Big Banks Soar as Earnings Season Kicks off with Strong Results

Big banks have kicked off the October 2025 earnings season with a bang, and the market is paying close attention. These financial giants are often the first to report results, and their performance sets the tone for the entire quarter. On October 10, 2025, several major U.S. banks released stronger-than-expected earnings. This surprised investors and lifted confidence across Wall Street.

Why does this matter? Banks sit at the heart of the economy. They handle lending, savings, business financing, and trading activity. When banks perform well, it often signals healthy consumer spending, stable credit conditions, and active markets. This quarter, rising interest income, steady loan demand, and improved trading revenue helped fuel their growth.

Investors reacted quickly as bank stocks soared right after the results were announced. This early strength is raising hopes that other sectors might also deliver solid performance in the weeks ahead. Still, questions remain about interest rates, loan defaults, and economic uncertainty.

As earnings season unfolds, one thing is clear: the financial sector just delivered a powerful start, and the rest of the market is now watching closely.

Why Bank Earnings Matter?

Banks sit at the center of finance. Their results show whether lending and markets are healthy. Big bank reports shape investor mood. They also influence credit and loan costs for people and businesses. When banks do well, it often helps stock markets rise. When banks stumble, markets can lose confidence quickly.

Overview of the Strong Results

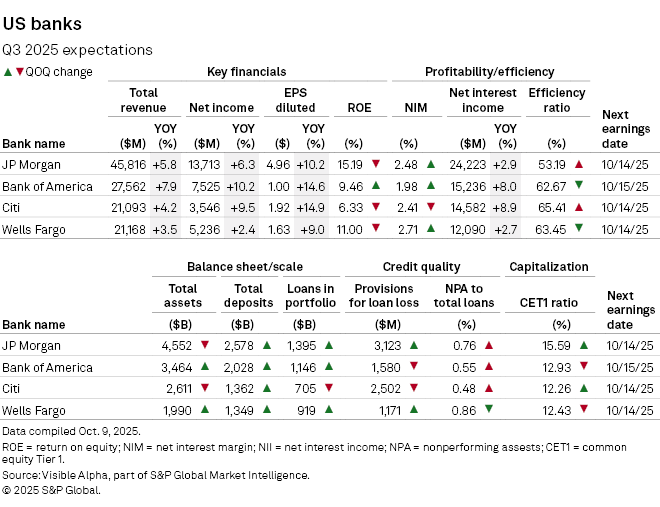

Several large banks reported upbeat signals as third-quarter releases began in mid-October 2025. JPMorgan scheduled its Q3 release for October 14, 2025, and Wells Fargo released results the same day. Bank of America set its results for October 15, 2025. Early previews showed higher net interest income and solid trading results. These items powered better-than-expected top lines and profits in many cases.

Revenue and Profit Drivers

Higher short-term rates widened the gap between what banks earn on loans and what they pay on deposits. This pushed net interest income up. Trading desks also saw more activity. That lifted the fee and trading revenue. At the same time, some banks kept costs steady. Fewer loan loss provisions than feared also helped net profit. Analysts had expected mixed results, but the rate boost and trading gains offset some worries.

Segment Performance

Retail banking showed steady deposit flows and growth in credit card balances. Wealth and asset management continued to draw clients, helping to increase fee income. Investment banking had a more mixed picture. Deal volumes were not back to pre-pandemic highs. But some firms logged higher advisory fees and bond trading gains. Overall, the mix of interest income and trading wins produced stronger aggregate results.

Key Drivers behind the Surge

First, the interest rate environment mattered most. Central bank policy kept short rates elevated through much of 2025. That raised loan yields. Second, consumer demand for credit stayed firm. Card spending and mortgages did not collapse. Third, market volatility helped trading desks. More swings mean more trading profit opportunities. Fourth, cost controls and technology moves cut some expenses. These four forces combined to lift quarterly results.

How Big Banks Performed?

