Samsung Shares Surge Toward Record High on AI and Chip Industry Hopes

Samsung is stealing the spotlight in global markets as its stock edges closer to an all-time high. Investors are rushing in, excited by the growing demand for artificial intelligence (AI) technology and a strong rebound in the semiconductor industry. On October 10, 2025, Samsung Electronics’ shares continued their upward trend, reflecting renewed confidence in its long-term growth.

The company is not just riding the AI wave; it is building the engines behind it. Samsung supplies high-performance memory chips that power AI servers, data centers, and advanced computing tools. Experts say the chip market is entering a new growth cycle, and Samsung is well-positioned at its center.

At the same time, global tech spending is rising again. Major clients are increasing orders, and analysts expect stronger profits in the coming quarters. Investors now see Samsung as a key player in the future of AI, chips, and digital innovation.

With momentum building, many are asking one big question: Can Samsung break its record and lead the next tech boom?

Recent Samsung’s Share Performance

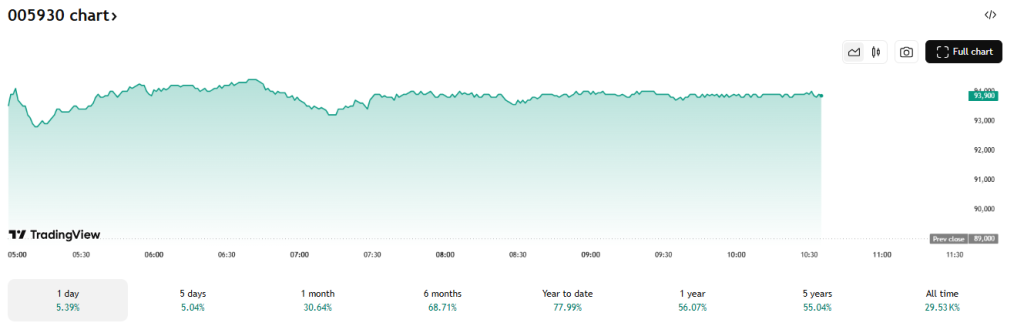

Samsung’s shares climbed sharply in early October 2025. On October 10, 2025, the stock pushed near its all-time high. Traders pointed to a string of upbeat headlines and stronger chip demand as the main triggers. The gains followed a steep move earlier in the month when Samsung rose after news of large AI-focused deals. Bloomberg and Reuters reported the jump and the surge driven by AI and memory-chip optimism.

Key Drivers Behind the Surge

The first driver is AI demand. Big AI projects now need huge amounts of memory. Samsung makes DRAM and HBM chips used in AI servers. OpenAI’s recent initiatives and data center plans raised hopes for steady orders into 2026. Industry reports say these projects could absorb a large slice of global memory output.

The second driver is chip-price recovery. Memory prices have shown signs of firming in late 2025. Stronger pricing helps Samsung’s margins grow faster. Morgan Stanley and other brokers lifted price targets after seeing better fourth-quarter pricing forecasts. These upgrades added fuel to the rally.

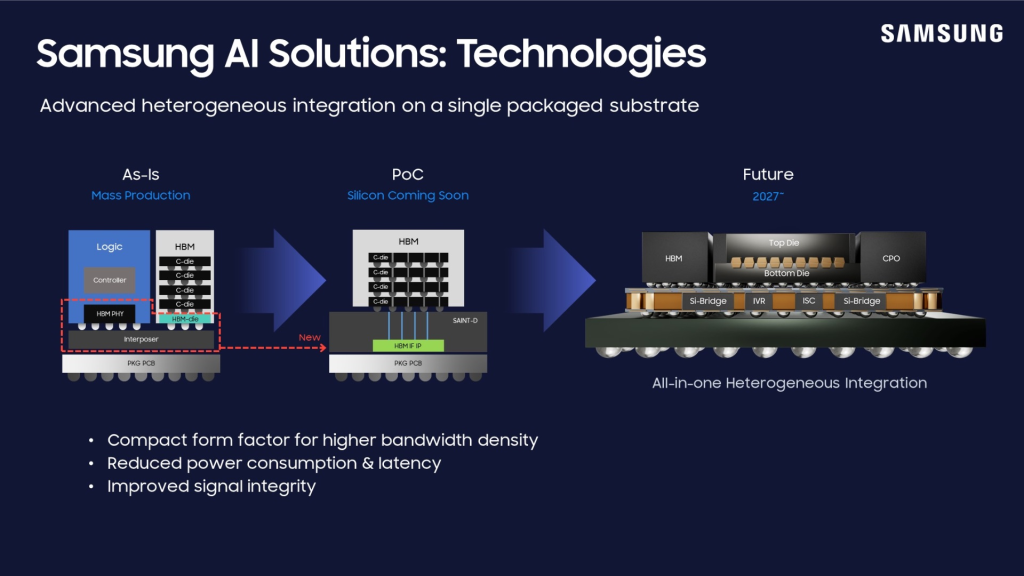

The third driver is foundry and system-chip progress. Samsung plans to expand advanced foundry capacity for AI and high-performance chips. Roadmap updates and new node plans helped investors see a clearer growth path beyond memory. This drew buyers who want exposure to the whole chip chain.

