Westpac Breaks From RBA Trend With Surprise Interest Rate Move

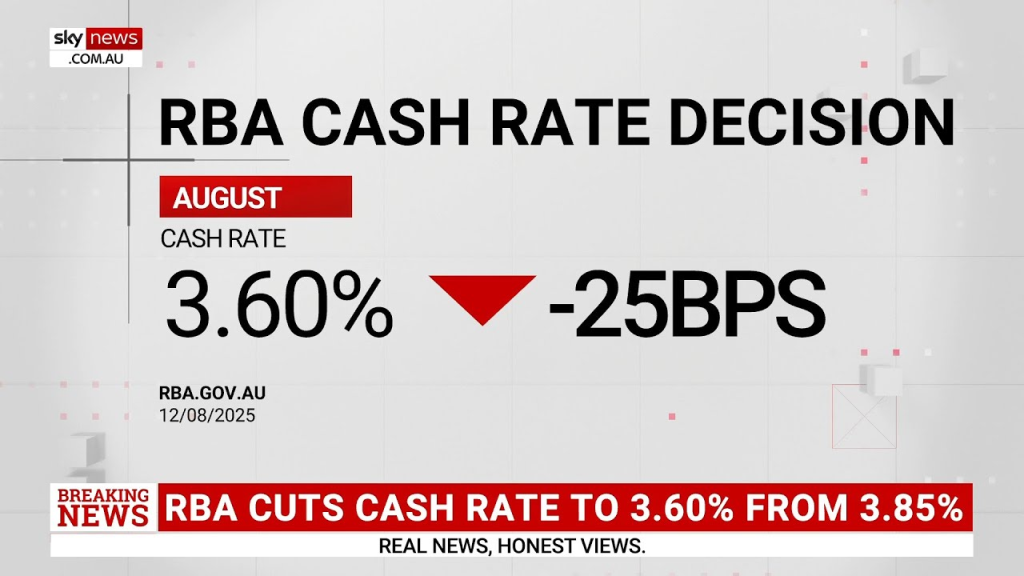

We live in a time when banks rarely break ranks. So when Westpac surprised markets with a rate move off the usual path, it caught many of us off guard. On 12 August 2025, the Reserve Bank of Australia (RBA) cut its official cash rate by 0.25 percentage points, bringing it to 3.60 %.

But instead of simply echoing that move, Westpac acted in a way that signals a new direction. We saw the bank adjust home loan and deposit rates in a manner that didn’t fully mirror the RBA’s step.

Let’s discuss what Westpac did, why it matters, and how it may affect borrowers, savers, and the market at large. We’ll show how this divergence might signal tension between central banking policy and real-world banking strategy.

Background: Australia’s Interest Rate Overview

The Reserve Bank of Australia cut its cash rate by 25 basis points to 3.60% on 12 August 2025. This was the third cut of the year. The move followed slowing inflation and weaker domestic demand. Markets and economists had largely expected the cut after months of easing pressure on prices.

After the August cuts, debate grew over how fast rates would fall further. Some forecasters saw one more cut before year-end. Others said the RBA might pause to watch data. By 30 September 2025, the RBA held the cash rate at 3.60%. This signals caution amid mixed inflation signals.

Australian banks usually pass the RBA’s moves to customers. That link has been strong for years. Banks match their home loan and deposit pricing to the central bank when costs and margins allow. But the link is not automatic. Banks face their own pressures.

Westpac’s move: What happened?

On 12 August 2025, Westpac announced it would change retail rates after the RBA cut. Westpac said it would reduce variable home loan rates by 0.25 percentage points. The cuts for customers were set to take effect from 26 August 2025. Westpac also adjusted some deposit offers.

The bank framed the change as passing on the RBA’s easing to borrowers. The announcement included effective dates and the exact products affected. This action followed similar moves by other major banks, but timing and product details varied across lenders.

Market and Industry Reaction

Markets moved quickly. Major bank share prices showed short-term swings on the day of the RBA decision and the follow-up pricing announcements. Mortgage brokers and comparison sites saw a spike in enquiries. Many customers checked rates and sought refinancing options.

Competitors reacted fast. Commonwealth Bank, NAB, and ANZ also passed on cuts around the same dates. Each bank sets slightly different effective dates for rate changes. That created short-lived competition in the mortgage market. Analysts flagged that banks were trying to balance margin protection and customer retention.

Possible Reasons Behind the Decision

Rising wholesale funding costs forced banks to weigh margins. Funding can change faster than the RBA’s cash rate. Banks must protect mortgage margins when deposit competition is fierce. That can lead to partial or delayed pass-through of central bank cuts.

Another factor is strategy. Banks use rate moves to win customers. A timely cut can attract new borrowers or stop defections. Westpac’s product mix and market share goals likely influenced the timing and size of its action. Global rate trends and investor expectations also matter.

Operational lag is another reason. Systems and contract terms mean changes take days or weeks to appear for customers. This explains the different effective dates across banks. It also explains why media and customers sometimes see a patchwork of price moves.

Implications for Borrowers and Savers

Borrowers gained relief from lower variable mortgage rates. The average homeowner saw small but helpful drops in monthly payments once the cuts took effect. For new borrowers, advertised rates became more attractive. Shoppers with fixed rates saw no immediate change.

Savers faced mixed news. Some deposit rates fell. Other banks offered targeted deposit deals to hold customer funds. That meant savers had to hunt for the best offers. Comparison tools and the occasional AI stock research analysis tool helped some customers scan options faster.

For businesses, cheaper borrowing costs can ease short-term cash flow. But businesses that rely on consumer spending watched carefully. If households feel marginally better off, spending can rise. If uncertainty persists, firms may delay investment.

Broader Economic Impact

If banks broadly pass on rate cuts, borrowing costs fall for many households. That supports consumer spending and can lift the housing market. If banks hold back, the impact of the RBA easing is weaker. The degree of pass-through matters for how quickly policy feeds into the real economy.

The RBA watches these outcomes. If banks do not pass on cuts fully, the RBA may need to factor that into future moves. On 30 September 2025, the RBA held the cash rate at 3.60% and stressed data dependency for the next steps. That shows the central bank is sensitive to how policy transmits through banks and markets.

Expert Insights and Predictions

Some economists argue that banks will keep tightening competition for good customers. That could push effective mortgage rates down further later in 2025. Others warn that banks will defend margins if wholesale costs rise again. Analysts expect the banking sector to remain cautious and nimble.

Scenarios to watch include a renewed inflation surprise or a fresh shock to funding costs. If inflation rebounds, the RBA may abandon cuts. If wholesale markets calm and competition grows, household rates could fall faster. The next RBA meetings and bank updates will be key.

Wrap Up

Westpac’s August 2025 pricing moves landed in a noisy policy period. The RBA cut to 3.60% on 12 August 2025, and banks adjusted product rates in the days that followed. The size and timing of these moves shape how fast households and businesses feel relief. Watch future bank statements and RBA decisions closely. They will show whether this pass-through continues or whether banks chart a different path.

Frequently Asked Questions (FAQs)

Westpac changed its rates on 12 August 2025 to manage its own costs and profits. Banks sometimes adjust rates independently, even when the RBA keeps policy steady.

If you have a variable mortgage, payments may drop slightly after 26 August 2025. Savers might see lower deposit returns or new short-term promotional offers.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.