Tesla Crosses $1 Trillion Valuation Mark on 3.31% Share Price Rise

On October 1, 2025, Tesla’s stock price surged by 3.31%, closing at $459.46 per share. This remarkable increase propelled the company’s market capitalization to over $1 trillion, reaffirming its position among the world’s most valuable companies. Notably, this milestone was achieved despite the recent expiration of the $7,500 federal electric vehicle (EV) tax credit, which had previously provided significant incentives for EV buyers and lessors. In response, Tesla adjusted its pricing strategies, notably increasing lease prices for models like the Model Y, to offset the loss of this credit.

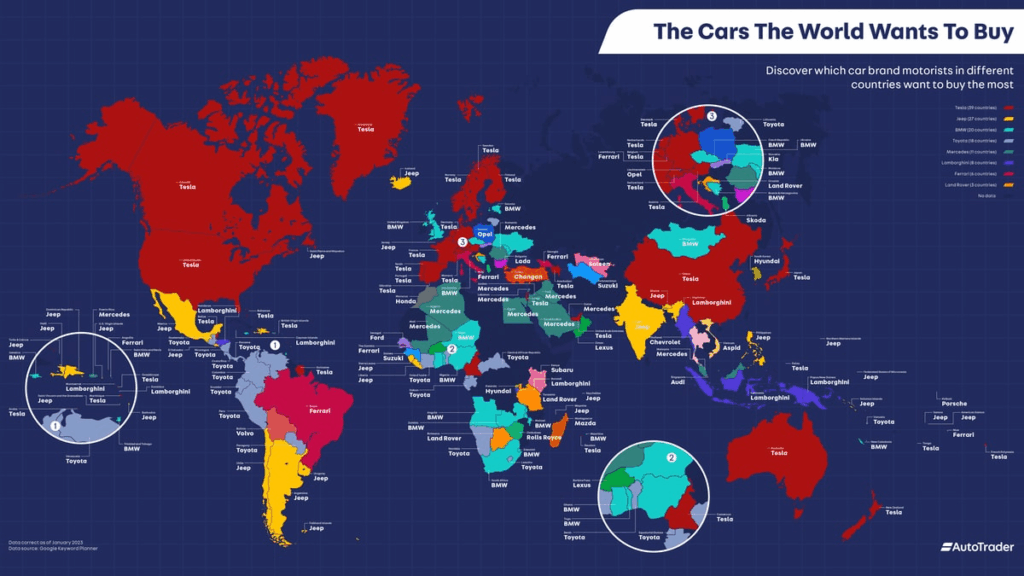

Tesla’s ascent to a $1 trillion valuation underscores its transformative impact on the automotive industry and highlights investor confidence in its future prospects. Tesla’s work in AI, self-driving technology, and robotics puts it at the lead in next-generation transportation. The company is shaping the future of how we travel. As Tesla continues to expand its product offerings and global presence, its trajectory suggests that the company is not merely participating in the EV revolution but is actively shaping its future.

We will explore what drives Tesla’s growth, compare its path with other tech giants. We’ll also examine what a $1 trillion valuation means for investors and the market.

Tesla’s Market Performance Leading Up to the Milestone

On October 1, 2025, Tesla’s stock price surged by 3.31%, closing at $459.46 per share. This increase propelled the company’s market capitalization to over $1 trillion, reaffirming its position among the world’s most valuable companies. Even after the $7,500 federal EV tax credit ended, Tesla’s stock kept rising. The company maintained strong demand and investor confidence despite losing this incentive. In response to the loss of this credit, Tesla adjusted its pricing strategies, notably increasing lease prices for models like the Model Y, to offset the impact on its financials.

Tesla’s rise to a $1 trillion value shows its big impact on the car industry. Investor confidence in Tesla’s future is very strong. Its growth is changing the market. The company’s innovative advancements in artificial intelligence, autonomous driving technologies, and robotics have positioned it at the forefront of the next generation of transportation solutions.

