Idea Shares Rally Over 9% on 7 Oct, Touch Six-Month High

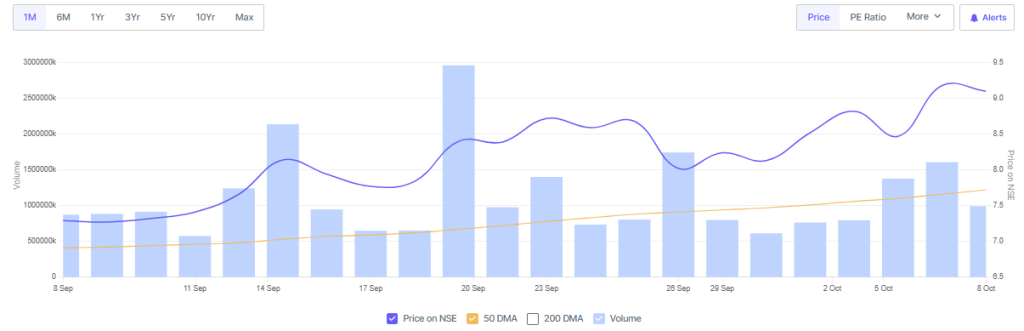

On Tuesday, October 7, 2025, Vodafone Idea Ltd. (Vi) saw its stock jump sharply. It closed at ₹9.24, up 9% from the day before. This rise brought the stock to its highest level in six months. Trading was heavy, with over 378 million shares changing hands.

The surge came from several reasons. Investors hope the company’s long-standing AGR dues may be resolved soon. This issue has been a big concern for the telecom firm. Another factor is the upcoming visit of UK Prime Minister Keir Starmer to India. Talks during the visit are expected to benefit Vodafone Idea.

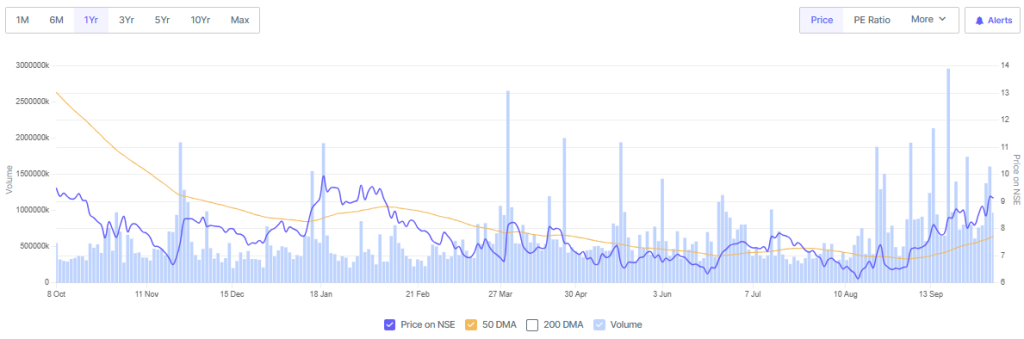

This rise is part of a bigger trend. Over the last nine weeks, the stock has grown more than 50%. This shows that investors are gaining confidence in the company. Understanding these developments helps explain why the stock has moved so strongly.

Background on Vodafone Idea Ltd.

Vodafone Idea Ltd. (Vi) is a major telecom company in India. It was formed in 2018 when Vodafone India merged with Idea Cellular. The company provides mobile voice, data, broadband, and enterprise services. Despite a large network and many customers, Vi faces big financial challenges. The main issue is the high AGR dues from the Department of Telecommunications (DoT).

Over the past year, Vi’s stock has been very volatile. Investors worry about its financial health and the AGR dispute. The company’s debt and strong competition make things harder. Recently, new strategies and possible regulatory relief have boosted investor interest. This has caused Vi’s stock price to rise noticeably.

Stock Performance on 7 October 2025

On Tuesday, October 7, 2025, Vodafone Idea’s shares jumped 9.09%. They closed at ₹9.24 on the NSE, the highest in six months. Trading was heavy, with 378 million shares changing hands.

