BoE’s New Stablecoin Policy Marks Major Step for UK Digital Finance

As of October 1, 2025, the Bank of England unveiled a bold new stablecoin policy that may reshape the UK’s digital money scene. We live in a world where people expect fast, cheap payments all the time, and stablecoins promise exactly that: crypto tokens whose value stays steady because they’re backed by real assets. But until now, regulation in this space has been murky.

With this new framework, the BoE aims to treat widely used stablecoins almost like regular bank money with rules, oversight, and protections. We see this as a turning point. It offers clarity for firms, confidence for consumers, and room for innovation without chaos.

Let’s dig into how this policy works, why it matters for Britain, what risks lie ahead, and how it stacks up globally. We’ll also explore how financial institutions and fintechs could change under these rules.

About Stablecoins

Stablecoins are digital tokens that try to keep a steady value. Most link their price to a currency like the US dollar or the pound. Some hold cash or short-term bonds as a reserve. Others use crypto collateral or code-based rules to keep value stable. People use stablecoins for fast payments, trading, and decentralised finance.

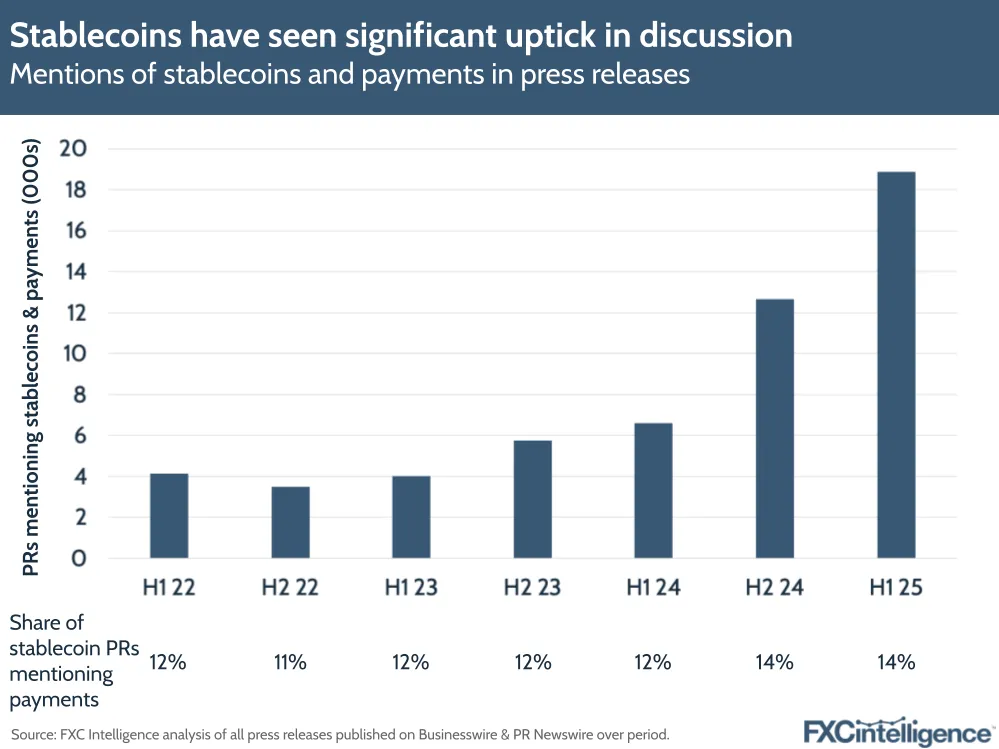

Global stablecoin supply reached hundreds of billions by 2025, led by large dollar-pegged tokens. That scale raises a question: when does a stablecoin matter to the wider financial system? The answer depends on how many people use it and how it is backed.

Overview of the Bank of England’s New Policy

On October 1, 2025, Bank of England Governor Andrew Bailey signalled a shift. The Bank proposed regulating widely used stablecoins more like bank money. Key moves include strict reserve rules, oversight of issuers, and possible access to central bank accounts for systemically important tokens. The Bank aims to make stablecoins safe for everyday payments.

