TCS Q2 Earnings Preview: What Analysts Expect from Tata Consultancy’s September-Quarter Results

The TCS Q2 report is one of the most-watched corporate events this earnings season. Tata Consultancy Services faces a tricky backdrop. Analysts expect modest revenue growth, steady margins, and careful management commentary. Investors will look for signals on deal wins, attrition, and the H1B visa impact.

Reports from sources frame the consensus view ahead of the September-quarter numbers.

TCS Q2 expectations: the headline view

Analysts broadly expect muted growth in the TCS Q2 results. LiveMint and Economic Times note that revenue may be softer quarter on quarter as global IT spending cools. Profit and operating margins are likely to be stable, helped by efficiency gains and cost control, but pressure from travel and wage costs may limit upside.

Why are TCS Q2 earnings in focus this time? This quarter will show how TCS weathers slower demand in the US and Europe, visa cost pressures, and whether its AI and digital services can sustain growth.

Key metrics analysts will track in TCS Q2

Investors and traders are watching a short list of indicators that will shape the share reaction after results:

- Revenue growth: Analysts expect modest sequential growth, reflecting steady demand in digital services but cautious client budgets.

- Operating margin and PAT: Margins are expected to be broadly stable, as cost cuts offset rising travel and wage pressures.

- Deal wins and TCV: Contract wins and total contract value remain a core focus for future revenue visibility. Analysts want clarity on large deal closures. .

- Attrition and hiring: Any improvement in attrition rates will be watched as a sign of stabilizing talent churn.

- H1B visa costs: Visa-related expenses remain a near-term drag, and analysts will seek commentary on their outlook.

A market bulletin from ET NOW summed it up:

“All eyes on TCS Q2, with focus on margins, deal wins, and commentary on FY26 outlook.”

Management’s unusual step this quarter

TCS will skip its usual post-results media conference, a move flagged by Moneycontrol. That decision has sparked questions about the company’s communications strategy and timing, especially amid leadership transition talk.

Market observers expect written commentary or selective investor calls instead. A social post highlighted investor curiosity:

“TCS skipping its post-earnings media interaction for Q2 has fuelled speculation on strategic changes within the company.”

How global factors could shape TCS Q2 results

TCS’s outsized exposure to the US and Europe makes it sensitive to client spending cycles. Slower decision-making in sectors like banking and retail can delay projects. Currency moves, travel expense normalization, and onshore hiring trends also show up in margins.

AI Stock research firms note that macro swings can amplify short-term volatility, even for large, diversified IT players like TCS.

The H1B visa story and employee costs

One recurring theme is the H1B visa situation. TCS sends thousands of employees to the US. Policy shifts and administrative delays have raised costs.

Analysts expect the company to quantify the impact and outline steps to mitigate this through local hiring and pricing changes. As one market watcher noted:

“H1B-related costs have trimmed near-term profit expectations, but TCS remains operationally efficient.”

Segment focus: BFSI, cloud, and AI-led services

TCS’s BFSI vertical remains a major revenue contributor. Any softness there will matter. At the same time, cloud migration and generative AI services are growth pockets. Analysts want to see whether digital projects and AI deals compensated for weakness in traditional services.

AI Stock Analysis across peers indicates that companies showing tangible traction in AI-led offerings often enjoy better margin resilience and higher deal velocity.

Deal pipeline and TCV: what to watch

Deal wins are the forward engine for revenue. Analysts will assess whether TCS converted its pipeline into meaningful TCV during the quarter. A strong book of large deals would lend confidence to H2 growth projections.