Factors Driving Tesla’s Growth

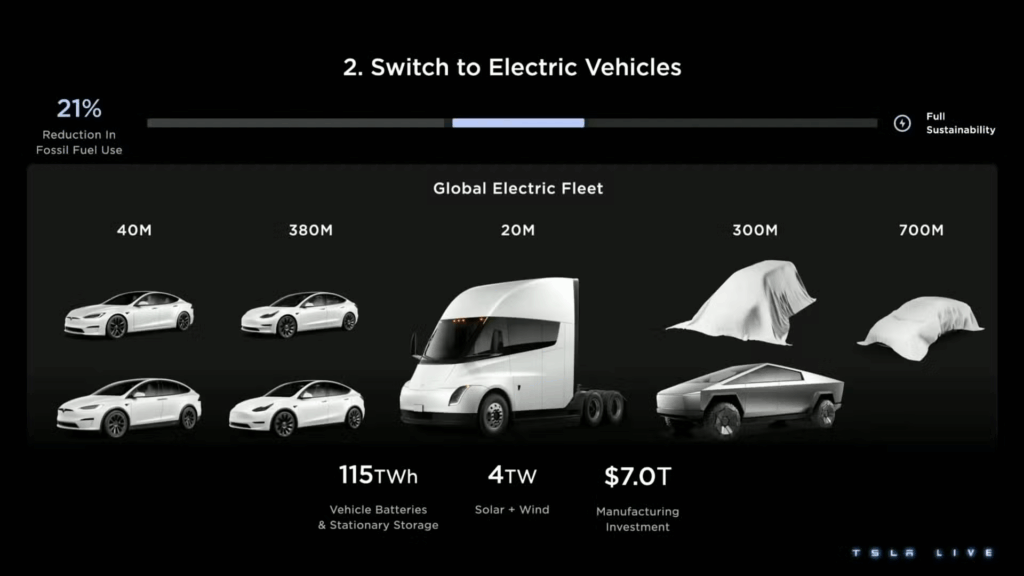

Tesla’s commitment to innovation is evident in its expanding EV lineup, including the Model S, 3, X, Y, and the upcoming Cybertruck. The company has made significant advancements in battery technology, enhancing vehicle range and performance. Additionally, Tesla’s focus on autonomous driving features has set it apart from competitors, attracting a loyal customer base and driving demand for its vehicles.

Tesla’s global expansion strategy has been instrumental in its growth. The establishment of Gigafactories in key markets such as the United States, China, and Europe has increased production capacity and reduced manufacturing costs. This expansion has enabled Tesla to meet the growing demand for EVs and solidify its presence in international markets.

Beyond electric vehicles, Tesla has diversified its business portfolio to include energy solutions. The company’s solar products and energy storage solutions have gained traction, contributing to its revenue streams. These ventures align with Tesla’s mission to promote sustainable energy and reduce dependence on fossil fuels.

Investor confidence in Tesla has been bolstered by the company’s consistent performance and growth prospects. The popularity of the EV sector and the increasing emphasis on sustainability have further fueled investor interest. Elon Musk’s leadership and vision have also played a significant role in shaping public perception and attracting investment.

Comparison with Other $1 Trillion Companies

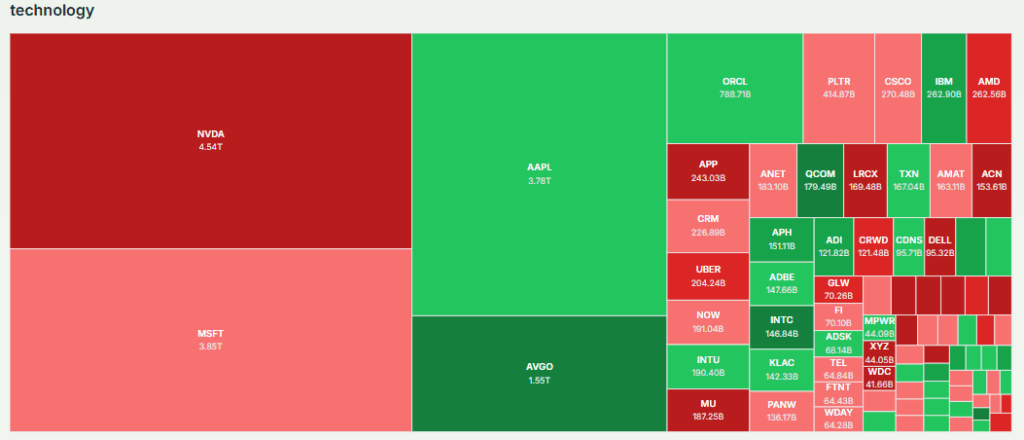

Tesla’s achievement of a $1 trillion valuation places it alongside other tech giants such as Apple, Microsoft, and Amazon. However, Tesla’s path to this milestone differs due to its unique position at the intersection of the automotive and technology industries.

