Waaree Renewable Q2 Results: Net Profit Jumps 100% to ₹116 Crore

Waaree Renewable Technologies posted a strong performance in its Q2 FY2025 results released on October 12, 2025. The clean energy boom in India is real, and Waaree is proving it. The company recorded a 100% jump in net profit to ₹116 crore, showing high demand for solar power and better cost control.

This success did not come overnight. Waaree has been growing its solar EPC projects, increasing efficiency, and winning big contracts. India’s push for renewable energy has also helped the company scale faster.

Investors and analysts are now watching closely. Waaree is not only growing but also beating many rivals in the sector. Revenue went up, profit margins improved, and the order book became stronger. These signs show steady earnings in the future. In a market driven by green policies and sustainability goals, Waaree is becoming a key player in India’s energy shift.

This article will explain how the company reached this level, what is driving its growth, and whether it can continue this momentum in the next quarters.

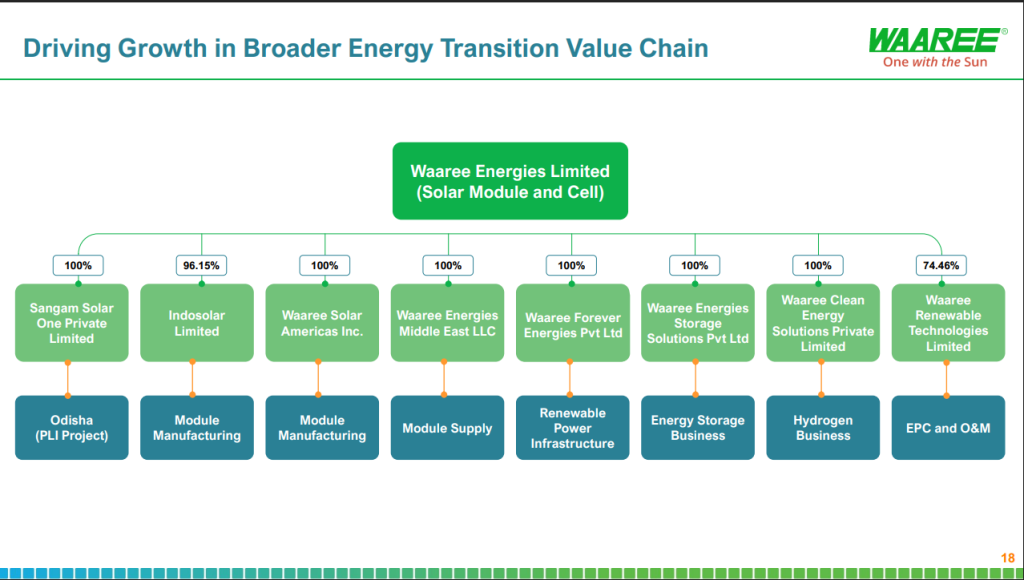

Company Background and Business Mix

Waaree Renewable Technologies is a major Indian solar firm. The company builds solar farms. It also makes solar modules and offers EPC services. In recent years, it has moved into new energy areas. These include battery energy storage systems and data centre power solutions. The firm now serves utility, commercial, and industrial clients across India. Its mix of manufacturing and project work helps smooth revenue swings. This strategy gave Waaree more control over projects and margins in the quarter under review.

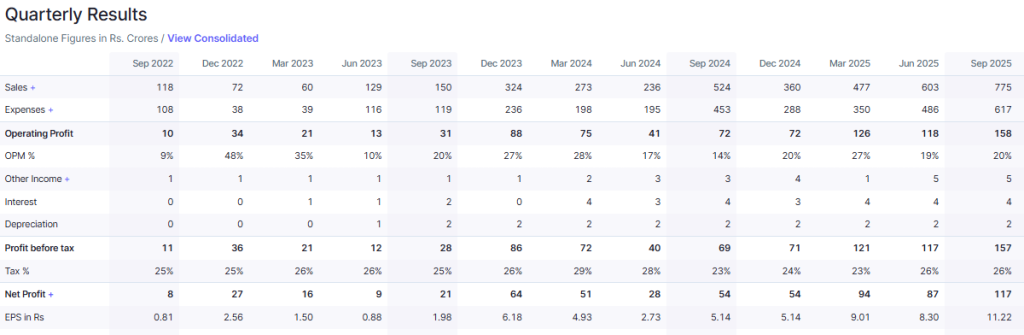

Q2 FY26 Financial Performance

The September quarter of FY26 brought record numbers. Consolidated net profit rose to ₹116.34 crore. That is more than double the ₹53.51 crore a year earlier. Revenue from operations climbed to ₹774.78 crore. This was a 47.7% year-on-year rise. EBITDA more than doubled to ₹157.94 crore. EBITDA margin widened to about 20.4% from around 13.6% a year earlier. The company called this its highest-ever quarterly revenue and PAT. These figures were published on October 11-13, 2025, when results and filings were released.

