved money from safe havens to risk assets. Fund managers increased exposure to Asian cyclical stocks. Foreign institutional flows into Asian markets ticked up after the data. Analysts flagged that the flow was still cautious and selective. Tools such as an AI stock research analysis tool can help managers scan sectors and spot earnings or valuation gaps faster. Still, sentiment gains depend on follow-through in economic data and corporate results.

Sectoral Winners and Losers in Asia

Technology and exporters generally benefited first. Lower real yields lift growth stocks. Banks and financials also gained on hopes of improved loan growth if local demand firms up. Consumer discretionary and travel stocks edged higher as rate-cut expectations lifted spending bets. Defensive sectors such as utilities and staples lagged. Energy names were mixed because oil prices did not rally strongly. Market participants noted that sectors tied to China’s domestic recovery will outperform only if policy support continues there.

Potential Risks and Reasons for Caution

The rally may be fragile. Inflation could re-accelerate if wages or rents surge. Data reliability debates in the U.S. add uncertainty about the true inflation path. Geopolitical events in Asia could wipe out risk appetite quickly. Local central banks may not move in sync with the Fed. Large capital inflows could reverse if global sentiment shifts. Analysts warn against chasing gains without checking earnings and balance sheets. Diversified risk checks remain essential.

What Investors Should Watch Next?

Key items to track include upcoming U.S. jobs and PCE inflation prints. Also, watch central bank statements across Asia. India’s RBI actions and China’s policy signals matter for regional flows. Corporate earnings will test whether improved sentiment has real economic backing. Traders should follow dollar moves, U.S. Treasury yields, and commodity trends. Clear, timely data will determine whether the late-September optimism becomes a sustained recovery or a short-lived bounce.

Bottom Line

The U.S. inflation report of September 11, 2025, offered relief rather than alarm. Markets reacted quickly. Asian equities, currencies, and bonds all showed positive moves as traders eyed rate-cut potential. The boost is welcome. It is not risk-free. Future data will tell if this lift can last. Careful attention to follow-up U.S. releases and regional policy choices is essential for any investor betting on the rally.

Frequently Asked Questions (FAQs)

On September 11, 2025, lower U.S. inflation lifted hopes of future Fed cuts. This made Asian stocks attractive, bringing more foreign money into markets and boosting investor confidence.

After the U.S. inflation report on September 11, 2025, the yen, won, and rupee gained slightly. A softer dollar reduced inflation pressure and improved sentiment in Asian economies.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.