While companies like Apple and Microsoft have established themselves in the tech sector, Tesla’s integration of AI, robotics, and sustainable energy solutions sets it apart. This convergence of industries has allowed Tesla to tap into new markets and drive innovation in ways that traditional automakers have not.

Implications for Investors & Market Analysts

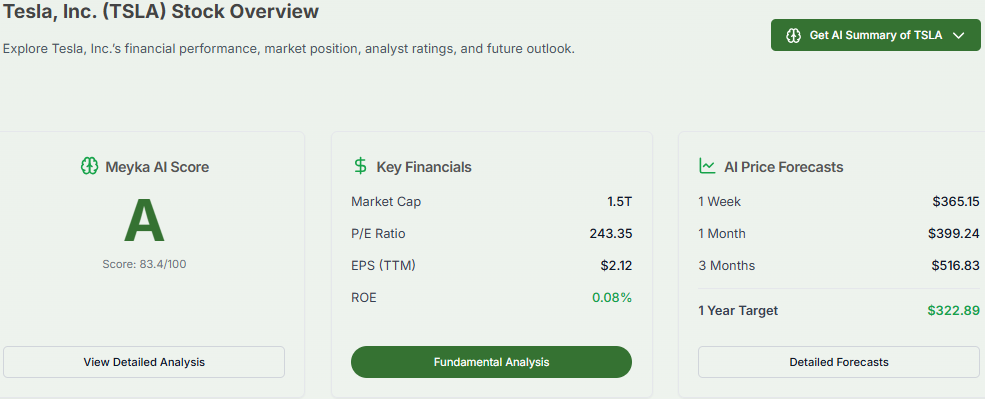

Tesla’s $1 trillion valuation has significant implications for investors and market analysts. The company’s performance serves as a benchmark for the EV industry, influencing investment decisions and market trends. Analysts closely monitor Tesla’s financials, production capabilities, and technological advancements to assess its growth trajectory. The company’s ability to navigate challenges, such as the expiration of the EV tax credit, will be critical in maintaining investor confidence and sustaining its market position.

Challenges Ahead for Tesla

The EV market is becoming increasingly competitive, with new entrants and established automakers launching their own electric vehicles. Tesla faces the challenge of differentiating its products and maintaining market share amidst this growing competition.

Operating in multiple countries exposes Tesla to various regulatory and geopolitical risks. Changes in government policies, trade relations, and environmental regulations can impact the company’s operations and profitability.

Scaling production to meet global demand presents logistical challenges. Supply chain disruptions, shortages of critical components, and manufacturing constraints can hinder Tesla’s ability to deliver vehicles on time and maintain quality standards.

The stock market is subject to fluctuations, and Tesla’s high valuation may be susceptible to corrections. Investors and analysts will need to monitor market conditions and assess whether Tesla’s growth prospects justify its current valuation.

Wrap Up

Tesla’s achievement of a $1 trillion valuation marks a significant milestone in the company’s journey. Driven by innovation, strategic expansion, and a commitment to sustainability, Tesla has transformed from a niche electric vehicle manufacturer to a global leader in the automotive and technology sectors. While challenges lie ahead, Tesla’s ability to adapt and innovate positions it well for continued success in the evolving market landscape.

Frequently Asked Questions (FAQs)

Tesla’s market capitalization surpassed $1 trillion on October 1, 2025, driven by a 3.31% increase in stock price, strong quarterly deliveries, and investor confidence in AI ventures.

Following the expiration of the $7,500 federal EV tax credit on September 30, 2025, Tesla increased the lease prices for models such as the Model Y and Model 3.

Tesla’s board proposed a $1 trillion performance-based compensation package for Elon Musk, contingent on achieving ambitious milestones over a decade, including an $8.5 trillion market cap.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.