Unemployment Surge Sends Aussie Dollar Plunging, RBA Faces New Challenges

Australia has been hit with a sharp rise in unemployment, and the impact is being felt across financial markets. The latest data from September 2025 shows a noticeable jump in jobless numbers. This signals that businesses are struggling and hiring has slowed. This sudden shift has shaken investor confidence and caused the Australian dollar (AUD) to fall sharply against major currencies. When fewer people are working, spending drops, growth weakens, and global traders begin to question the country’s economic strength.

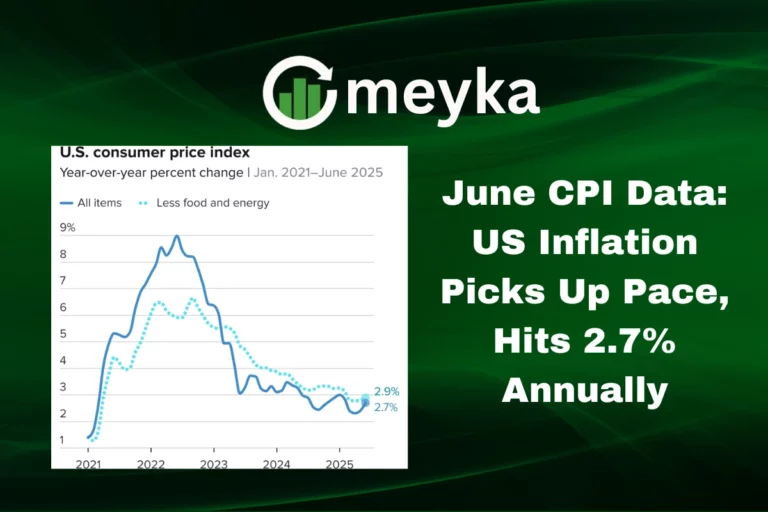

At the same time, the Reserve Bank of Australia (RBA) is under pressure. Inflation is still higher than its target, but cutting interest rates too soon could bring back price spikes. Keeping rates high, however, may lead to even more job losses. This creates a difficult balancing act for policymakers.

The unemployment surge is no longer just a number; it affects families, businesses, and the nation’s financial stability. As the AUD continues to decline, the RBA must act carefully to prevent deeper economic pain. The next few months will shape Australia’s recovery path and test the strength of its economy.

About the Unemployment Surge

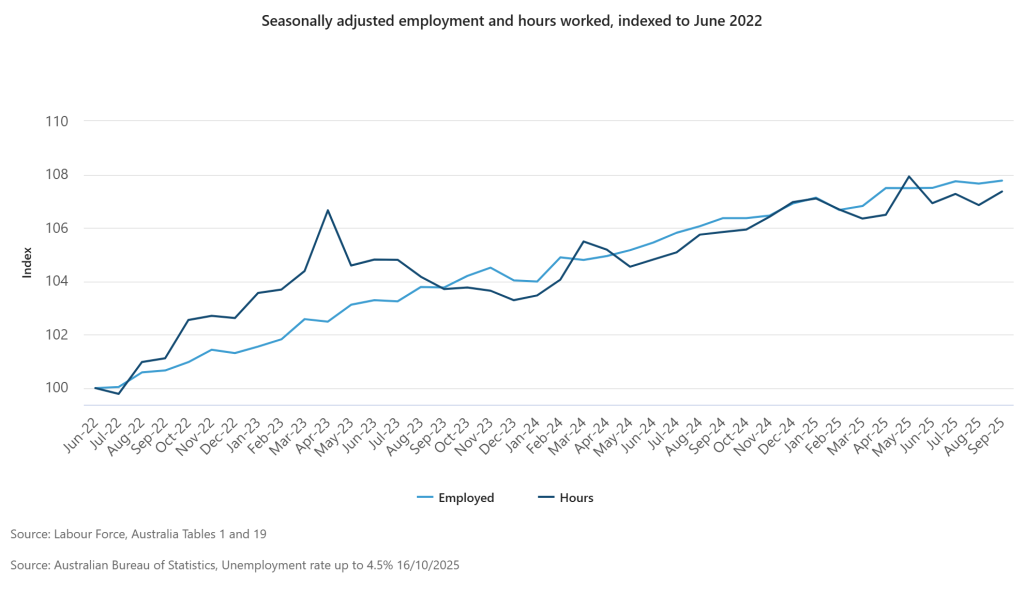

Australia’s jobless rate jumped to 4.5% in September 2025. The Australian Bureau of Statistics released the data on 16 October 2025. The rise is the highest since late 2021. Officials said the climb reflected a faster-growing labour force and fewer jobs than expected. Employment rose, but not by enough to absorb new jobseekers.

Many sectors felt pressure. Retail and hospitality showed weakness. Construction hiring slowed. Youth and part-time workers were hit hardest. This pattern points to a broad softening, not a single-sector shock.

Why do job losses happen?

Firms face higher costs. Many still deal with high borrowing rates. Global demand for some Australian exports has cooled. Businesses paused hiring. Some firms cut hours or held off on new projects. These forces combined to push unemployment higher. Analysts also noted that rising participation added to the headline jobless rate.

How did this Weak Labour Market Hit the AUD?

