TruAlt Bioenergy IPO Fully Subscribed; GMP Signals 19% Listing Premium

India’s IPO market has been buzzing with strong investor interest in 2025. On September 27, 2025, TruAlt Bioenergy Limited joined the list of companies tapping public markets. The IPO was fully subscribed, showing solid demand from both retail and institutional investors. What makes this offering even more exciting is the Grey Market Premium (GMP). As of the latest update, the GMP signals a 19% listing premium. This suggests healthy debut expectations.

TruAlt Bioenergy is not just another company raising funds. It works in renewable energy, with a strong focus on biofuels. At a time when India is pushing for cleaner energy and reduced oil dependence, such companies attract special attention. We all know how government policies are shifting toward green energy. This makes the IPO more than just a short-term listing event. It also raises questions about long-term growth and sector stability.

Let’s explore the company, its IPO details, investor response, financial strength, and industry outlook. We will also look at what this means for retail investors like us, both in terms of listing gains and long-term opportunities.

TruAlt Bioenergy IPO: Company Overview

TruAlt Bioenergy is a large Indian biofuels firm. The company mainly makes ethanol. It also produces by-products such as liquid CO₂ and dry ice. TruAlt has several distilleries and dual-feed capability. That means the plants can use molasses, damaged grains, maize, or syrup as raw material. The firm gained Oil Marketing Company (OMC) status in mid-2025 and plans a retail network. This gives TruAlt a wider role in fuel supply beyond ethanol.

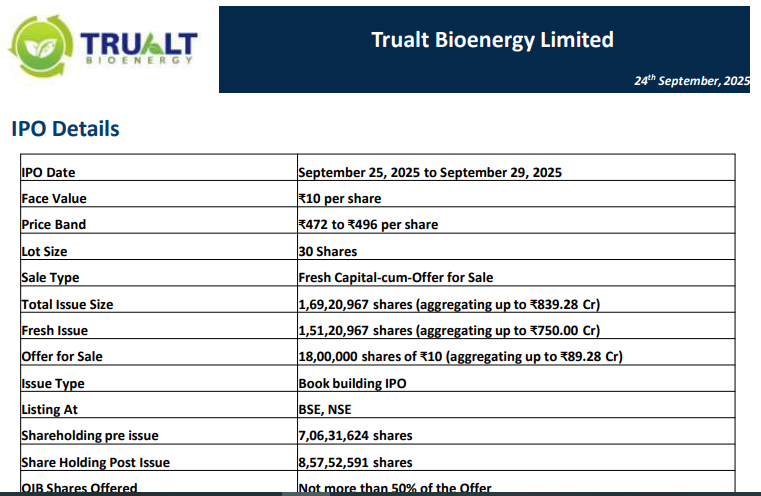

TruAlt Bioenergy IPO Details

The IPO opened on September 25, 2025, and closed on September 29, 2025. The issue size is ₹839.28 crore. The price band was set at ₹472 to ₹496 per share. The offer comprised a fresh issue and an offer-for-sale. The shares are planned to list on both BSE and NSE on October 3, 2025. Lot size and registrar details were published in the company prospectus and press releases.

Subscription Status & Investor Response

Demand rose through the final day of bidding. By the close on September 29, several outlets reported full subscription. Non-institutional investors (NIIs) and retail bidders pushed volumes higher. Some news outlets cited large oversubscription multiples on Day 3. Market chatter showed strong interest from both small investors and HNIs. This late surge changed early day-by-day subscription dynamics and led to full subscription by the deadline.

Grey Market Premium (GMP) Insights

The grey market showed positive sentiment throughout the offer. Reports on September 29 put the GMP near ₹109 per share. That implies an expected listing price of about ₹605, if the premium holds against the upper band of ₹496. That calculation points to a potential listing gain close to 20-22%. GMP can be a quick market thermometer. It is not a guarantee. Investors should use it along with fundamentals and broker notes.