JPMorgan and peers led the calendar for third-quarter disclosure. JPMorgan’s investor relations page showed the firm planned its Q3 call for October 14, 2025. Wells Fargo confirmed Q3 reporting for that day as well. Bank of America planned its release on October 15, 2025. Citi and Goldman were also in the mix and drew close analyst attention. Early previews suggested the largest banks posted gains in net interest income and stable trading results.

Market Reaction

Bank stocks rose as the quarter began. Traders priced in stronger profits and tighter bank spreads. After the initial reports, analysts tweaked earnings models and, in some cases, raised price targets. Market news feeds and live earnings trackers showed the sector outperforming broader indices during the first days of reporting. That lift helped the financial sector pull some weight in major benchmarks.

What does this mean for the Broader Market?

Stronger bank results can boost investor confidence. They suggest that credit is flowing and that consumers and firms keep borrowing. A healthy financial sector tends to support housing and business investment. It can also reduce fears of a credit crunch. Still, one quarter does not erase macro risks. The economy needs steady jobs and stable inflation to keep the momentum.

Risks and Warnings

Interest rates could shift quickly. A rapid fall or rise would change bank margins. Credit quality is another worry. Higher defaults in consumer or commercial loans would hit profits. Commercial real estate exposure remains a watch item for some lenders. Regulatory changes may raise costs, too. Geopolitical shocks could dent markets and trading income. Investors should keep these risks in mind.

Outlook for the Rest of Earnings Season

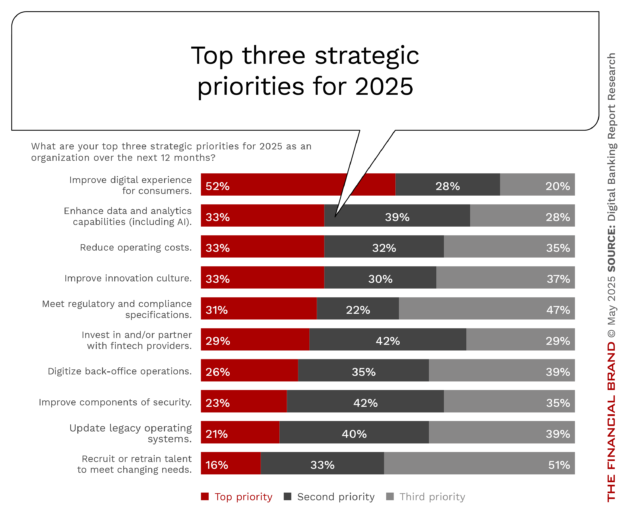

The next wave of reports will test if the strength is broad. Tech and consumer earnings will matter. If more sectors show resilience, the market rally could widen. If not, the financial sector may cool. Short-term trading will react to guidance and forward outlooks from CEOs. The use of tools like an AI stock research analysis tool can speed up fact checks and scenario scans for active investors.

Earnings Season: What to watch next?

- October 14, 2025: JPMorgan and Wells Fargo Q3 results and calls.

- October 15, 2025: Bank of America Q3 release and call.

- Weekly Fed commentary and monthly credit reports.

- Loan loss provision trends in bank supplements.

Wrap Up

The financial sector started earnings season on a strong note in mid-October 2025. Higher interest income and active markets contributed to the improvement. Early gains lifted investor sentiment. Yet risks remain. Rate moves, credit trends, and global shocks could change the story. Watch the coming weeks for clearer signs. The market reaction so far shows hope. But the full picture will come as more firms publish results.

Frequently Asked Questions (FAQs)

Bank earnings show how well the financial system is working. If banks make strong profits, investors feel confident and buy stocks, which can push the market higher.

Strong bank earnings can be a positive sign, but they do not tell the full story. They may show steady loans and spending, but other data must also be checked.

Large U.S. banks like JPMorgan, Wells Fargo, and Citigroup usually report first. For example, JPMorgan and Wells Fargo began Q3 earnings on October 14, 2025.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.