Cryptocurrency Bitcoin Today: On-Chain Data Hints at BTC Price Breakout or Pullback

Bitcoin is consolidating near key support after a sharp correction, and on-chain data now points to two possible paths: a decisive breakout or a short-term pullback. Traders are watching whale wallets, exchange flows, and liquidity metrics to judge whether BTC resumes its uptrend or gives back more ground.

This piece breaks down the on-chain signals, technical levels, and what to watch next.

Bitcoin: current market snapshot and why on-chain data matters

Bitcoin trades in a tight range after a recent 16% pullback from its local highs. On-chain indicators show mixed readings: supply is clustered near current prices, exchange inflows have fallen, but momentum indicators are fragile. That mix means Bitcoin could swing sharply once sentiment tips.

Why does on-chain data matter? Because blockchain metrics reveal real holder behavior, not just chart patterns, they help us read whether coins are being accumulated or dumped.

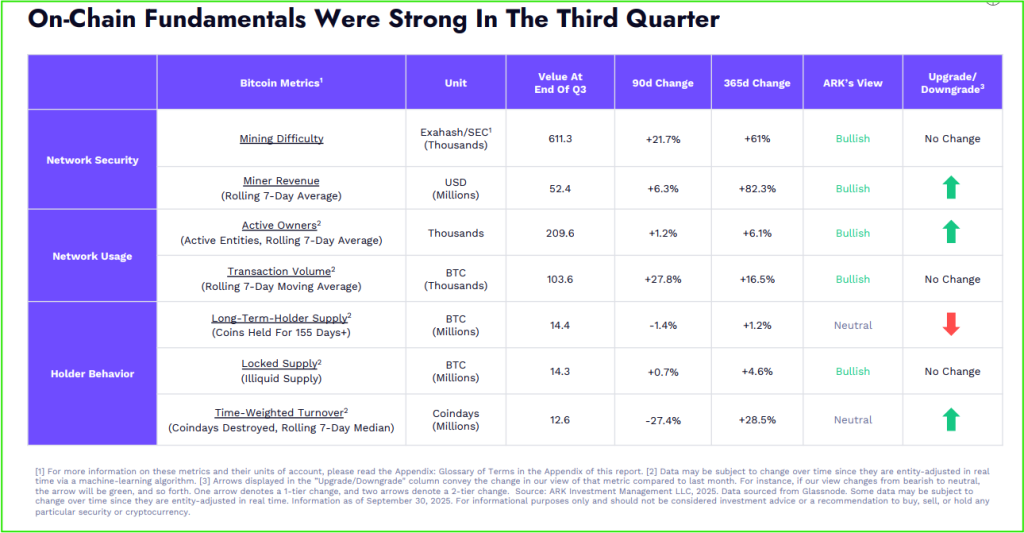

Bitcoin: what on-chain metrics are signaling now

On-chain data points to several important features. First, illiquid supply has risen, meaning more coins are held by addresses unlikely to move them. That is often bullish. Second, exchange reserves have declined, which reduces near-term sell pressure and supports the price.

Third, supply density shows a large share of coins last moved near current levels, a setup that often precedes volatility. These dynamics suggest Bitcoin is poised for a large move, though direction remains undecided.

What is supply density?

Supply density measures how concentrated coin movement is around current prices. High density can mean a lot of holders bought recently, so a short-term catalyst can create big price swings as clustered holders react.

Bitcoin: whale movements and accumulation patterns

Whales matter. Large addresses can push markets by moving big blocks of BTC into exchanges or into cold storage. CoinStats flagged recent whale accumulation patterns that indicate some large holders are adding to positions rather than selling into the dip.

That accumulation reduces immediate downside and can set the stage for a breakout if buying continues. A timely tweet by @adezxbt suggested that Bitcoin’s consolidation phase could precede a sharp upward move if whale activity sustains.

Why do whale actions matter?

Large buys or transfers change available liquidity and often lead to price moves before retail traders react. Watching wallet clusters helps anticipate big shifts.

Bitcoin: short-term bearish signals and technical resistance

CryptoRank points out that momentum remains fragile after the correction, and short-term indicators show caution. Bitcoin faces strong resistance in the $67,500–$68,000 zone; bulls need a convincing break above to target higher highs.

The RSI and moving average crossovers show indecision, and lower volume during consolidation suggests traders await a catalyst. A noted comment from @hillery_dan captured this cautious mood among desk traders.

Where is resistance and why it matters

Resistance near $68,000 matters because a close above it would clear a major supply zone and likely trigger momentum buys, while a rejection can invite a retracement.

