Atlanta Electricals Shares Debut at 14% Premium Over IPO Price on NSE

On September 29, 2025, Atlanta Electricals made its stock market debut with a strong start. The company’s shares opened at a 14% premium over the IPO price on the NSE, creating buzz among investors. Many of us have seen IPOs open flat or even at a discount in recent months. That is why this performance stood out and drew attention.

Atlanta Electricals is not just another name in the electrical equipment industry. It has built its reputation over time and entered the market with clear growth goals. The listing day numbers showed both investor trust and rising interest in companies linked to India’s growing infrastructure and energy needs.

We often ask ourselves why some IPOs shine while others struggle. In this case, the mix of strong demand, sound business fundamentals, and a positive market mood worked together. The debut is not just about numbers. It is also a signal of confidence in the company’s future and in the sector it operates in.

Atlanta Electricals Shares: Company Background

Atlanta Electricals is a transformer maker with over three decades of experience. The firm makes power, auto, furnace, and inverter-duty transformers. It runs three plants in India: two in Anand, Gujarat, and one near Bengaluru, Karnataka. The group claims an aggregate capacity of around 16,740 MVA. The company serves utilities, industry, and OEM customers across the country. Its long history helped shape its market reputation and production scale.

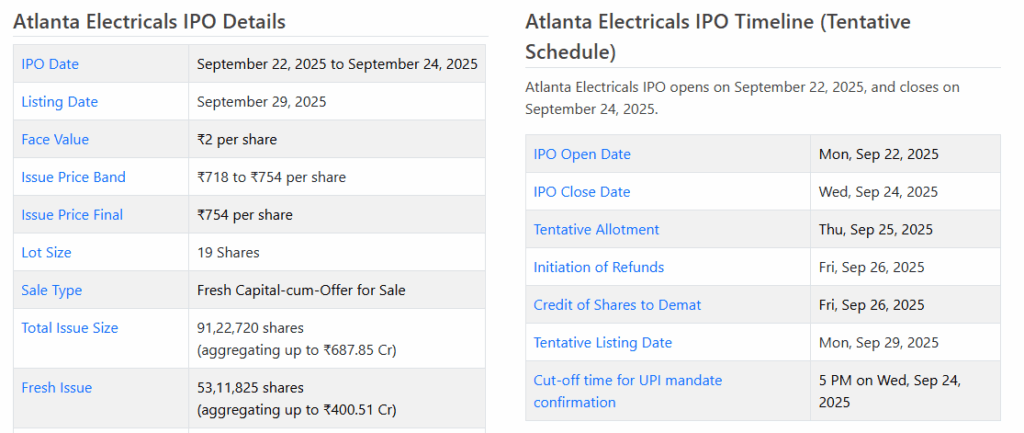

Atlanta Electricals IPO Details

The IPO ran from September 22 to September 24, 2025. The price band was ₹718-₹754 per share. The total issue size was about ₹687.34 crore, made up of a fresh issue and an offer for sale. The lot size was 19 shares. The company said funds would go to working capital and to reduce debt. Allotment was finalized on September 25, 2025, and shares were credited to demat accounts on September 26, 2025. Listing took place on September 29, 2025.

The issue drew big interest. Qualified institutional buyers (QIBs) led the demand. The IPO was subscribed many times over on the final day. This high subscription set an expectation of a strong listing.

