Silver Price Skyrockets to Record High Amid London Market Turmoil

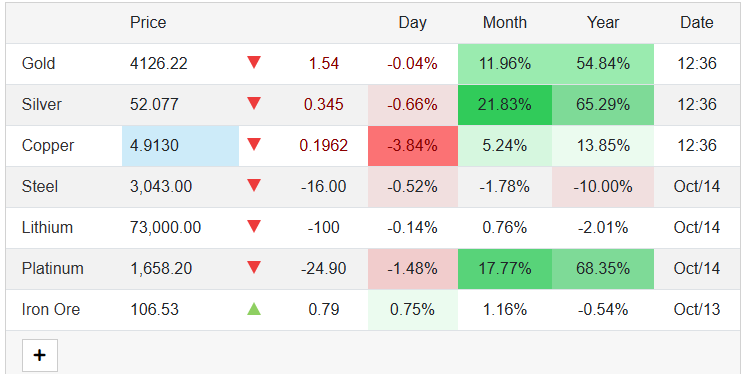

Silver price just made history. In early October 2025, global silver prices surged to an all-time high, shocking investors and industries alike. The sharpest moves were seen in London, home to the world’s largest precious metals market. Traders reported unusual price gaps, delayed settlements, and sudden liquidity shortages signs of deep market stress.

Why is this happening now? Silver is no longer just for jewelry and coins. It powers solar panels, electric vehicles, and high-tech electronics. This makes it one of the most important industrial metals in the world. As demand jumped and supply stayed tight, investors rushed in, treating silver as a safe haven against inflation and currency weakness.

At the same time, economic uncertainty and policy changes triggered panic in London trading desks. This combination of real demand and market turmoil sent prices soaring at record speed.

This surge is more than a short-term spikeNit could reshape global trade, investment strategies, and the future of precious metals. Let’s break down why silver is rising, why London is struggling, and what comes next.

What Triggered the Silver Price Spike?

Several forces came together in October 2025 to push silver far higher. Industrial demand rose because of growth in solar panels and electronics. At the same time, investors bought silver as a safe asset amid rising geopolitical tensions and talk of U.S.-China trade barriers. A sudden rush for physical metal hit London hardest. That rush created a delivery shortfall and forced spot prices up sharply on October 13, 2025.

London Market Turmoil Explained

London is the world hub for bullion trading. Dealers and vaults there handle much of the physical flow. In early October, traders reported missing bars, long delivery waits, and extreme borrowing costs for silver. Premiums jumped. Some market participants called the situation a historic short squeeze. These problems made normal market plumbing fail and added panic to price moves.

Historical Comparison: How High is “Record High”?

The recent peak in mid-October 2025 beat decades-old nominal highs. Previous spikes in 1980 and 2011 were driven by different forces, like speculative mania and monetary fears. This 2025 move is unique because it combines real industrial demand, a long-running structural deficit, and a physical shortage in London. Adjusted for inflation, silver’s rarity now looks more like a structural change than a single bubble.

Global Factors Driving Silver Demand

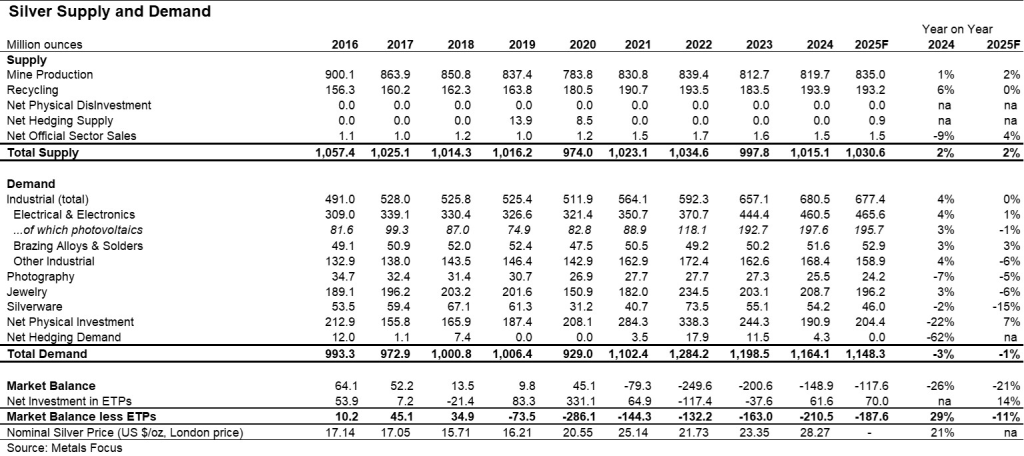

Demand for silver has two big pillars. First is industry. Silver is vital in solar panels, 5G hardware, and EV components. Second is investment. ETFs, coin buyers, and funds have added large amounts of physical silver to their holdings this year. The Silver Institute projected supply would lag demand in 2025, creating a multi-year deficit that set the stage for this squeeze.

