Samsung Shares Jump to New Record on Booming AI Chip Demand

Samsung Electronics is making headlines with its stock hitting an all-time high. On October 10, 2025, shares soared to 94,400 South Korean won, marking a 6.1% daily gain and a 77% increase this year. This surge is largely driven by the global boom in artificial intelligence (AI) technology.

As AI applications grow, the demand for advanced memory chips like DRAM and NAND has skyrocketed. Samsung, a leader in semiconductor manufacturing, is capitalizing on this trend. The company has secured significant deals, including a $16.5 billion chipmaking agreement with Tesla and partnerships with OpenAI for its Stargate data center project. These moves are positioning Samsung at the forefront of the AI revolution.

Analysts are optimistic, with some raising their price targets for Samsung’s stock, citing the company’s strong performance and strategic initiatives in the AI sector. As AI continues to reshape industries, Samsung’s role in supplying essential components places it in a prime position for sustained growth.

Overview of Samsung’s Stock Performance

Samsung Electronics has recently achieved a significant milestone, with its stock price reaching an all-time high. On October 10, 2025, the company’s shares closed at 94,400 South Korean won. This marks a 6.1% daily gain and a 77% increase over the past year. This surge reflects investor confidence in Samsung’s position within the rapidly growing artificial intelligence (AI) sector.

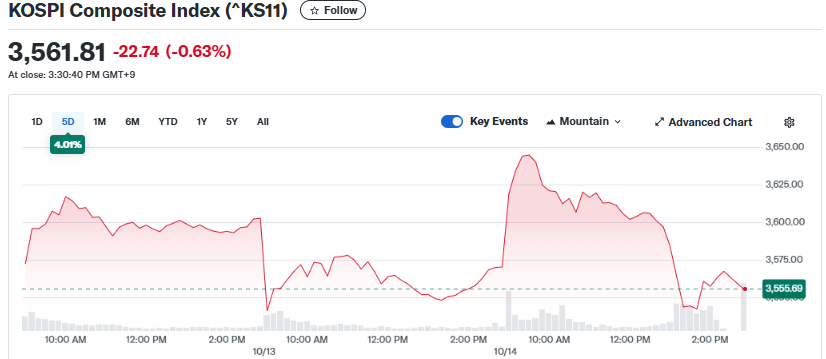

The company’s strong performance has also positively impacted South Korea’s stock market. The benchmark KOSPI index, which tracks the performance of major South Korean companies, has risen by 50% in 2025, partly due to the impressive gains of tech giants like Samsung and SK Hynix.

Booming AI Chip Demand

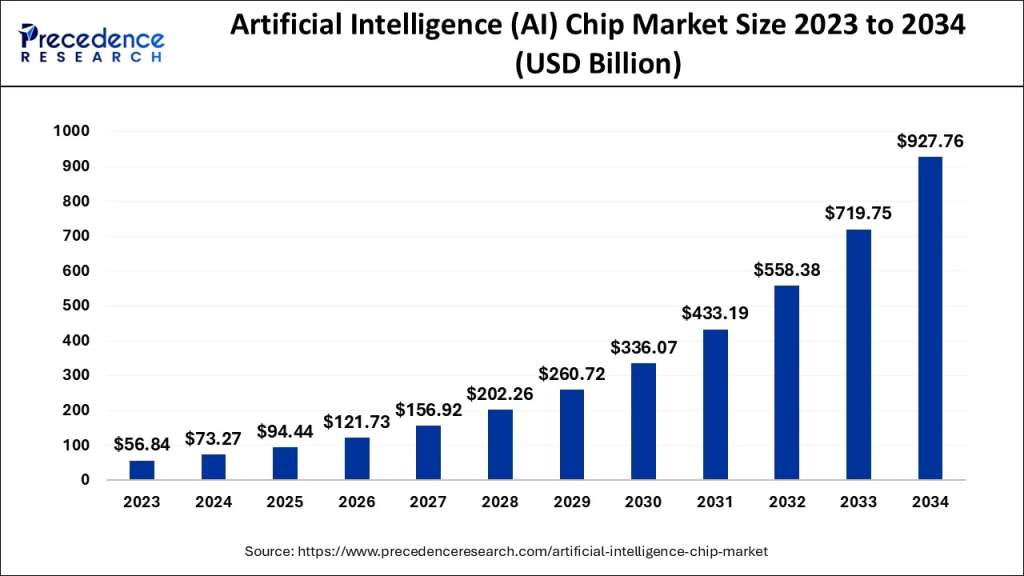

The surge in Samsung’s stock is closely tied to the global boom in AI technology, which has significantly increased the demand for advanced memory chips. AI applications, particularly in data centers and cloud computing, require high-performance chips to process vast amounts of data efficiently.

Samsung, as one of the world’s leading semiconductor manufacturers, has capitalized on this trend. The company has secured substantial contracts, including a $16.5 billion supply agreement with Tesla for the production of AI chips. Additionally, Samsung is collaborating with OpenAI to support its $500 billion Stargate data center project, further solidifying its role in the AI infrastructure space.