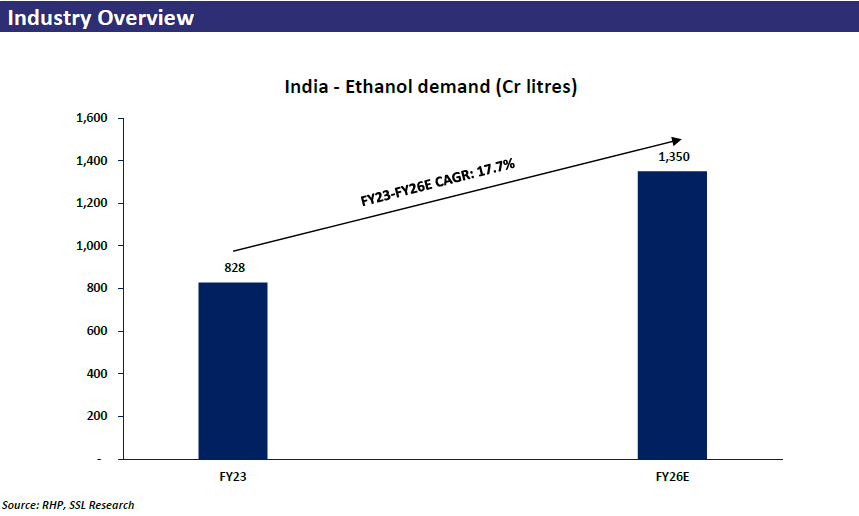

Industry Outlook

India is pushing ethanol blending and cleaner fuels. Policy support and blending mandates are major tailwinds. Ethanol demand rose as fuel marketers and the government expanded blending targets. At the same time, the wider renewable fuels market draws private investment. Competitors include large sugarcane distillers and integrated oil firms entering biofuels. TruAlt’s OMC approval and plans for retail outlets could create new revenue streams. This could help margins if execution is strong.

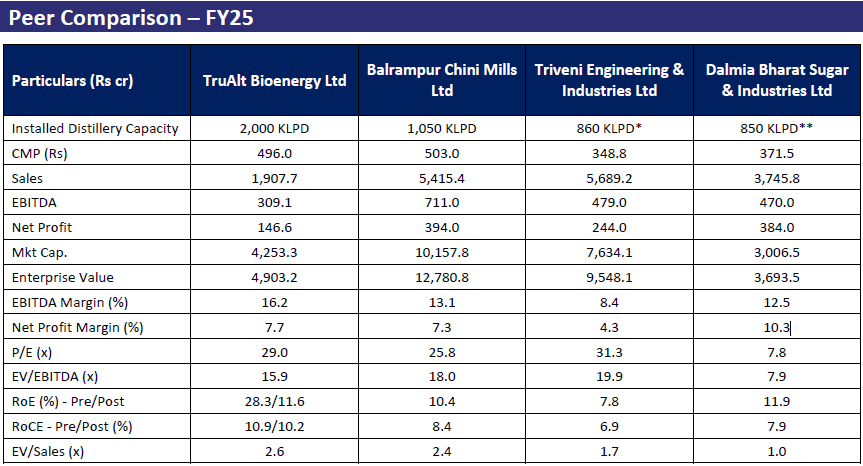

Financial Performance & Valuation

Recent financials show strong growth. Between FY 2024 and FY 2025, revenue jumped significantly, and profit after tax rose sharply. EBITDA and net worth improved, too. The company reported higher assets and better margins in the latest fiscal year. These numbers support the growth story. Still, valuation at listing will depend on market appetite and comparable peer multiples. Some broker notes point to a premium relative to smaller peers, given the OMC edge and capacity scale. Use an AI stock research analysis tool to quickly compare peers and multiples before deciding.

Expert Opinions & Market Expectations

Analysts gave mixed but mostly positive reads before listing. Some highlighted the company’s capacity and recent earnings jump as strengths. Others flagged execution risks tied to retail fuel roll-out and seasonality in feedstock supply. Short-term views leaned on GMP and listing momentum. Long-term views stressed policy steadiness and raw material cycles. Brokers set target ranges that factored in both near-term listing upside and medium-term delivery risks.

What does it mean for Investors?

Retail investors may see strong listing gains if the grey market premium holds into listing on October 3, 2025. Long-term investors should weigh policy support and capacity against commodity cycles. Ethanol margins can swing with feedstock prices and government procurement rates. OMC status is a structural plus, but the retail fuel business needs capex and time to scale. Risk appetite and holding horizon should guide choices. Keep allocation modest if the sole aim is a quick listing gain. Diversify if betting on long-term sector growth.

Wrap Up

The TruAlt Bioenergy IPO paints a picture of sector interest and policy alignment. Full subscription and a high GMP show strong near-term demand. Company fundamentals and recent profit growth back the growth narrative. Execution of retail outlets and steady feedstock supply will shape future earnings. Investors should balance listing excitement with careful review of financials and peer multiples. Check prospectus details and broker research before committing funds.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.