GIFT Nifty 50 Slips 10 Points Ahead of Market Open – Key Trading Setup for Today

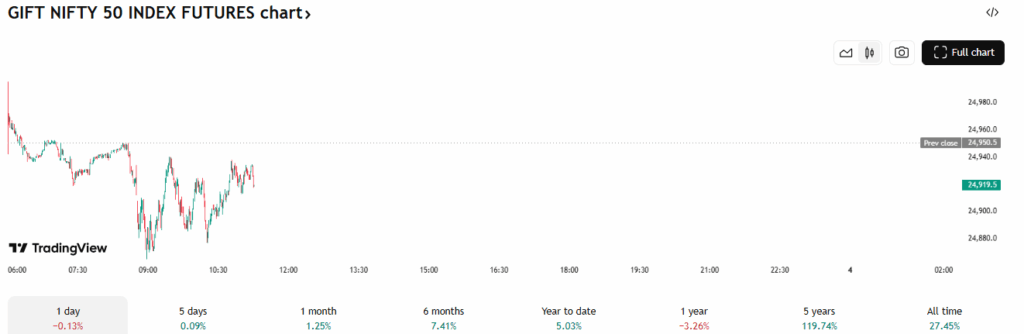

The GIFT Nifty 50 fell 10 points in early trade on October 3, 2025. It signaled a cautious start for the Indian stock market. This index, traded in GIFT City, reflects overnight global sentiment. It gives the first hint of how the Nifty 50 and Sensex may open.

Why does it matter? Because both global and local signals shape intraday momentum. Even a small slip can show caution, profit booking, or weak risk appetite.

Wall Street’s performance, Asian market strength, and commodity prices are shaping today’s view. Domestic factors like foreign investor flows and the rupee add weight.

In short, the theme is cautious optimism. Traders must track levels, sectors, and key stocks before entering the market.

Global Market Cues

Overnight gains on Wall Street set a mixed tone. The S&P 500 and Nasdaq closed near record highs on October 2, 2025. Investors cheered fresh AI and tech deals. This lifted global risk appetite. At the same time, worries about a U.S. government shutdown and delayed data kept some traders cautious. These two forces made markets look optimistic but fragile. U.S. rate expectations also mattered. Hints of earlier Fed easing pushed yields down. That helped equities but raised the possibility of night-to-day reversals.

Asian markets were uneven as India opened. The Nikkei showed strength. The Hang Seng and Shanghai were steady to higher. This split view kept GIFT Nifty sensitive to small moves. Traders watched commodity prices too. Brent crude and gold influenced energy and metal names in India.

Domestic Market Sentiment

On October 3, 2025, GIFT Nifty futures signaled a small downtick. Early trade showed about a 10-point slip. This hinted at a cautious opening for domestic equities. The rupee hovered near record lows. That puts extra pressure on import-heavy firms. Foreign institutional investors were net sellers recently. This added to the cautious mood. At the same time, some domestic funds kept buying select midcaps. The result was a mixed flow picture for the day.