Samsung’s Strategy and Production Capabilities

Samsung’s strategy involves a significant investment in AI-related semiconductor technologies. The company has announced plans to produce AI chips for Tesla and image sensors for Apple’s next-generation iPhone at its Texas facility, marking a strategic push to reclaim ground in chip manufacturing lost to competitors like TSMC and repair former industry partnerships.

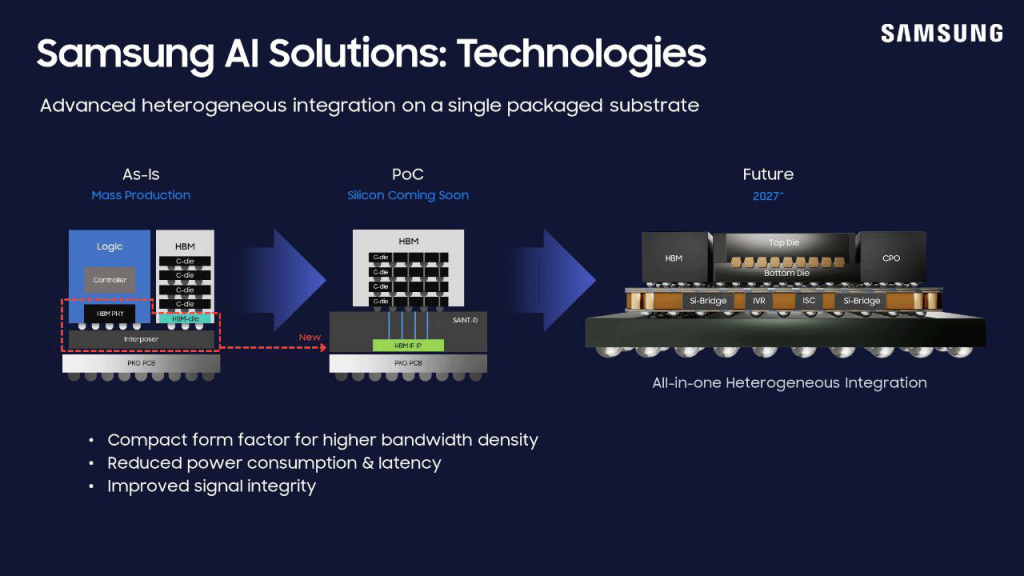

Furthermore, Samsung is focusing on developing high-bandwidth memory (HBM) chips, which are critical for AI applications. Despite initial delays in supplying its latest 12-layer HBM3E chips to major clients such as Nvidia, Samsung is making strides in this area and is expected to ship HBM4 chips commercially by 2026.

Market Analysts’ Perspective

Analysts are optimistic about Samsung’s prospects in the AI chip market. The company’s strong performance in the third quarter of 2025, with an estimated operating profit of 12.1 trillion won ($8.5 billion), surpassing analysts’ expectations, has bolstered investor confidence.

However, some analysts caution about potential risks. While Samsung is making progress in developing advanced AI chips, it faces stiff competition from other industry leaders like Nvidia and AMD. Additionally, global trade tensions and potential U.S. tariffs could impact Samsung’s consumer electronics segment.

Impact on Investors and Market

The surge in Samsung’s stock price has positively affected investors’ portfolios. The company’s strong performance has contributed to the overall growth of the South Korean stock market, attracting both domestic and international investors.

The increased demand for AI chips has also influenced the broader semiconductor industry. Companies like SK Hynix have experienced significant stock gains, reflecting the industry’s optimism about the future of AI technology.

Challenges and Risks

Despite its strong position, Samsung faces several challenges in the AI chip market. One of the primary concerns is the competition from established players like Nvidia and AMD, which have a significant share of the AI chip market.

Additionally, the development of advanced AI chips requires substantial investment in research and development. Samsung must continue to innovate and improve its chip technologies to maintain its competitive edge. Moreover, global supply chain issues and geopolitical tensions could pose risks to Samsung’s operations and profitability.

Future Outlook

Looking ahead, Samsung’s prospects in the AI chip market appear promising. The company’s strategic investments in AI-related semiconductor technologies position it well to capitalize on the growing demand for AI infrastructure.

Samsung’s focus on developing advanced memory chips, such as HBM4, and its collaborations with major tech companies like Tesla and OpenAI, are expected to drive future growth. However, the company must navigate the competitive landscape and address potential risks to sustain its upward trajectory in the AI chip market.

Wrap Up

Samsung’s record stock surge highlights its strong position in the booming AI chip market. Strategic deals, advanced technology, and global demand are driving growth. While competition and risks remain, Samsung’s focus on AI semiconductors positions it for continued success in 2025 and beyond.

Frequently Asked Questions (FAQs)

Samsung’s stock reached a record high on October 10, 2025. Strong demand for AI chips and deals with Tesla and OpenAI boosted investor confidence and drove the share price upward.

Samsung is making advanced AI chips like HBM3E and HBM4. It works with Tesla and Apple, expanding production in Texas. This growth strengthens its position in the AI chip market.

Samsung faces competition from Nvidia and AMD. Trade tensions, tariffs, and high research costs could affect profits. Technological challenges may also slow the company’s AI chip progress.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.