Supply-Side Challenges

Mining output has not kept pace with rising demand. Production growth is slow. Added to that are logistical snags. Shipping delays and tight vault inventories made deliverable silver scarce in London. Inventories on key platforms fell substantially year-over-year. This loss of available bars left traders scrambling to source metal quickly.

Role of Central banks and Monetary Policy

Central bank actions shape bullion markets. Low real interest rates and weaker currencies make holding hard assets more attractive. In 2025, market talk of Fed rate cuts increased the appeal of precious metals. That changed investor calculations and pushed more capital into silver and gold. The effect was amplified when geopolitical shocks raised fears about inflation and trade.

Investor Behavior and Market Speculation

Hedge funds and large traders played a role. Short positions on silver were sizable before the squeeze. When physical demand outstripped available metal, short sellers raced to cover. That covering added fuel to the rally.

At the same time, some retail flows and ETF allocations drained inventories. Social chatter and headlines made momentum worse. Traders also used tools like an AI stock research analysis tool to scan flows and sentiment, which added speed to their decisions.

Impact on Industries and Consumers

A steep rise in silver costs can hit manufacturers fast. Producers of solar panels and electronics face higher input prices. That raises production costs and may slow project rollouts. Jewelers and coin mints also feel the pain through higher raw-material bills. For consumers, some price increases may pass through to final goods. Emerging markets that import metal could see larger import bills and currency pressure.

Trading Strategies for Investors

Volatility is high. Traders should use tight risk controls. Long-term investors might prefer physical allocated silver or trusts that hold real metal. Others may choose mining stocks or diversified commodity funds. Futures and leveraged products suit only those who accept big swings. Given the delivery risk in some markets, checking liquidity and storage options matters more now than it did before the squeeze.

Government and Regulatory Response

Regulators and market bodies moved quickly. The LBMA and exchange operators began reviewing settlement rules and inventory reporting. Some firms changed margin rules to limit forced liquidations. Authorities also pressed vault operators and dealers for clarity on deliverable stock. These steps aim to calm markets and restore trust in the settlement pipeline.

Comparison with Other Precious Metals

Silver is more volatile than gold. It has a larger industrial share of demand. That makes silver sensitive to both economic cycles and tech trends. Gold still holds the top safe-haven role, but silver’s industrial use gives it an extra growth story. The silver-to-gold ratio fell sharply during the October surge. That ratio often guides traders looking for value between the two metals.

Geopolitical and Global Economic Implications

A stressed physical market for silver can ripple through trade and manufacturing. Countries dependent on metal imports may face tighter balance-of-payments pressure. Rising raw-material costs could add to global inflation. At the same time, bullion flows can shift vaulting patterns and change where metal is stored. These changes may last beyond the initial price shock.

Outlook: Will Prices Stay High or Correct?

Two paths exist. One is continued tightness. If industrial demand keeps rising and mine output lags, prices can stay elevated. The other is a pullback. New supplies, eased logistics, or heavy profit-taking could cool the rally. Market watchers now focus on inventories, premium levels, and settlement times in London. Expect high volatility in the near term as the market finds a new balance.

Final Words

The October 2025 surge shows how physical shortages can drive big market moves. London’s delivery squeeze made a price story into a market crisis. For traders and firms, the message is clear: check where metal is held and how it is delivered. Plan for higher input costs and more uncertainty for industries. For investors, risk control and clear custody are now essential.

Frequently Asked Questions (FAQs)

Silver price is rising in October 2025 because industrial demand is growing, supply is tight, and investors are buying silver as a safe asset during global market uncertainty.

Silver may still be a good investment because it is used in technology and clean energy, but high prices and market swings mean investors should be careful and plan wisely.

Silver prices might drop if supply improves or investors take profit, but they could stay high if demand remains strong and global economic risks continue.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.