Samsung’s Strategic Investments

Samsung has moved on several fronts. The company is expanding HBM capacity for AI accelerators. It is also pushing its foundry roadmap into smaller nodes that serve data centers and AI workloads. Samsung’s U.S. and global investment plans aim to shorten supply timelines and serve large cloud customers. The firm also seeks key client approvals for next-gen HBM. These steps show a push to grab more share in both memory and custom logic markets.

Samsung also strengthened commercial ties with major AI players in October 2025. Reports show preliminary supply agreements and letters of intent tied to big AI projects. Such moves reduce uncertainty about long-term demand and make revenue paths more visible to investors.

Global Market and Competitive Landscape

Samsung sits in a unique position. It makes memory, runs a growing foundry, and sells devices. Competitors like TSMC lead in pure-play foundry. SK Hynix and Micron dominate other parts of memory. But Samsung’s vertical scale gives it flexibility.

The company can cross-sell silicon and devices. That blend appeals to investors seeking a diversified chip play. Competitive risks remain. TSMC’s lead in cutting-edge logic and specialized chip makers’ ties to cloud firms are strong counterweights.

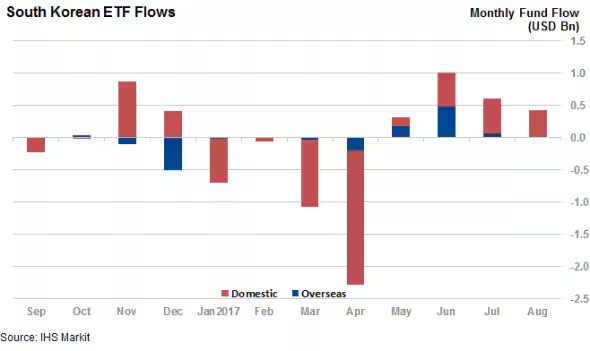

Investor Sentiment and Institutional Support

Large investors moved quickly after the AI deals hit headlines. Foreign funds and ETFs increased South Korea’s exposure. Analysts raised target prices and some issued upgrade notes.

In addition, market chatter mentioned an AI stock research analysis tool being used to model memory demand scenarios, which showed a clear upside in multi-year memory revenue. That kind of data backing reassured funds and retail traders. The net effect was more buying and fewer sellers.

Risks to Consider

The rally still has risks. First, chip cycles are volatile. A sudden drop in cloud spending would hit memory hard. Second, geopolitics could complicate supply chains or sales in key markets. Third, trade-secret disputes and legal noise in the industry could slow technology sharing. Recent reports flagged tensions and leaks that could create delays or costs. Finally, margin gains depend on sustained price improvement. If prices slide, profit forecasts will need revision.

Long-Term Growth Opportunities

Long-term demand looks promising if AI adoption keeps rising. Data centers, edge AI, automotive chips, and advanced mobile processors all need memory and advanced logic.

Samsung’s push into HBM for AI accelerators and aggressive foundry roadmaps could unlock new revenue streams from cloud giants. If the company secures long-term supply contracts, the memory business may enjoy steadier volumes and tighter pricing.

Outlook: Can Samsung Hit a Record High?

A bull case rests on continued AI spending, steady memory prices, and successful foundry ramp-ups. That combination can lift earnings and investor confidence. A bear case would show weaker cloud budgets, renewed price falls, or delays to new-node production. Traders should watch quarterly guidance, large AI contract updates, and memory price trends. Key dates include upcoming earnings and supplier announcements in late 2025 and early 2026.

Final Words

Samsung shares reflect real shifts in the chip market. AI projects and stronger memory pricing gave the rally momentum in October 2025. Strategic investments and client wins added credibility. Yet risks remain. The path to a fresh record high will depend on steady demand, supply execution, and clear proof that price gains are durable. Investors should track earnings, major AI contract news, and memory price indicators for the next moves.

Frequently Asked Questions (FAQs)

Samsung shares are rising in 2025 because demand for AI and memory chips is growing fast. On October 10, 2025, investors showed strong confidence in future profits.

AI growth increases the need for powerful memory chips, which Samsung makes. More AI projects mean higher sales, better earnings, and a stronger stock price over time.

Samsung may be a good long-term investment because it leads in memory chips and invests in AI technology. However, chip markets change, so investors should stay careful.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.