Analysts Explain Canara HSBC Life’s Discount Valuation vs. HDFC Life

Canara HSBC Life and HDFC Life operate in one of India’s fastest-growing sectors, life insurance, which crossed ₹8.2 lakh crore in premium income in FY2024. Yet, both companies do not receive the same treatment in the market. HDFC Life trades at a premium valuation and is seen as a trusted industry leader.

On the other hand, Canara HSBC Life is valued at a discount despite having strong bank partners like Canara Bank and HSBC. This gap has caught the attention of analysts and investors. They want to know why two companies in the same industry with similar goals have such different market perceptions. Is the discount fair, or is the market missing something?

Let’s explore the reasons behind this valuation difference using real market data, performance metrics, and expert analysis. We also look at whether Canara HSBC Life has the potential to close the gap in the coming years.

Company Snapshots and Recent Moves

Canara HSBC Life is a joint venture between Canara Bank and HSBC Insurance (Asia Pacific). The firm filed for a public offering in October 2025 with a price band of ₹100-₹106 per share. The IPO window opened to retail investors on October 10, 2025. At the upper band, the company sought a market value near ₹100.7 billion. Investors took note because the listing came at a marked discount to HDFC Life.

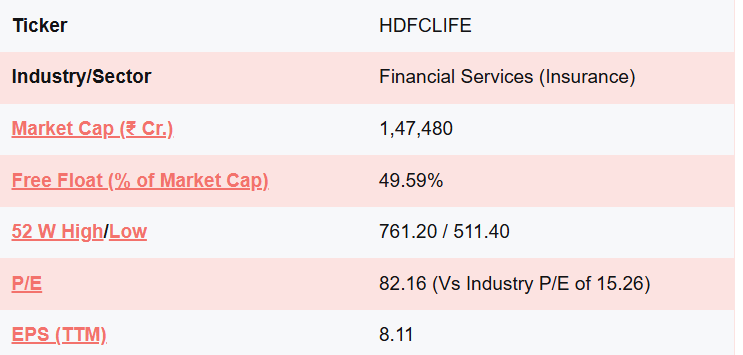

HDFC Life is a large, listed insurer with a long public record. The company has a high brand recall. HDFC Life posts larger volumes of new business value and larger embedded value. It also benefits from deeper analyst coverage and a longer track record as a public company. Recent public filings for FY2025 show HDFC Life’s scale and operating metrics that support its premium valuation.

Valuation Snapshot: How Big is the Gap?

The headline fact is simple. Canara HSBC’s IPO implied valuation sits notably below HDFC Life’s market value per embedded value and other multiples. Media analysis around October 9-10, 2025, noted roughly a 40-45% discount versus HDFC Life on common comparables. That gap surprised many investors, given Canara HSBC’s steady profit history. The market priced the IPO using a conservative multiple. That left room for debate on whether the discount was fair or too steep.

Business Mix and Profitability

HDFC Life earns higher VNB margins than many peers. VNB margin is a key profitability metric for life insurers. HDFC Life’s VNB margins have historically been above many rivals. Canara HSBC’s VNB margins are lower. One reason is product mix. Canara HSBC sells more ULIPs and lower-margin savings products.

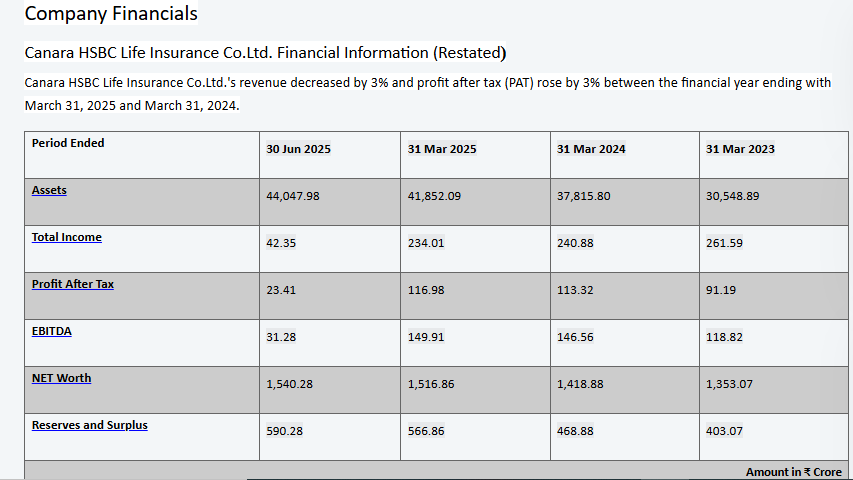

ULIPs generate lower upfront margins than protection or traditional savings plans. That difference reduces valuation multiples tied to future profit streams. Recently published VNB figures show Canara HSBC’s VNB rose from ₹377.5 crore in FY2024 to ₹446 crore in FY2025, while margins moderated slightly to about 19%. HDFC Life’s margins typically run materially higher.

