Asia PMIs Split Amid Tariff Tensions; South Korea and Vietnam Hold Steady

In September 2025, Asia’s manufacturing data painted a mixed picture. Some countries saw sharp declines, while others held firm or even improved. The region now stands divided in the face of growing tariff tensions between the U.S. and its trade partners.

We must understand what this split means. A falling PMI (Purchasing Managers’ Index) signals a slowing factory sector. A rising or steady one hints at resilience. Many Asian economies depend on exports and supply chains, so tariffs can hit them hard.

Yet, two nations appear to buck the trend. In South Korea, factory activity climbed above the 50 mark, signaling expansion for the first time in months. In Vietnam, production stayed stable despite headwinds. These exceptions offer clues about how some economies adapt.

Let’s explore why Asia’s PMIs diverged in September 2025. We dig into what factors helped South Korea and Vietnam stay steady. And we consider what it means for the rest of the region.

About PMI and Its Role

PMI stands for Purchasing Managers’ Index. It tracks how manufacturing and service sectors perform monthly. A number above 50 means expansion. A number below 50 points to contraction. We often use PMI as an early warning sign business conditions often change before official statistics reflect them.

In export-oriented Asian economies, PMI is especially vital. It shows shifts in global demand, input costs, and supply chain pressures. Policymakers, investors, and firms watch it closely. When tariffs or trade disputes heat up, PMI swings can show how deeply those effects penetrate real production and orders.

Global Backdrop: Tariff Tensions and Economic Impact

In 2025, new U.S. tariffs and countermeasures have rattled global trade. Supply chains are under strain. Many exporters face rising costs and uncertainty over duties. Demand in large markets like the U.S. and China has softened.

Tariffs raise the cost of imported inputs. They also force firms to reroute supply chains or absorb margins. For Asia, where many economies lean heavily on trade, these stresses amplify. The risk: even strong domestic momentum may not fully counter external headwinds.

PMI Divergence Across Asia

In September 2025, Asia’s PMI readings diverged sharply. Some economies slipped deeper into contraction. Others held steady or even rebounded.

- China: Official PMI hovered below 50. The manufacturing sector contracted for the sixth straight month.

- Japan: Its factory activity fell at the fastest rate in six months, according to the survey.

- India: Slower expansion. Manufacturing growth cooled, highlighted by inflation pressures.

- ASEAN region (broadly): The manufacturing PMI dropped. In some member states, contraction deepened.

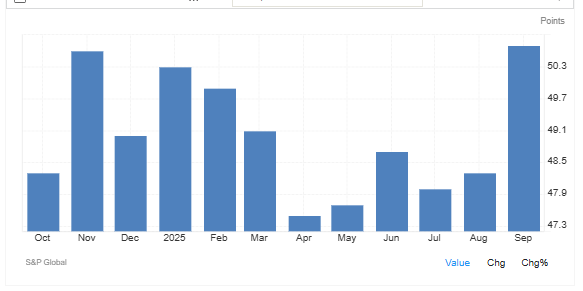

Against this weak trend, South Korea and Vietnam stood out. South Korea’s factory PMI rose to 50.7 in September, crossing into expansion territory. In Vietnam, the PMI remained steady around 50.4, showing resilience.

The divergence reflects differences in export structure, trade links, and internal buffers. Some nations depend heavily on volatile sectors (like electronics or basic goods), while others have more diversified or flexible industrial bases.

South Korea: Stability Despite Challenges

South Korea’s manufacturing PMI reached 50.7 in September, marking the first expansion in eight months. Output and new orders both climbed. Overseas demand improved, especially from the Asia Pacific markets.

Tech and electronics exports remain key. Companies launched new products and stepped up production. Firms also increased hiring and input purchases, responding to stronger order flow. Still, risks persist. The domestic economy is weaker, and inflation remains a concern.

Trade talks with the U.S. are unresolved. Tariff threats could dampen momentum. South Korea’s ability to ride the rebound depends on global demand for semiconductors and tech hardware, and on managing trade policy risks.

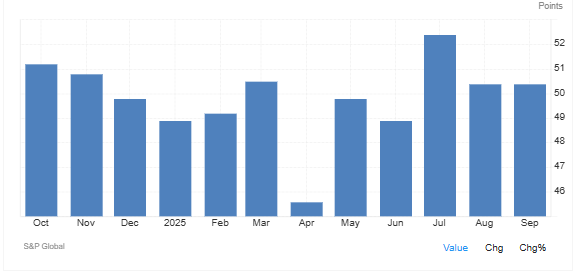

Vietnam: Emerging as a Supply Chain Winner

Vietnam’s PMI in August was about 50.4, slightly down from earlier months, but still holding ground. Its steadiness amid regional weakness draws attention.

Vietnam benefits from trade diversification. As companies shift some production out of China to avoid tariffs, Vietnam has been a prime recipient. Free trade agreements and favorable labor costs enhance its appeal.

Foreign direct investment continues to flow in. The government has worked on infrastructure and trade policies to stay competitive. Challenges remain: rising labor costs, infrastructure bottlenecks, and potential tariff spillovers. If U.S. tariffs widen, Vietnam may feel pressure too. Still, its current resilience suggests it may capture more of the restructured global supply chains.

Broader Regional Implications

The split in Asia’s PMI landscape sends several signals. Growth is uneven. Some economies are vulnerable; others are adapting. Trade flows may realign. Countries with stable PMIs may attract more foreign firms. Others may need to act quickly or risk slipping further.

Firms and investors are watching closely. Many apply AI stock research analysis tools to assess vulnerabilities in regional equities tied to manufacturing. That helps identify countries or sectors facing stress.

In the coming months, policy responses will matter. Monetary easing, fiscal support, or trade diplomacy could tip the balance. Heading into Q4 2025, the outlook is cautious. Only nations that adapt swiftly to shifting demand and trade rules may maintain momentum.

Final Thoughts

Asia’s PMI data for September 2025 highlights a region moving in different directions. Some major economies like China and Japan continue to face contraction, reflecting weak demand and tariff pressures. Others, such as South Korea and Vietnam, have shown resilience. South Korea benefited from a rebound in tech exports, while Vietnam kept steady as supply chains shifted toward its factories.

The divergence shows how trade tensions and tariff disputes reshape Asia’s industrial landscape. Nations that adapt through diversification, policy support, and investment can hold firm. Those reliant on fragile supply chains may continue to struggle.

Looking ahead to late 2025, the region’s growth story will hinge on global demand and trade policy outcomes. For now, South Korea and Vietnam stand as examples of how resilience and strategy can help weather external shocks.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.