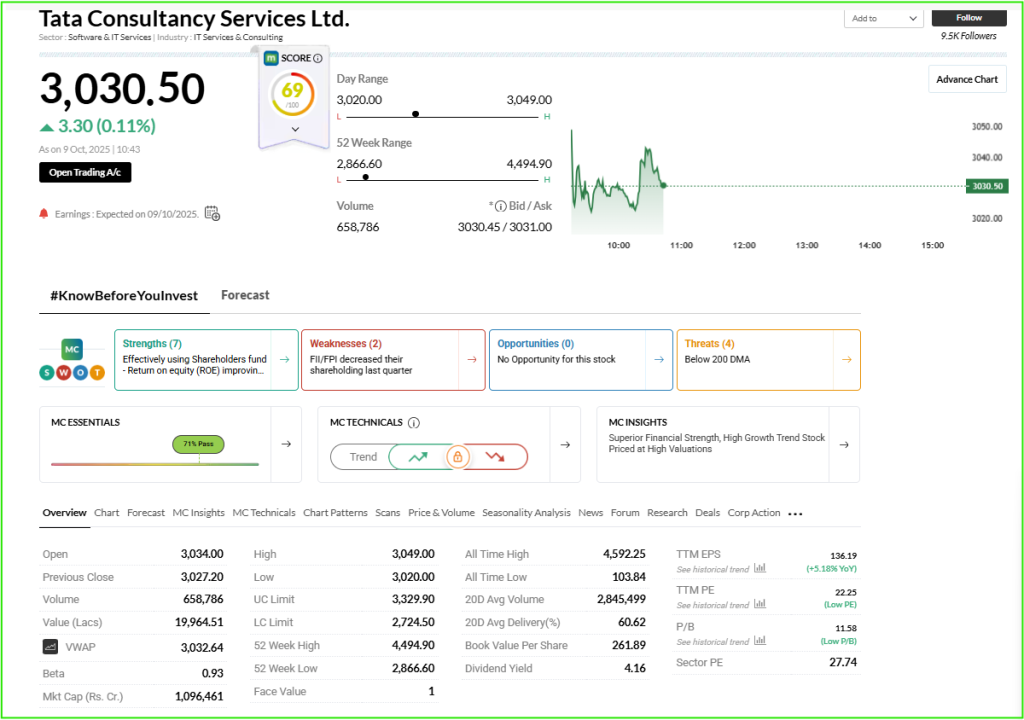

Market reaction and investor positioning before TCS Q2

Shares have been range-bound as investors weigh the risks and the near-term outlook. Business Today highlighted that TCS’s market cap has seen notable moves in October as sector sentiment shifted.

Short-term traders may react to surprises, while long-term investors focus on structural elements: client retention, cash flow, buybacks, and capital allocation.

A social update captured the mood:

“TCS stock remains range-bound ahead of Q2 earnings, with analysts projecting muted growth but steady margins.”

And another post noted expectations around AI commentary:

“TCS expected to outline its AI-led revenue strategy during Q2 commentary.”

Analyst stance and recommendations

Brokerages show a mix of Hold and Buy stances reflecting a cautious view. The common thread is patience: strong fundamentals justify a wait for clearer signs of margin recovery and deal conversion. Many analysts believe TCS will continue share buybacks and maintain a conservative cash posture.

What happens after TCS Q2 is out?

The immediate market reaction will hinge on three things: revenue beat or miss, margin guidance, and management tone on visas plus deal pipeline. If TCS delivers steady numbers and optimistic guidance on AI and cloud adoption, the stock could regain momentum. If the company signals prolonged margin pressure, markets may reprice expectations.

AI Stock watchers will track whether TCS’s AI investments translate into client wins and recurring revenue.

What is the single most important takeaway from TCS Q2? Look for management’s view on demand sustainability, H1B cost trajectory, and whether digital and AI deals offset softer traditional spending.

Conclusion: TCS Q2 could set the tone for the IT sector

In short, TCS Q2 is likely to be steady rather than spectacular. The report will test whether TCS can grow in a cautious spending environment and manage visa-related costs while scaling AI-led services.

Given its size and client mix, TCS’s tone on the quarter will shape sentiment across the India IT services space. Investors will parse the results for signals on H2 and FY26, and the company’s commentary could influence peers and the broader market in the weeks ahead.

FAQ’S

Analysts have set the next target for TCS between ₹4,200 and ₹4,500, driven by strong Q2 earnings, improving deal wins, and steady demand in digital transformation services.

TCS remains larger than Infosys in terms of market capitalization, revenue, and global workforce. It continues to lead India’s IT sector with a market cap exceeding ₹15 trillion.

Long-term projections suggest TCS could reach ₹5,000–₹5,200 within two years, backed by consistent earnings growth, stable margins, and expansion in AI and cloud services.

Recent short-term declines in TCS stock are linked to profit booking and weak global IT spending trends. However, analysts view it as a healthy correction within an overall uptrend.

Some experts consider TCS slightly overvalued compared to peers, trading at a premium due to its strong brand, steady growth, and leadership in digital technology services.

Infosys, Wipro, HCLTech, and Accenture are among TCS’s biggest competitors in the IT services and consulting industry, competing across global enterprise technology segments.

Disclaimer

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.