Embedded Value and Growth Profile

Embedded value (EV) captures the present value of in-force business plus net assets. It is central to insurer valuation. Canara HSBC’s EV improved strongly from FY2023 to mid-2025. As of June 30, 2025, Canara HSBC reported an embedded value of ₹6,350 crore. That growth is positive. Yet HDFC Life’s absolute EV and scale remain much larger. Scale matters. A bigger EV gives room to sustain higher valuations. Investors reward size when growth and margins are solid.

Distribution Strength and Brand

Distribution matters in life insurance. HDFC Life has a wide mix of agency, bancassurance, and digital channels. That mix lowers dependence on any single partner. Canara HSBC leans more on bancassurance. That gives a steady flow of customers. But it also concentrates risk in bank partnerships. Investors prefer diversified distribution. They see it as less risky. Brand recognition is another factor. HDFC Life’s brand is well known. Canara HSBC’s brand is strong within bank networks. But it lacks HDFC Life’s retail visibility. This gap influences sentiment and hence valuation.

Liquidity, Listing History, and Analyst Coverage

HDFC Life is a long-listed stock. It draws more institutional investors and analyst attention. That creates better liquidity. It also tightens the premium investors pay. Canara HSBC was entering public markets through an OFS/IPO in October 2025. New listings often face initial discounts. Part of this is pricing conservatively to ensure a successful sale.

The IPO structure and the fact that some shares were sold by selling shareholders, not as a fresh fund raise, contributed to the perception of a cautious listing. More analyst reports are needed to narrow informational gaps.

Regulatory and Ownership Considerations

Regulatory shifts shape insurer economics. IRDAI moves on to persistency, surrenders, or product design affects VNB and long-term profits. Insurers with higher ULIP share feel more immediate margin pressure under new rules. Ownership also matters.

Canara Bank and HSBC remain key promoters. Their stakes, and any changes after the IPO, affect investor views on governance and strategic direction. The market often discounts firms where future strategic moves seem less clear or where promoter exits are possible.

Strengths that Argue against a Permanent Discount

Canara HSBC has clear strengths. The company has shown steady profits for over a decade. Solvency ratios are healthy. The embedded value has expanded fast through FY2023-June 30, 2025.

The firm reported improvements in assets under management and a near-99% claim settlement record noted in public disclosures. These facts argue that some of the discounts may be temporary. If the company shifts product mix toward higher-margin lines and expands distribution beyond core bank partners, valuation could re-rate.

Can the Gap Close? Key Catalysts and Obstacles

A rerating would need clearer evidence. Higher VNB margins are the strongest catalyst. That means selling more protection and non-ULIP products, or lifting persistency. Better retail brand presence would help. Broader distribution beyond bank channels can reduce concentration risk. Execution risk remains. Management must balance growth and margin control. Macro shocks or regulatory changes can set back progress. Analysts will watch quarterly VNB, EV expansion, and persistency numbers. Market tools like the AI stock research analysis tool can speed model updates, but fundamentals still drive long-term re-ratings.

Analyst View and Investor Takeaway

Analysts view the discount as a mix of risk premium and conservative IPO pricing. Many say the valuation partly reflects differences in margins, product mix, scale, and liquidity. Others see opportunity if management delivers higher margins and expands distribution.

For long-term investors, the decision depends on risk appetite. Those who value scale, brand, and proven public track records may prefer HDFC Life. Those willing to bet on execution and margin improvement might find Canara HSBC attractive at its IPO price band.

Final Note

Numbers and regulatory notes cited here are current as of October 9-10, 2025, when Canara HSBC launched its IPO and analysts published early takes. Readers should review company filings and updated analyst reports after listing. Market conditions change quickly. Use official RHPs and annual reports for the precise disclosures referenced.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.