Tata Motors Demerger nears Completion with Stock Down 29% YoY

On October 14, 2025, Tata Motors reached a significant milestone by completing its demerger process. This strategic move separated the company into two distinct entities: Tata Motors Passenger Vehicles Limited (TMPVL), focusing on passenger cars and electric vehicles, and Tata Motors Limited (TMLCV), dedicated to commercial vehicles. The demerger was finalized on October 1, 2025, with the record date set for October 14, 2025.

The immediate market reaction was dramatic. Tata Motors’ stock opened at ₹399 per share on the Bombay Stock Exchange, a sharp decline from the previous day’s closing price of ₹660.90. This 40% drop left many investors bewildered, prompting concerns about the company’s future direction.

However, it’s important to note that this decline was not an actual loss in value. Instead, it reflected the structural changes resulting from the demerger. Shareholders received one new share of TMLCV for each share of Tata Motors held, effectively splitting the company’s value between the two new entities.

Let’s analyze the details of Tata Motors’ demerger, its implications for investors, and the potential long-term effects on the company’s growth trajectory.

Background of Tata Motors

Tata Motors, a prominent member of the Tata Group, has established itself as a significant player in the global automotive industry. The company operates across various segments, including passenger vehicles, commercial vehicles, and electric vehicles (EVs). Notably, its subsidiary, Jaguar Land Rover (JLR), has been a key contributor to its international presence.

In recent years, Tata Motors has been at the forefront of India’s EV revolution, introducing models like the Nexon EV and Tigor EV. These initiatives align with the nation’s push towards sustainable transportation solutions. However, despite these advancements, the company’s stock performance has faced challenges, reflecting broader market dynamics and investor sentiments.

What the Demerger Entails?

On October 1, 2025, Tata Motors initiated a significant corporate restructuring by demerging its commercial vehicle division. This move resulted in the creation of two distinct entities:

- Tata Motors Passenger Vehicles Ltd (TMPVL): This entity focuses on passenger cars, electric vehicles, and the Jaguar Land Rover division.

- Tata Motors Commercial Vehicles Ltd (TMLCV): This new company is dedicated to the commercial vehicle segment, encompassing trucks and buses.

The demerger was finalized on October 14, 2025, with shareholders receiving one share of TMLCV for every share of Tata Motors held. This strategic separation aims to provide operational clarity and allow each entity to pursue focused growth strategies in their respective markets.

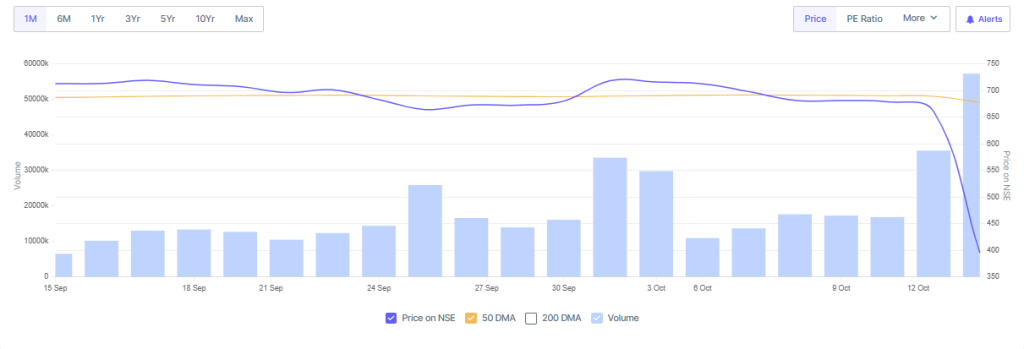

Stock Performance Analysis

The announcement and subsequent implementation of the demerger had a notable impact on Tata Motors’ stock performance. On October 13, 2025, the stock closed at ₹660.75. However, on October 14, 2025, the stock opened at ₹399.00, marking a significant decline. This sharp drop was primarily due to the structural changes resulting from the demerger, rather than any immediate loss in business value.

Analysts have indicated that the demerger’s impact on stock prices is a common occurrence during such corporate restructuring events. The adjustment reflects the revaluation of the company’s assets and the market’s reassessment of its future prospects.

Market and Investor Implications

The demerger presents both opportunities and challenges for investors. By creating two independent entities, Tata Motors aims to unlock shareholder value and enhance operational efficiency. However, the initial market reaction suggests a period of adjustment as investors recalibrate their expectations.

Institutional investors may find the separation beneficial, allowing for more targeted investment strategies. Retail investors, on the other hand, will need to assess the long-term potential of both TMPVL and TMLCV before making investment decisions.

Expert Opinions and Analyst Insights

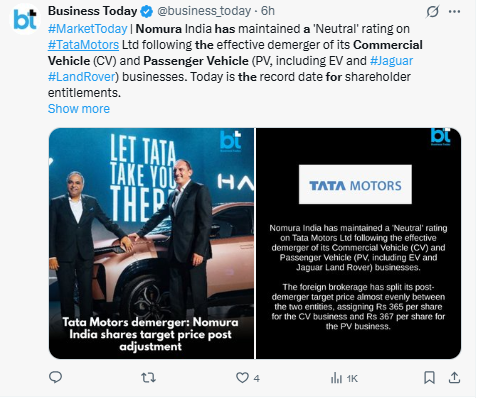

Financial analysts have provided mixed perspectives on the demerger’s implications. Nomura, a global financial services group, has valued the passenger and commercial vehicle divisions nearly equally, indicating a balanced outlook for both entities. However, they also caution about potential near-term volatility and technical risks associated with the share price following the structural change.

Other analysts have highlighted the strategic advantages of the demerger. They noted that it allows each entity to focus on its core competencies and pursue growth opportunities more effectively.

Future Outlook

Looking ahead, the success of the demerger will depend on how well each entity executes its growth strategies. TMPVL’s focus on passenger vehicles and EVs positions it to capitalize on the growing demand for sustainable transportation solutions. TMLCV, with its emphasis on commercial vehicles, aims to strengthen its market presence in the logistics and infrastructure sectors.

Investors should monitor the performance of both entities in the coming quarters to assess the effectiveness of the demerger and its impact on shareholder value.

Wrap Up

The completion of Tata Motors’ demerger marks a significant milestone in the company’s evolution. While the initial market reaction has been characterized by volatility, the long-term benefits of operational clarity and focused growth strategies may outweigh the short-term challenges. Investors are advised to stay informed and consider the potential of both TMPVL and TMLCV as they navigate this new phase in Tata Motors’ journey.

Frequently Asked Questions (FAQs)

Tata Motors demerged its commercial vehicle division into a new company, Tata Motors Commercial Vehicles Ltd (TMLCV), effective October 1, 2025. Shareholders received one share of TMLCV for each Tata Motors share held as of October 14, 2025.

The 40% drop in Tata Motors’ stock on October 14, 2025, was due to the demerger adjustment. This reflected the separation of the commercial vehicle business, not an actual loss in value.

Tata Motors’ passenger vehicle division began trading separately on October 14, 2025. The commercial vehicle division, TMLCV, is expected to list in November 2025.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.