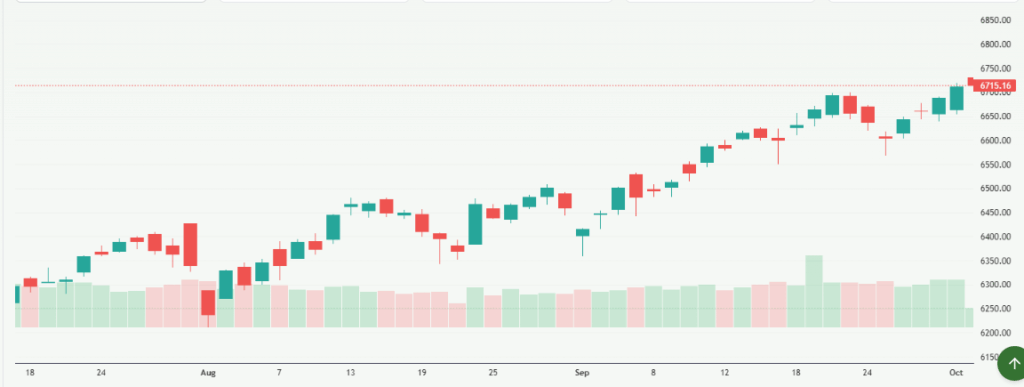

Technical Outlook on Nifty 50

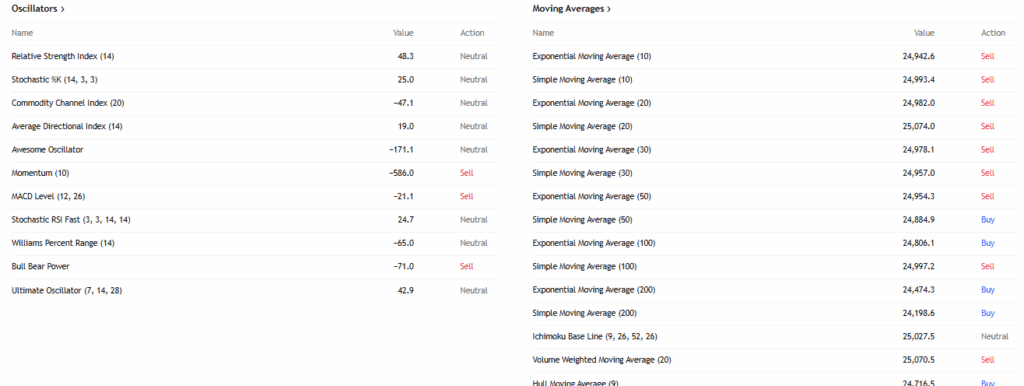

Key support sits near the 24,700-24,800 zone. This band is close to the 200-day moving average on many charts. Immediate resistance shows up around 25,000-25,100. Shorter moving averages, 20 and 50 DMA, are flattening. The daily RSI is below the overbought zone. MACD is neutral to mildly bearish on short timeframes. Low volumes on the slip suggest range trading is likely unless a big trigger appears. Traders should watch intraday pivot levels for quick trades. For deeper scans, some may use an AI stock research analysis tool to spot momentum shifts faster.

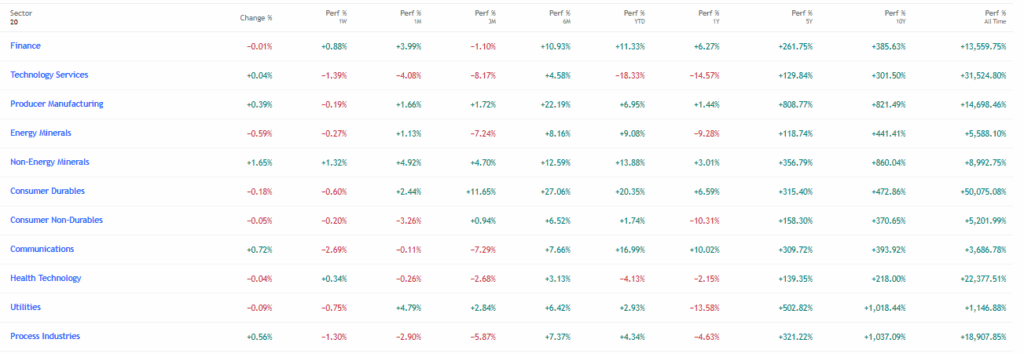

Sectoral Trends to Watch

Banks may lead the index moves. Bank Nifty levels will steer market tone. Rate expectations and bond yields influence bank earnings. IT names will track U.S. tech. Strong Nasdaq gains tend to lift large-cap IT stocks. Energy and metal firms will follow oil and commodity moves. FMCG may stay defensive if volatility rises. Auto and retail will watch consumer data and currency swings. Active traders should pick sectors with clear catalysts today.

Stock-Specific Action

Large heavyweights can drag the index. Reliance, HDFC Bank, TCS, Infosys, and ICICI Bank are the names to watch. Any surprise in these names can widen market moves. Look for stock news on earnings, deals, or government orders. On October 3, 2025, early trades showed Tata Motors and some retail stocks moving more than their peers. Midcaps with recent positive flows may outpace large caps in a steady market. Watch volume spikes as a sign of fresh interest.

Derivatives & F&O Data

Put-call ratio is a quick mood meter. A rising PCR can mean protective buying in puts. Open interest build-up near key strikes signals possible pinning. Traders should check the option chain for high interest at 24,800 and 25,000 if activity clusters there. FII positions in index futures can add momentum when they pile in one direction. For intraday signals, watch sudden changes in OI with volume. These moves often precede sharp intraday swings.

Macro & Policy Watch

RBI statements and forex moves will matter on October 3, 2025. The rupee’s dip near lifetime lows keeps RBI intervention on the radar. Any comment from the central bank can trigger volatility. On the fiscal side, no major announcements are expected today. But traders will eye global headlines for spillover effects. Domestic inflation prints and industrial data remain key for the week ahead.

Trading Strategies for the Day

Keep trades small until a clear trend appears. For intraday traders, use tight stops. Trade breakouts only if volume confirms the move. Range traders should use the 24,700-25,100 band for entry and exit. Avoid holding large directional bets overnight, given currency and FII flow risk. For short-term investors, accumulate selectively in quality names if prices correct to strong support. Use stop-loss levels equal to a fixed percent of trade size. Risk control is the priority today.

Final Words

On October 3, 2025, the small GIFT Nifty slip is a cue, not a signal by itself. Global optimism from tech and U.S. gains competes with local currency stress and outflows. Technical levels close to 24,700 and 25,000 will guide short-term moves. Traders should watch sector cues and option data. Keep risk tight and trade with facts, not fear. Follow live updates through trusted market feeds and trade plans that protect capital.

Frequently Asked Questions (FAQs)

GIFT Nifty is a futures contract on India’s Nifty 50 index, traded in GIFT City. Nifty 50 tracks 50 top Indian companies on NSE.

GIFT Nifty trades in two sessions. The morning session runs from 6:30 AM to 3:40 PM IST. The evening session continues from 4:35 PM until 2:45 AM.

Retail investors in India cannot trade GIFT Nifty directly. It is mostly for institutional and foreign investors. Regulations limit direct access for common traders.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.