Buffett’s Berkshire in Advanced Talks to Acquire OxyChem for $10B

On September 30, 2025, news broke that Berkshire Hathaway had entered advanced talks to acquire OxyChem, the petrochemical arm of Occidental Petroleum, at a price tag near $10 billion. We see this move as a bold play: Berkshire already owns roughly 27 % of Occidental shares, which gives it insider familiarity and alignment of interests.

This possible deal is rich with promise. OxyChem’s products are essential to sectors like construction, packaging, and water treatment. Meanwhile, Occidental is under pressure to lower its debt after aggressive oil-asset acquisitions in recent years. For Berkshire, the acquisition offers a chance to deploy idle capital into a business with steady demand. For Occidental, the sale may ease financial strain and let it refocus on its core energy operations.

In what follows, let’s explore how this deal might be structured, why it appeals to both sides, what market watchers think, and the risks that could make or break the transaction.

Berkshire’s Playbook and Why Chemicals Fit the Bill?

Berkshire Hathaway has long bought strong, cash-generating businesses. The company piles up cash to strike when prices look fair. Berkshire already owns a large stake in Occidental. That inside view may make a deal easier to value and close. Reports say Berkshire could use cash to buy OxyChem outright. The move would echo past chemical deals like Lubrizol.

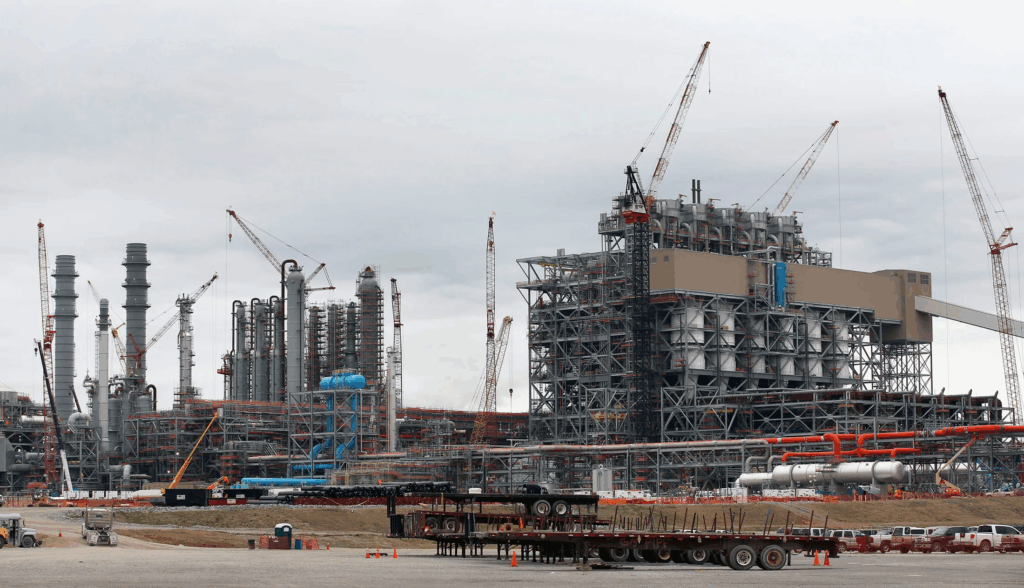

OxyChem makes vinyls, PVC resin, chlorine, and other basic chemicals. These products run through many industries. They are used in pipes, medical supplies, packaging, and water treatment. OxyChem runs large U.S. plants and a major ethylene cracker. The unit posted strong mid-2025 revenue. Its businesses sell steady volumes even when oil and gas swing.

Deal Size and Likely Terms

Reports on September 30, 2025, put the deal at $10 billion. Sources say Berkshire may pay in cash. The talks are advanced and could close quickly if both sides agree. Some outlets note the deal would rank among Berkshire’s largest since its recent big purchases. Public filings show Berkshire holds about a quarter to nearly 28% of Occidental’s stock, which shapes the dynamics.

Why Berkshire might like OxyChem?

OxyChem offers steady demand and predictable margins. Chemicals such as PVC are needed for homes, hospitals, and factories. That makes cash flow easier to forecast. Berkshire favors businesses with clear cash streams. OxyChem also diversifies Berkshire’s industrial base beyond insurance and utilities. A cash purchase would put idle cash to work, rather than leaving it in low-yield accounts.

Why Occidental May Sell?

Occidental faces heavy debt from past deals. Large purchases, including Anadarko in 2019 and CrownRock in 2023, pushed leverage higher. Selling OxyChem could free up cash. That would cut interest costs and let Occidental focus on oil, gas, and carbon projects. Management has already sold other assets to reduce debt. A $10 billion sale could accelerate that plan.

Market View and Investor Moves

News of the talks moved markets modestly. Occidental shares rose after reports surfaced. Some analysts see the price as fair for a unit that makes essential products. Others question how regulators will view the sale. Active traders and those using an AI stock research analysis tool flagged the story quickly, given the size and the players involved.

Industry Context and Competitive Landscape

The chemicals market has several big players. Companies such as Dow and LyondellBasell compete in many of the same product lines. Demand for PVC and vinyl tends to track construction and manufacturing cycles.

Still, long-term needs like water infrastructure and medical supplies support steady demand. If Berkshire closes the deal, it would own a major U.S. vinyl and chlorine operator. That could shift competitive dynamics in North America.

Financial and Operational Risks

Regulatory checks are a real risk. Antitrust or environmental reviews could slow the deal. Chemical plants face strict permitting and cleanup rules. Commodity swings also matter. Feedstock and energy costs can squeeze margins quickly. Integration matters too. Running a large chemical unit is not the same as owning an insurance company or a railroad. Berkshire would need skilled operators and clear plans to keep performance steady.

What to Watch Next?

Look for an official announcement from Berkshire or Occidental. Watch filings for any sale agreement. Monitor debt figures and how Occidental plans to use proceeds. Track regulatory filings that might show scrutiny. Also watch near-term revenue trends for OxyChem. If the deal closes, expect a period of operational focus to protect cash flow.

Bottom line

A $10 billion OxyChem sale would be big for both sides. Berkshire would add a steady industrial business. Occidental would gain headroom to cut debt and focus on core oil and gas work. The deal could close fast, but regulatory and integration hurdles remain. Exact outcomes will depend on filings and final terms announced after September 30, 2025.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.