BTCUSD Update: Strategy’s Bitcoin Holdings Top 640K After $22M Buy

The cryptocurrency market continues to capture global attention as institutional players increase their exposure to Bitcoin (BTC). Recently, Strategy’s Bitcoin holdings surged past 640,000 BTC after the company made another significant purchase worth $22 million. This move reflects the growing confidence in Bitcoin as a long-term store of value despite ongoing market volatility.

Strategy’s Bitcoin Accumulation: Crossing 640K Milestone

Strategy, led by its pro-Bitcoin management team, has consistently added to its Bitcoin portfolio since 2020. With the recent $22 million acquisition, the company’s total Bitcoin holdings now exceed 640,000 BTC, making it one of the largest institutional holders in the world.

At current prices, this translates into billions of dollars in assets under management tied directly to the performance of BTCUSD. Such aggressive accumulation not only reinforces Bitcoin’s position as a digital gold but also signals institutional conviction in its long-term value.

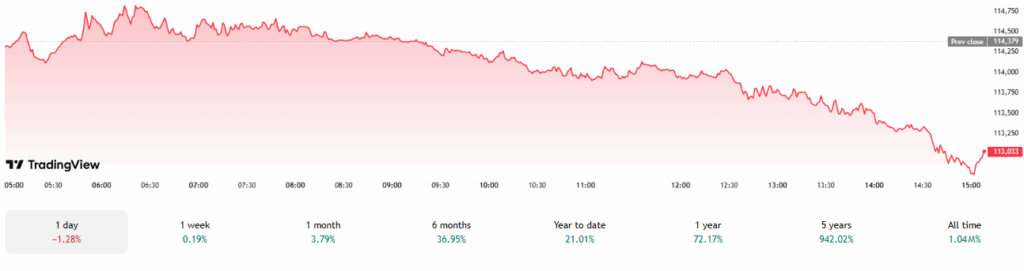

BTCUSD Market Reaction and Price Trends

The BTCUSD pair has been closely tracking institutional interest, and large acquisitions like this one often impact short-term price movements. Following the latest buy, Bitcoin experienced a modest upward trend, reflecting renewed optimism among retail and institutional investors alike.

However, the crypto market remains highly volatile. While large purchases provide bullish momentum, macroeconomic factors such as U.S. Federal Reserve policies, inflation rates, and global liquidity continue to influence BTCUSD performance. Investors should remain cautious while recognizing the long-term bullish outlook that such large holdings represent.

Why Institutions Are Bullish on Bitcoin

Several reasons explain why firms like Strategy continue to accumulate Bitcoin aggressively:

- Hedge Against Inflation: Bitcoin’s capped supply of 21 million coins makes it an attractive hedge against currency debasement.

- Diversification: Institutions are seeking exposure to non-correlated assets beyond traditional stocks and bonds.

- Growing Adoption: With increased global acceptance, from retail use to government recognition, Bitcoin is transitioning into a mainstream financial asset.

- Long-Term Store of Value: Similar to gold, Bitcoin is being positioned as a digital reserve currency.

This steady institutional demand has a ripple effect, influencing both stock market trends and retail investor sentiment.

Stock Market and AI Stocks Influence

Interestingly, Bitcoin’s adoption is also being closely linked with advancements in AI stocks and technology companies that leverage blockchain. Major firms investing in AI-driven financial solutions are integrating Bitcoin and digital assets into their strategies, bridging the gap between traditional finance, AI, and crypto.

While stock research often focuses on equities, investors are increasingly monitoring BTCUSD correlations with tech-heavy indexes like the NASDAQ. Bitcoin’s resilience has also encouraged portfolio managers to diversify holdings across both crypto assets and innovative stock sectors such as AI.

The Strategic Significance of 640K BTC

Owning over 640,000 Bitcoin gives Strategy an unprecedented influence over the crypto market. This level of accumulation not only secures its position as a dominant player but also establishes Bitcoin as a legitimate corporate treasury asset.

Such holdings can shape investor psychology. For example:

- Market Confidence: Large and consistent buys demonstrate institutional conviction, strengthening investor confidence in BTCUSD.

- Liquidity Impact: While Bitcoin’s supply remains fixed, massive acquisitions reduce available market liquidity, potentially creating upward price pressure.

- Regulatory Attention: Large-scale holdings naturally attract scrutiny from regulators, possibly shaping future crypto regulations.

BTCUSD Long-Term Outlook

The long-term trajectory of BTCUSD depends on multiple factors:

- Regulatory Developments: Governments around the world are drafting clearer rules for cryptocurrencies. Positive regulatory clarity could attract even more institutional investors.

- Mainstream Adoption: Bitcoin’s use as a payment method and its integration into financial services will continue to drive demand.

- Macro Trends: Global inflation, interest rates, and currency fluctuations remain critical to Bitcoin’s price performance.

- Technological Innovation: The rise of blockchain applications, DeFi, and AI-driven financial systems may reinforce Bitcoin’s ecosystem.

While short-term fluctuations are inevitable, the consistent accumulation by institutions highlights a strong belief in Bitcoin’s long-term growth.

Risk Factors for Investors

Despite bullish momentum, risks remain:

- High Volatility: BTCUSD is prone to significant daily and weekly price swings.

- Regulatory Crackdowns: Sudden policy changes could impact liquidity and adoption.

- Market Correlations: Bitcoin, once seen as uncorrelated, is increasingly moving in sync with stock markets during periods of global uncertainty.

Investors should conduct thorough stock research and risk assessments before making significant allocations.

Conclusion

Strategy’s Bitcoin holdings, surpassing 640,000 BTC after a fresh $22 million buy, underscore the growing institutional embrace of digital assets. For the BTCUSD market, this signals long-term strength, despite persistent volatility. The move also highlights Bitcoin’s increasing correlation with global stock markets, particularly in sectors like AI stocks and emerging technologies.

As adoption expands and regulatory frameworks evolve, Bitcoin’s role as both a speculative and strategic asset will continue to grow. Investors should monitor these developments closely while balancing their portfolios with proper risk management.

FAQs

Strategy now holds over 640,000 BTC, making it one of the largest institutional holders globally.

Large purchases can create short-term bullish momentum and influence liquidity, but macroeconomic factors also play a crucial role in BTCUSD movements.

While Bitcoin offers long-term growth potential and acts as a hedge against inflation, it remains volatile and subject to regulatory risks. Investors should diversify and manage risk accordingly.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.