China Exports to US Plunge 30% in September as Trade Tensions Rise

China’s exports to the United States fell by 30% in September 2025, marking one of the steepest drops in years. This is not just another trade update for China exports; it signals a major shift in the global economy. The U.S. has long been one of China’s biggest buyers, especially for electronics, machinery, and consumer goods. But rising tariffs, political tension, and supply chain changes are now taking a serious toll.

Many American companies are moving their production to countries like Vietnam, India, and Mexico. The U.S. government is also pushing for “less dependence on China” in key industries such as technology and energy. At the same time, demand in both countries is slowing, making the situation even worse.

This sudden decline raises big questions. Is this just a short-term dip, or the beginning of a long-term separation between the world’s two largest economies? And if trade continues to shrink, who will fill the gap: other Asian nations, or American factories?

This article explores the reasons behind the plunge, its global impact, and what the future of China-U.S. trade might look like.

The September Data and Key Figures

Customs data released on October 13, 2025, shows a sharp fall in shipments to the United States. Exports to the U.S. fell about 27% year-on-year in September 2025. At the same time, China’s total exports rose 8.3% to $328.5 billion, the biggest monthly gain in six months. This contrast points to a shifting pattern. While global demand lifted overall exports, U.S.-bound goods weakened significantly.

China Exports: Which Goods were Hit Hardest?

High-tech and strategic items showed big swings. Shipments of rare earths and related materials dropped sharply in September. Customs and trade data show rare-earth exports fell month-on-month by about 31% in September. That decline came after tighter Chinese export rules for some strategic materials. Electronics and some machinery categories also saw large falls in U.S. orders. These moves matter because many high-value supply chains depend on those inputs.

Why Exports to the U.S. Plunge?

Multiple forces are at work. First, new U.S. tariff threats and tougher export controls raised costs. Political rhetoric in October 2025 included proposals for higher tariffs. That pushed some buyers to pause orders or look elsewhere. Second, companies continue to follow a “China+1” strategy. They shift factories to Vietnam, India, or Mexico to cut risk.

Third, Beijing has tightened controls on certain exports. Those curbs made shipments slower and harder to license. Finally, demand patterns shifted. U.S. buyers pulled back on some consumer and tech orders amid macro uncertainty. Together, these factors created the steep drop in U.S.-bound shipments.

The Impact inside China

Factory managers reported lower work orders for U.S. clients. That hit some export zones and clusters hard. Rare-earth firms faced licensing delays. Ports handled different cargo flows as exporters redirected goods to new hubs. Policymakers will watch jobs in export towns. Beijing may offer targeted support to firms that lose major contracts. The wider trade surplus fell in September, underlining the changing mix of buyers.

Effects on U.S. Firms and Consumers

U.S. firms that rely on Chinese parts could face higher input costs. Some importers will pay more to source from other countries. In some cases, firms that can’t switch suppliers fast may see delays. For final consumers, the hit could show up as higher prices for electronics or small appliances. But some U.S. manufacturers might benefit if reshoring gains pace. Policymakers warn that rapid tariff moves could add to U.S. inflationary pressures.

Global Trade Realignment in Motion

The drop in U.S. orders is speeding a wider shift. Southeast Asia, India, and Mexico are gaining new factory investment. China is also rerouting shipments through hubs like Vietnam. These moves change logistics flows and port demand across the region. Over time, value chains for specific goods could re-center outside China. Yet some supply links advanced chips, certain rare minerals, and specialised components remain hard to move quickly.

Market and Expert Reactions

Markets reacted to the news on October 13, 2025. Analysts warned of more volatility if trade hostility rises. Some banks said that overall Chinese trade resilience so far shows that tariffs alone do not stop exports. Others noted that targeted controls, especially on strategic metals and tech, have outsized effects on specific industries.

A few equity analysts used an AI stock research analysis tool to model which sectors face the biggest revenue hit. The models highlighted suppliers of magnets, EV components, and precision metals as most at risk.

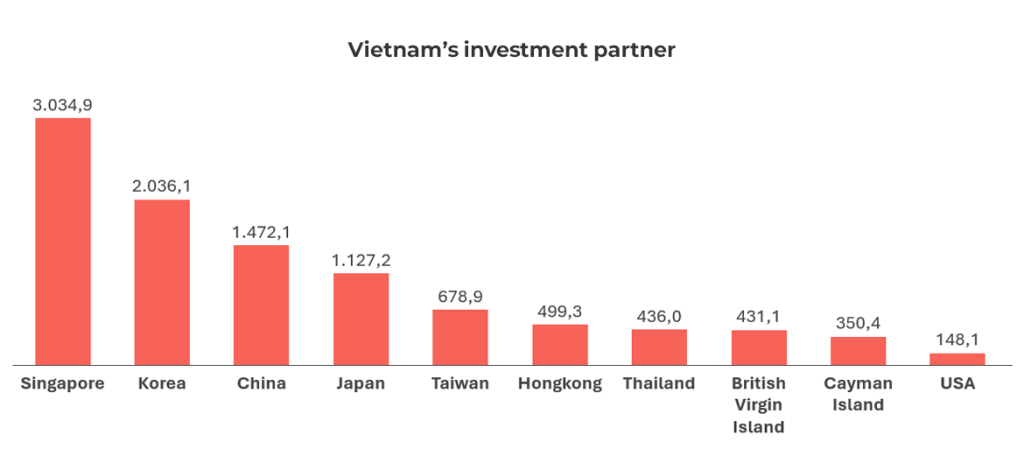

Winners and Opportunities for Other Countries

Countries in Southeast Asia are the near-term beneficiaries. Vietnam and Thailand reported rising orders from foreign firms. India is winning more electronics and textile investments. Mexico benefits from nearshoring by North American firms. These shifts create export and job opportunities for those economies. They also invite fresh investment in ports, power, and skills. But building full ecosystems takes time and capital. Not every factory or supplier can move overnight.

China Exports: What could Happen Next?

The path ahead depends on politics and policy. If tariff threats escalate, more buyers may cut China exposure. If talks cool, some trade could return to earlier patterns. Beijing could loosen some export restrictions or expand incentives to keep orders. The U.S. may pursue tighter controls on key tech and strategic inputs. Either way, firms will keep diversifying sourcing to reduce single-country risk. Watch for new customs data and any concrete tariff decisions in the coming weeks.

Wrap Up

September 2025 marks a clear turn in China-U.S. trade flows. Customs figures on October 13, 2025, show a pronounced drop in U.S.-bound exports, even as China’s global shipments rose. The change blends politics, policy, and business choices. It will reshape supply lines over months and years. Firms and policymakers must adapt fast. The next moves by governments will matter a great deal for global trade and for which countries win new factory jobs.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.