Listing Day Performance

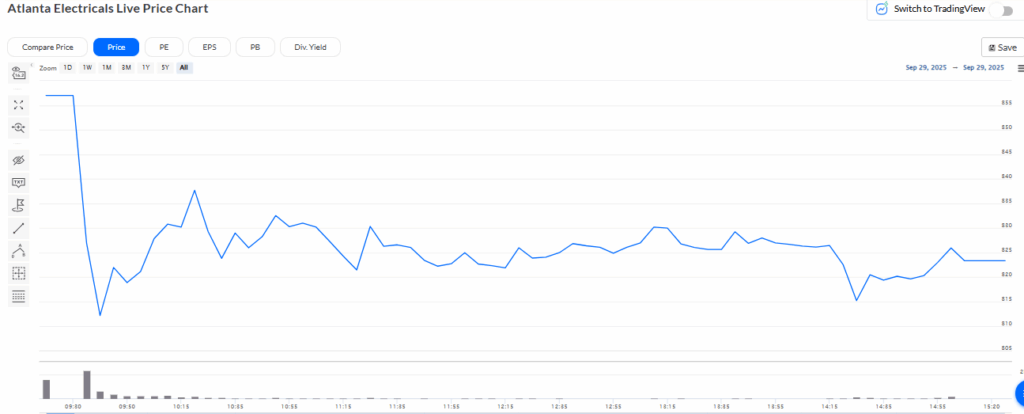

On September 29, 2025, the Atlanta Electricals shares were listed with a clear gain. The stock debuted around ₹857, about 13.66% above the issue price of ₹754 on the NSE. On the BSE, the open price was about ₹858.10, a near 13.8% premium. Intraday swings were limited as buyers outnumbered sellers on the first day. Trading volumes were healthy for a new listing. The grey market had shown a healthy premium before listing, which matched the listing strength.

Factors behind the Strong Debut

Several simple reasons explain the listing gain.

First, demand was very high in the IPO. The final subscription figure was extremely large. That created listing pressure.

Second, the transformer business links to big, long-term projects. India is pushing for more infrastructure and renewable power. That supports steady orders for transformer makers. Investors often reward firms in such sectors.

Third, the company showed scale and capacity. Its three manufacturing units and large MVA capacity gave investors comfort on execution. Lenders and large buyers tend to prefer established plants.

Fourth, the market mood was supportive. Many new listings have seen gains when investors are upbeat. The grey market premium and anchor investor interest added to the positive sentiment.

Expert and Analyst Reactions

Brokerage notes and research reports gave a mixed but mostly positive early read. Many brokers recommended a subscription for the long term. They pointed to steady cash flows and a strong order book as positives. Analysts flagged valuation as a watch item. Some noted that margins could face pressure if raw material costs rise. Market commentary said the listing reflected both quality and current liquidity in markets.

One practical tip from market analysts was to use an AI stock research analysis tool for quick checks on trading patterns and volume after listing. That helps spot early trends and liquidity.

Future Growth Prospects

The firm aims to grow via higher capacity use and by adding newer product lines. Demand drivers include grid upgrades, more renewable projects, and rising industrial electricity use. Exports may also offer long-term upside if global demand picks up. Planned capital expenditure funded by fresh issue proceeds could smooth production bottlenecks.

Risks include competition from other transformer makers. Another risk is raw material prices, like copper and steel. Policy shifts in power procurement or delays in big projects could also affect order timing. Investors should watch order inflows and quarterly margins.

Investor Takeaways

The listing gain shows strong early demand. Short-term traders may view the stock as tradeable on momentum. Long-term investors should judge the company on execution, margin stability, and order book growth. Watch the next two quarterly results for clarity on margins and revenue growth. Keep an eye on promoter shareholding and any lock-in expiries. Use reliable research and risk controls before entering a position.

Wrap Up

Atlanta Electricals’ debut on September 29, 2025, was a clear initial success. The near-14% listing premium matched strong subscription and positive grey market signals. The company’s size and sector link to infrastructure support the long-term case. Still, valuation and input-cost risks matter. Investors should follow earnings and order updates to see if the early enthusiasm turns into sustained growth.

Frequently Asked Questions (FAQs)

Atlanta Electricals’ shares were listed on September 29, 2025, at about ₹857 per share on NSE, which was nearly 14% higher than its IPO issue price of ₹754.

Atlanta Electricals showed a strong debut on September 29, 2025. Experts suggest watching earnings, order book, and margins before deciding. Future growth depends on demand and market conditions.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.