After Record Wall Street Gains, US Stock Futures Show No Movement

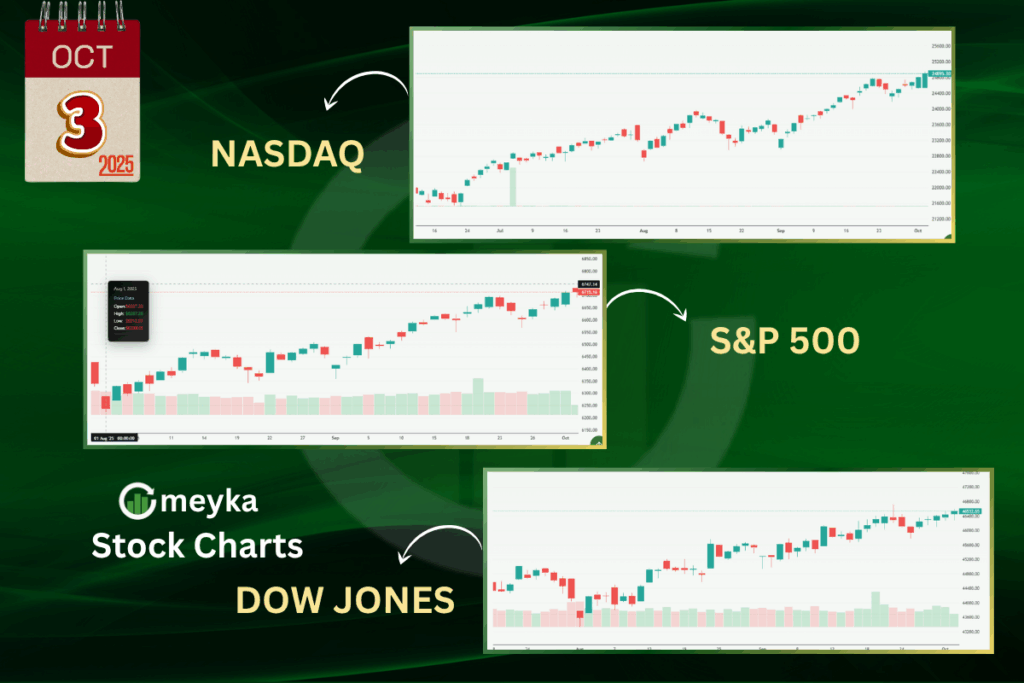

On October 2, 2025, U.S. stock markets reached new record highs, driven by gains in technology and AI-related stocks, despite a U.S. government shutdown that delayed critical employment data. The S&P 500 rose 0.1%, the Dow increased 0.2%, and the Nasdaq gained 0.4%, with all three indices hitting records.

However, the optimism didn’t carry over into the futures market. As of 19:24 ET, S&P 500 Futures steadied at 6,767.25 points, Nasdaq 100 Futures at 25,114.50 points, and Dow Jones Futures were flat at 46,807.0 points. This pause in futures trading has left investors and analysts questioning the market’s next move.

Let’s explore why U.S. stock futures are showing little movement despite record gains in Wall Street indices. We’ll understand the factors influencing this trend and what it means for investors.

Recap of Recent Wall Street Gains

On October 2, 2025, U.S. stock markets reached new record highs. The S&P 500 rose by 0.1% to 6,715.35, the Dow Jones Industrial Average increased by 0.2% to 46,519.72, and the Nasdaq Composite climbed by 0.4% to 22,844.05. The Russell 2000 index of smaller companies also rose by 0.7% to 2,458.49.

Technology stocks led the gains, spurred by OpenAI’s new AI infrastructure partnerships in South Korea. Fair Isaac also had a strong performance, surging after launching a customer-friendly program that bypassed major credit bureaus.

Weekly performance showed positive momentum across the board: the S&P 500 rose 1.1%, the Dow 0.6%, the Nasdaq 1.6%, and the Russell 2000 1%. Year-to-date, the indexes have performed strongly, with the S&P 500 up 14.2%, the Dow 9.3%, the Nasdaq 18.3%, and the Russell 2000 up 10.2%.

About Stock Futures and Their Role

Stock futures are financial contracts obligating the buyer to purchase, or the seller to sell, an asset at a predetermined future date and price. They are standardized agreements traded on futures exchanges. In the context of U.S. stock markets, futures contracts are available for major indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite.