Bitcoin: critical support zones and pullback risks

Key supports lie between $64,000 and $65,000, where buyers historically stepped in. If Bitcoin breaks this band and exchange inflows rise, a deeper correction toward roughly $62,000 becomes more likely.

On-chain signs such as declining transaction activity can show weakening conviction, which increases pullback risk in thin markets.

Could Bitcoin fall further before rising again? Yes, short corrections often happen before sustainable moves, especially when volatility and clustered supply are present.

Bitcoin: institutional flows and macro backdrop

Institutional demand still anchors the market. ETF inflows, custody adoption, and big-pocket buying give Bitcoin structural tailwinds over the long term. Macro factors like U.S. inflation prints, rate expectations, and dollar moves also shape BTC’s path in the short term.

A trader post by @ThisTrainNoStop underscored that institutional buying remains a steady influence despite short-term volatility.

Bitcoin: AI and data tools changing how traders read on-chain signals

AI Stock research is now used by desks to parse millions of blockchain events quickly, spotting accumulation and distribution patterns. These models help filter noise and surface meaningful shifts in whale flows, exchange balance changes, and miner activity.

Later, teams apply AI Stock Analysis to stress test scenarios and estimate likely price moves under different liquidity and macro outcomes. Even retail platforms leverage AI Stock tools for alerting users to abnormal on-chain events.

These data-driven tools do not predict moves with certainty, but they sharpen probabilistic views.

Bitcoin: bullish breakout scenarios

A bullish script requires sustained accumulation, falling exchange reserves, and a clean break above $68,500 with volume confirmation. If that happens, near-term targets extend toward $70,000–$72,000, as liquidity gaps above current prices get filled and momentum traders add exposure.

CryptoNews noted analysts see reduced liquidity and lower volatility as precursors to decisive upside moves once buying resumes. Long-term holders and funds appear positioned for upside, which supports the bullish narrative.

What level signals a breakout?

A daily close above roughly $68,500 with higher-than-average volume and falling exchange reserves would be a strong breakout cue.

Bitcoin: bearish scenarios and warning signs

The bearish path would show renewed exchange inflows, spikes in miner selling, and a decisive break below $64,000. CryptoRank’s analysis warned that momentum indicators leaned bearish after recent volatility, and that could lead to deeper consolidation or a pullback if sentiment shifts.

If on-chain metrics reverse, more coins move to exchanges, and illiquid supply declines, then downside risk grows.

Bitcoin: community sentiment and social signals

Social chatter remains split between bullish optimism and cautious traders calling for risk management. The tweets and community analysis reflect that split: some expect a breakout, others warn of a corrective leg.

These social signals often amplify moves, so traders watch both on-chain data and sentiment for confirmation.

Bitcoin: what traders should watch next

Watch whale wallets for accumulation spikes, monitor exchange reserve trends, and track volume on any move above $68,000 or below $64,000. Use stop placements and position sizing, because clustered supply and high supply density can make moves sharp and fast.

For those trading the range, fade rejections at resistance and buy near key support only with clear signs of buyer strength.

Conclusion: Bitcoin’s near-term fork in the road

Bitcoin sits at a critical juncture. On-chain data shows both bullish accumulation and fragile momentum. If whales keep buying and exchange reserves fall, BTC could break higher toward $70,000 and beyond. If selling reappears and support breaks, a pullback toward $62,000 is plausible.

Traders should watch the on-chain signals closely, use risk controls, and let data guide decisions: in crypto, the chain often tells the real story behind the charts.

FAQ’S

Bitcoin’s price direction often depends on market sentiment, on-chain data, global economic factors, and investor behavior. Technical analysis and monitoring major whale movements can help identify potential trends.

On-chain analysis studies blockchain data like transaction volume, wallet activity, and miner behavior to predict Bitcoin’s price trends. It helps investors understand accumulation or selling phases.

Bitcoin’s value is influenced by supply and demand, regulatory updates, investor sentiment, and macroeconomic trends like inflation or interest rate changes.

Analysts expect Bitcoin’s trajectory to remain bullish long-term due to halving cycles, increasing institutional adoption, and limited supply, though short-term volatility is normal.

Traders use technical indicators, on-chain metrics, and market sentiment tools to forecast Bitcoin’s price movements. News events and regulatory updates also impact short-term trends.

Bitcoin trades 24/7, but price fluctuations at night depend on global trading activity. Movements are often influenced by Asian and European market hours.

Disclaimer

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.