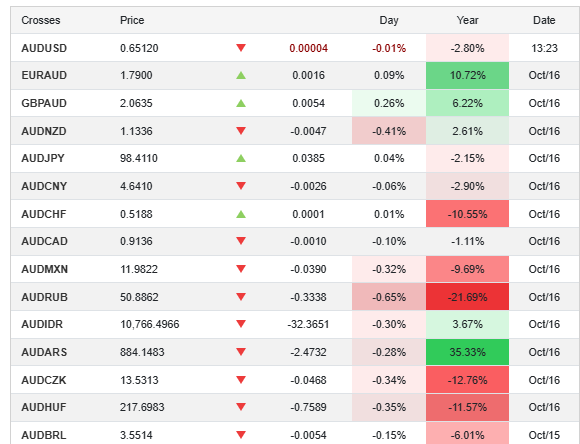

Currency traders reacted fast. The Australian dollar fell after the data. Lower job security makes traders expect interest-rate cuts. Lower rates usually weaken a currency. The AUD slid versus the US dollar and other major currencies inside hours of the release. Market pricing for a November RBA cut increased sharply.

RBA’s Current Policy Stance

The RBA has held policy rates higher to tame inflation. Core inflation showed signs of easing earlier in 2025. Still, inflation risks linger. The new labour data complicates the RBA’s choice. Cutting rates too soon could revive inflation. Waiting could deepen job losses. That trade-off is now front and centre at the central bank.

New Challenges for the RBA

First, the timing of rate cuts. Markets now expect a near-term easing. The RBA must judge if the jobs dip is temporary. Second, stubborn inflation risks. If prices re-accelerate, cuts would be costly. Third, communication. The RBA must guide markets without causing volatility. Finally, forecasting. The bank’s models must absorb fresh data quickly. Misreads could force abrupt policy shifts.

Fiscal and Government Options

The federal government can act with fiscal policy. Targeted job programs can help. Support for small businesses may prevent layoffs. Training and reskilling would ease structural problems. However, fiscal stimulus can add inflation pressure. Any package must be carefully sized and timed. Coordination between fiscal and monetary policy will be crucial.

What does this mean for Households and Firms?

Many households will feel tighter budgets. Job seekers may spend less. That cuts retail sales and services revenue. For firms, investment plans may stall. Builders and small employers may delay hiring. Mortgage stress could rise if incomes fall while mortgage costs stay high. These are second-round effects that can deepen a slowdown.

Market and Investor Reactions

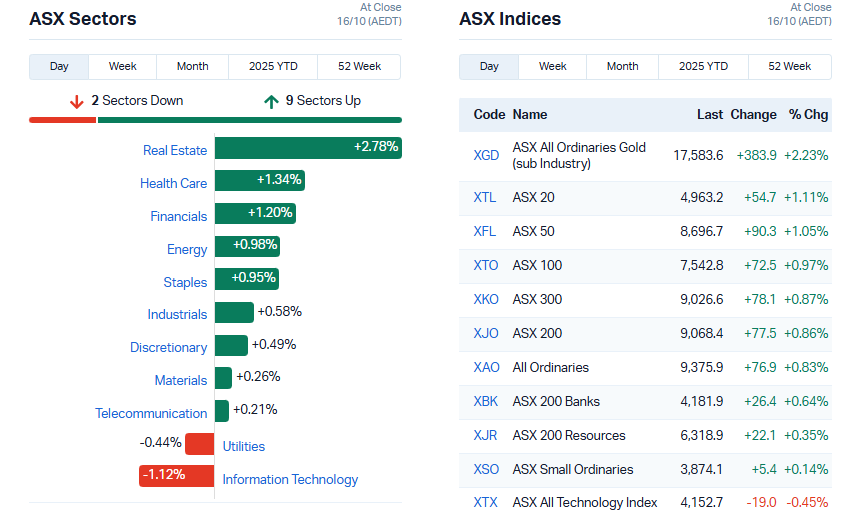

Bond markets are quickly priced at a lower terminal rate. Short-term yields fell. Equity markets reacted unevenly. Banks faced margin worries, but rate-cut bets lifted some growth stocks. Commodity-linked stocks fell on weaker AUD and demand concerns. Traders also started using tools like an AI stock research analysis tool to re-run valuations under new rate paths.

Possible Scenarios Ahead

Best case: The job dip is short-lived. Global demand recovers. Inflation continues to cool. The RBA cuts slowly and keeps markets calm. AUD stabilises.

Base case: Employment recovers slowly. The RBA makes one or two small cuts by early 2026. Growth stays weak but steady. AUD drifts lower but avoids sharp falls.

Worst case: Job losses deepen. Inflation re-accelerates due to supply shocks or wage pushes. The RBA is forced into volatile policy moves. The economy slips into recession and AUD falls sharply.

Key Data and Dates to Watch

- Next ABS labour force release. Watch monthly jobs and participation. (ABS release cadence continues in November 2025.)

- Q3 inflation reads due later in October 2025. Those numbers can change RBA plans.

- RBA meeting calendar and minutes. Any change in tone will move markets

Practical Takeaways

Protect cash flow. Households should check budgets and build small buffers. Businesses should stress-test plans against lower demand and lower rates. Investors should revisit risk exposures to commodity, bank, and consumer stocks. Keep an eye on central bank signals and the ABS labour releases for timely clues.

Bottom Line

The September 2025 jobs data, released on 16 October 2025, changed the market story. It raised the odds of an RBA rate cut. It also pushed the AUD lower. Policymakers now face a hard choice between jobs and inflation. The coming weeks of data will be decisive. Close attention to ABS releases, inflation prints, and RBA commentary is essential for anyone tracking Australia’s economic path.

Frequently Asked Questions (FAQs)

The jobless rate rose in September 2025 because fewer jobs were created, businesses cut hiring, and more people entered the workforce than the economy could absorb.

Higher unemployment weakens the economy, lowers investor confidence, and increases chances of interest rate cuts, which causes the AUD to lose value against other currencies.

The RBA may cut rates if unemployment keeps rising, but it must also control inflation, so any decision after October 2025 will depend on new economic data.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.