Futures contracts are used by investors and traders to hedge against potential market fluctuations or to speculate on the direction of the market. They provide a way to gain exposure to a broad market index without owning the underlying stocks.

For example, if an investor believes the S&P 500 will rise in the future, they might buy S&P 500 futures contracts. If the index does rise, the value of the futures contract increases. This allows the investor to sell the contract for a profit.

Reasons for No Movement in US Stock Futures

Despite the record gains in Wall Street indices, U.S. stock futures showed little movement. As of 19:24 ET on October 2, 2025, S&P 500 Futures steadied at 6,767.25 points, Nasdaq 100 Futures at 25,114.50 points, and Dow Jones Futures were flat at 46,807.0 points.

Several factors explain why futures are not moving. After big gains, markets often pause and prices stabilize. Some investors sell stocks to lock in profits, which slows upward momentum. Worries about the economy, like inflation and jobs data, make investors cautious. Futures can also hit technical resistance, where prices struggle to go higher without new triggers. All these reasons together keep futures mostly flat.

Sector and Stock-Specific Insights

Certain sectors and stocks have shown strength or weakness in futures trading:

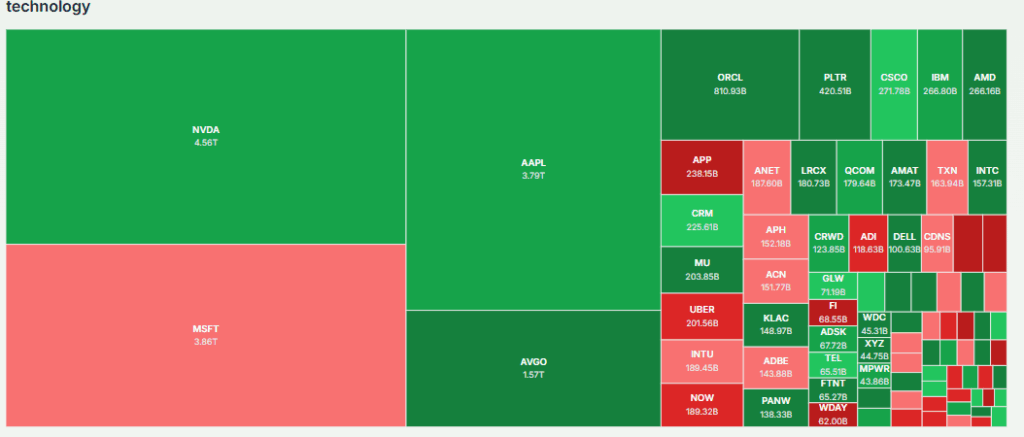

Technology Sector: The technology sector, particularly companies involved in artificial intelligence, has been a significant driver of market gains. Companies like Nvidia, AMD, and SK Hynix have seen their stock prices rise due to increased demand for AI-related products and services.

Financial Sector: The financial sector has faced challenges, with companies like Equifax and TransUnion experiencing declines in stock prices. These declines may be due to concerns over data security and regulatory issues.

Implications for Investors and Traders

The flat movement in stock futures after Wall Street’s record gains carries important lessons for investors and traders. It shows that caution is needed, and making quick decisions based on short-term swings can be risky. Instead, focusing on the fundamentals of companies and sectors helps guide smarter investment choices. Keeping a diversified portfolio also reduces risk, as it spreads exposure across different assets and protects against sudden market changes.

What to Watch Next?

Investors should monitor the following factors in the coming weeks:

- Upcoming reports on employment, inflation, and GDP growth will provide insights into the health of the economy.

- Statements from the Federal Reserve regarding interest rates and monetary policy can influence market expectations.

- Earnings reports from major companies will shed light on their financial health and future prospects.

Wrap Up

While U.S. stock markets have reached record highs, the lack of movement in stock futures indicates a period of consolidation. Investors should remain vigilant and consider both technical and fundamental factors when making investment decisions. Using an AI stock research analysis tool can help track trends and evaluate opportunities. Staying informed about economic indicators and market developments will be crucial in navigating the current market environment.

Frequently Asked Questions (FAQs)

Tesla delivered a record 497,099 cars in Q3 2025. On October 2, 2025, its stock fell 5.1% due to the tax credit ending, high valuation, and market competition.

The $7,500 U.S. EV tax credit ended on September 30, 2025. Q3 sales surged as customers rushed to buy. Future demand may fall without incentives; Tesla offers lease credits.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.