The policy also expects close work with the Financial Conduct Authority to split duties: the BoE would handle systemic risk, while the FCA would manage conduct and consumer protection. These steps follow earlier consultation work and a series of progress reports on the digital pound.

Why does the Policy Matter for the UK?

Clear rules reduce legal risk. That helps firms decide to build in the UK. Retailers could accept stablecoins with more confidence. Cross-border payments may get cheaper and faster if stablecoins link well with banks.

The policy also shapes the path to a central bank digital currency. The Bank’s digital pound work, updated in January 2025, shows how public and private digital money might coexist. Clarity can attract fintech startups and global token issuers. It can also keep the UK competitive against other hubs that move faster on stablecoin law.

Impact on Banks and Fintech Firms

Banks may face new rivals and new partners. Some banks are already testing tokenised deposits. The policy pushes banks to decide: compete, partner, or build token services. Fintech firms can offer faster settlement, token custody, or cross-border rails. But costs rise too. Firms will need stronger controls, proof of reserves, and clearer governance.

Smaller firms may struggle with compliance costs. Bigger firms could use token rails for instant settlement and new products. Investors and analysts may use tools like an AI stock research analysis tool to spot market moves tied to tokenisation and custody plays.

Global Comparison

The UK approach sits between strict bans and laissez-faire models. The EU adopted the MiCA path to set EU-wide rules. The US has been slower at the federal level, though state and federal agencies press for oversight. Singapore and Hong Kong offer licensing routes to support digital-asset firms. The BoE’s idea to classify “systemically important” stablecoins and give them central-bank account access is distinctive. It aims to couple innovation with safety. That balance may attract firms that want clear rules and access to the London market.

Potential Risks and Criticisms

The move is not risk-free. One worry is centralisation. Giving central bank accounts to private tokens could shift power to a few issuers. Privacy is another concern. Token usage can create rich data trails. Some crypto supporters fear overregulation that stifles creativity.

Market players also raise technical issues: are reserves truly liquid? Can redemptions work in a crisis? Critics argue that trust in stablecoins depends on law, audit, and clear recovery plans. The Bank has noted these risks and plans consultation papers to refine the rules.

Practical Steps for Implementation

Regulators will consult, and firms must prepare. Issuers should build robust reserve accounting and frequent audits. Custodians must improve safekeeping and segregation of assets. Payment firms should upgrade settlement tech and test cross-border links. Banks should map how token rails affect liquidity and capital rules.

Policy windows and pilot programmes are likely through late 2025 and into 2026. Firms that act now will face lower transition costs. The BoE and FCA consultations released in May and July 2025 provide guidance to start these changes.

How may Consumers and Businesses be Affected?

Consumers could gain faster and cheaper payments. Businesses may see lower costs for cross-border transfers and faster settlement cycles. But protection matters. New rules aim to secure redemptions and prevent runs. Clear issuer rules will make it easier for merchants to accept tokens. Yet user education is vital. People must know how to redeem tokens and what protections apply. Regulators plan outreach and clearer disclosure rules to help users make safe choices.

Stablecoin: The Road Ahead

Expect gradual change. The BoE will publish detailed proposals and hold consultations in the coming months. The window for formal rule changes may stretch into 2026. Parallel work on the digital pound will continue. The global rule book is also in flux, so coordination with overseas regulators will shape final outcomes. Firms should watch policy dates and consult legal and technical experts early. Pilots and sandbox projects will test the systems before broad rollouts.

Wrap Up

The BoE’s move in October 2025 marks a key moment for UK digital money. Clear rules can boost trust and invite innovation. Yet risks remain, and careful design is essential. The UK now faces a choice: lead with balanced rules or fall behind in the global race for digital finance. The next year will show how policy, technology, and markets adapt.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.