What Drove the Profit Surge?

Three clear drivers stand out. First, the strong execution of project orders led to higher billing. Many EPC projects moved from construction to revenue recognition. Second, margins improved from a better project mix and tighter cost control. Supply chain gains and better procurement also helped. Third, growth in new verticals added higher-value work. Battery storage and data centre power contracts boosted revenue per megawatt. Combined, these factors pushed EBITDA and net profit sharply upward. Company statements highlighted execution and sector tailwinds as key reasons.

Order Book, Backlog, and Pipeline

Waaree reported a large unexecuted order book. The backlog stood at about 3.48 GWp. The company said this backlog will be executed over the next 12-15 months. The bidding pipeline was described as 27+ GWp. A healthy order book gives revenue visibility for the near term. It also supports steady project flow and capacity use at manufacturing units. These figures suggest further revenue gains if execution stays on plan.

Balance Sheet and Cash Flow Snapshot

The company’s statements showed improving operational cash flow in the quarter. Higher EBITDA translated into better cash generation. Capital expenditure plans remain targeted at capacity expansion and storage solutions.

At the same time, management indicated a focus on working capital and disciplined spending. Debt levels were not flagged as a major concern in filings. Still, continued project execution will require careful cash and supplier management. Investors often watch receivables and margin trends for EPC-heavy firms.

Market and Industry Context

India’s push for renewables remains strong. Solar additions and rooftop adoption continue to rise. Policy support and corporate renewable purchases are key tailwinds. The move into storage and data centre power fits broader grid needs. These trends lift demand for EPC services and modules. Competition is intense.

Large players invest in scale and integrated solutions. Smaller firms fight on price. Waaree’s blended model of manufacturing plus EPC helps it compete on both cost and execution speed. Analysts see sector growth as a structural plus for players like Waaree.

Risks and Challenges

Execution risk tops the list. Large order books bring tight timelines and supply dependencies. Any delay can squeeze margins. Raw material prices can move against the company. Interest rates and financing terms also matter for project economics. Competition may drive pricing pressure in select tenders. Finally, policy and regulatory shifts in state-level approvals can slow some projects. Investors should watch order-to-cash cycles and working capital closely.

Stock Market Reaction and Investor View

Markets reacted quickly. Shares jumped after the results were filed. On October 13, 2025, the stock rose sharply and hit new highs on strong volumes. Analysts and brokerage notes highlighted the revenue beat, margin expansion, and robust order book. Some analysts raised near-term estimates and target prices. Still, a forward-looking view depends on sustained execution and stable margins. Short-term rallies can mirror good news, but long-term gains need repeatable quarterly performance.

Management Statements and Strategic Focus

Company executives said the quarter proved execution strength. They pointed to diversification into the storage and data centre business. The management stressed capacity expansion and bidding for large projects. They also noted a focus on improving margins and cash flows. Such statements align with recent investor calls and press releases. Investors should monitor further updates on large contract wins and ESOP or capital moves that can affect equity.

Outlook and What to Watch Next?

Near-term outlook looks positive if execution remains steady. Key items to watch next:

- Quarterly execution versus planned timelines.

- Order book conversion over the next 12 months.

- Trends in EBITDA margin and working capital.

- Progress in battery storage and data centre projects.

- Any guidance updates from the company

Analysts using an AI stock research analysis tool may track these metrics quantitatively. This will help compare Waaree against peers on delivery and margin metrics. If the firm converts backlog and keeps margins, future quarters could show continued profit growth.

Wrap Up

Waaree Renewable posted a clear break-out quarter in Q2 FY26. Profit and revenue hit record highs. Strong execution and new-energy verticals drove the gains. The large order book adds revenue visibility. The main tests ahead are timely execution and margin maintenance. If those play out well, the company can sustain growth. Investors should keep watching cash flow, backlog conversion, and margins for the next two quarters.

Frequently Asked Questions (FAQs)

Waaree Renewable’s profit doubled in Q2 FY26 because it completed more solar projects, improved cost control, and expanded into storage services. Results were announced on October 11, 2025.

Waaree Renewable showed strong profit growth and a large order book, which looks positive. However, investors should still review risks, market trends, and financial stability before deciding.

The company plans to build more solar capacity, expand battery storage projects, and enter new markets. It also aims to improve execution speed and maintain strong margins in the coming years.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.