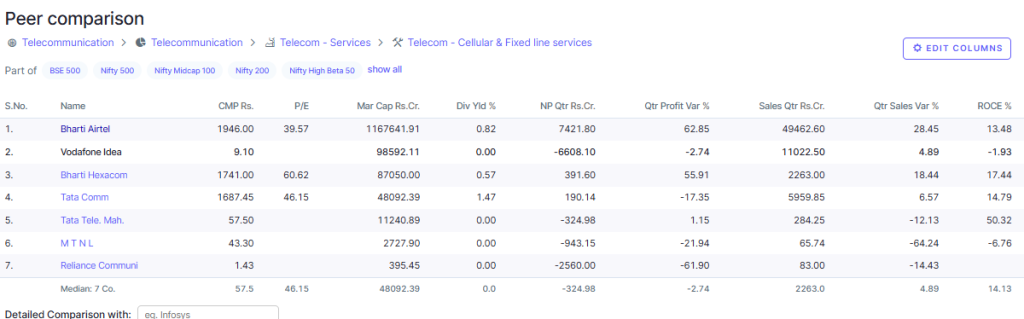

The rally beat the broader market. The BSE Sensex closed at 81,926.75, and the Nifty 50 at 24,900. This shows positive market sentiment. The rise in Vi’s stock reflects changing investor views, boosted by possible regulatory relief and the company’s new strategies.

Reasons Behind the Surge

Several factors drove Vodafone Idea’s stock rise on October 7, 2025. Investors hope the company’s long-standing AGR dues may be resolved. The Supreme Court will hear the plea on October 13. A positive decision could reduce the company’s financial burden.

The Indian government may offer a one-time settlement for Vi’s AGR dues. This could include waiving interest and penalties. Such relief would improve the company’s financial outlook. Vodafone Idea is expanding its 4G and 5G networks. The company wants to improve service and attract more customers. It has also raised retailer commissions to boost sales.

Tejas Mehta became the new Chief Financial Officer on October 6, 2025. Investors view this positively. His experience as CFO of Mondelez India adds valuable expertise during this critical time.

Market Analysis

Vodafone Idea’s stock on October 7, 2025, shows a wider recovery in the telecom sector. The share closed above its Volume Weighted Average Price (VWAP). Traders see this as a bullish sign. It indicates real buying interest, not just speculation.

In comparison, Bharti Airtel, a major rival, rose only 1.40% that day. It underperformed both the market and Vodafone Idea. This shows that investors are more confident in Vi after recent developments.

Implications for Investors

The recent rise in Vodafone Idea’s stock brings both chances and risks for investors. A good outcome in the Supreme Court hearing on October 13 could lower the company’s debts. This may help the stock rise further. The company’s efforts to expand its network and improve service can also make it stronger in the market.

Despite positive news, some uncertainties remain. The final decision on AGR dues is still pending. The company must also execute its plans well. Investors should watch these developments carefully before making decisions.

Future Outlook

Looking ahead, Vodafone Idea’s future depends on a few key factors. The Supreme Court hearing on October 13 is very important. A positive outcome could help the company reduce its debts and support a stronger stock recovery.

Investing in 4G and 5G networks is crucial. It will help Vodafone Idea stay competitive and meet the growing demand for fast internet.

The telecom market is very competitive. Companies like Reliance Jio and Bharti Airtel are strong rivals. Vodafone Idea must focus on service quality and customer experience to succeed long-term.

Final Words

Vodafone Idea’s 9.09% stock rise on October 7, 2025, is a key step in its recovery. The surge came from hopes of AGR dues relief, government support, new strategies, and leadership changes. Investor confidence has improved. Challenges still exist, and the company must handle them carefully. The Supreme Court hearing on October 13 is important. Investors should follow updates to make smart decisions about Vodafone Idea stock.

Frequently Asked Questions (FAQs)

Vodafone Idea shares rose 9% on October 7, 2025. Investors reacted positively to hopes of AGR dues relief and strong trading activity, boosting confidence in the company’s future.

AGR dues are a long-standing debt issue for Vodafone Idea. Any news about relief or settlement can affect the stock price and investor sentiment, as seen in October 2025.

Future rises depend on company actions, AGR dues resolution, and market trends. The stock may move up or down, so investors should watch updates closely after October 2025.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.