Meta’s $30 Billion AI Push: Secures Massive Private Capital Deal with Blue Owl

In August 2025, Meta made headlines by securing a $29 billion private financing deal with PIMCO and Blue Owl to supercharge its artificial intelligence expansion. This is one of the largest private credit deals in technology history, proving that the AI race is no longer just about innovation; it’s about scale, infrastructure, and speed. Meta is investing this money in massive AI-powered data centers in Louisiana, custom chips, and advanced models like Llama, aiming to become the backbone of the next generation of AI tools.

So why does a trillion-dollar company need this level of funding? Because the future of social media, advertising, commerce, and even the metaverse will be powered by AI. And Meta wants to build the infrastructure that everyone else will depend on.

This deal also marks a major shift in Silicon Valley. Instead of relying only on traditional loans or equity, tech giants are now turning to private credit to fuel AI growth. Is this a winning strategy or the start of an expensive AI war?

Background: Meta’s AI Shift and Ambition

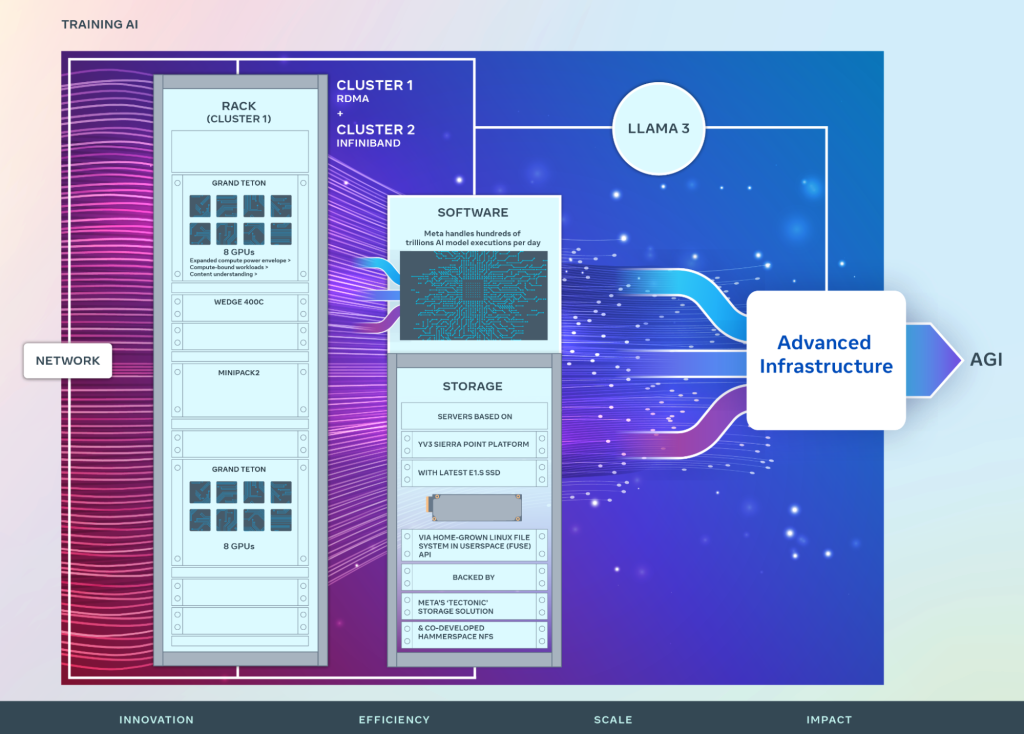

Meta has changed. The company is no longer only a social network firm. It now aims to be an AI infrastructure leader. Meta has invested heavily in large language models, custom chips, and global data centers.

In 2025, the company accelerated those plans. Reports in June and August 2025 described a major funding push to build massive AI sites in rural Louisiana. These projects are meant to host huge compute loads for models such as Llama and future systems.

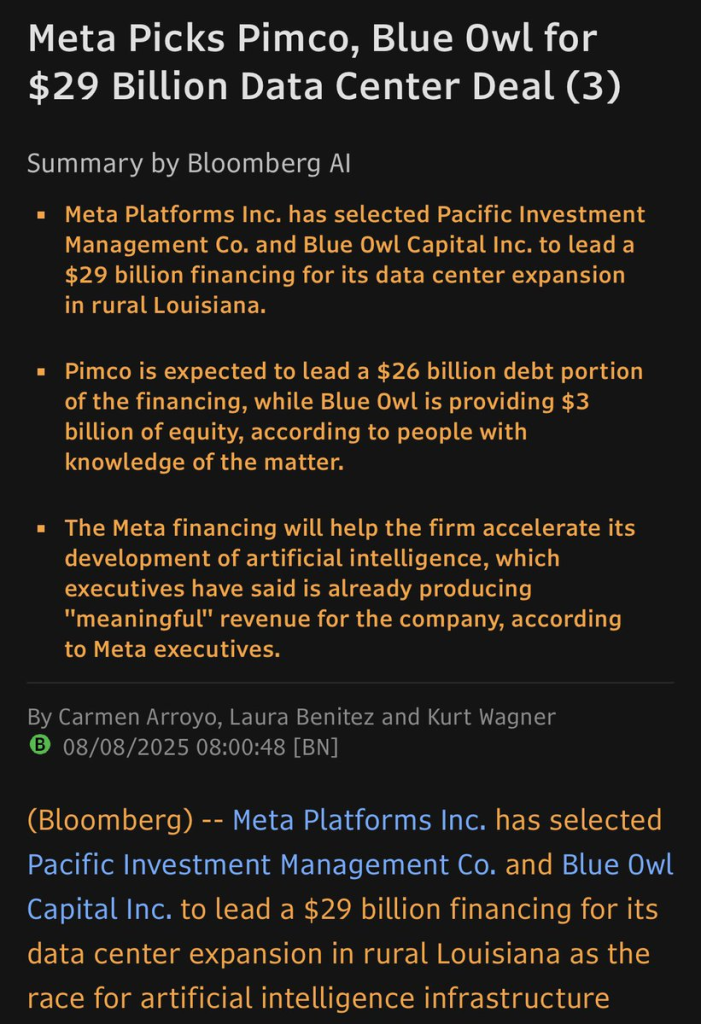

Inside the $29 Billion Financing Deal

In early August 2025, Meta picked PIMCO and Blue Owl to lead a $29 billion financing package for its Louisiana data-center expansion. The deal combines roughly $26 billion in debt, mainly via bonds, with about $3 billion in equity from Blue Owl.

Morgan Stanley helped structure the transaction. The financing is arranged through a special-purpose vehicle (SPV), which will own the site while Meta acts as developer, operator, and tenant. This structure keeps much of the project off Meta’s direct balance sheet.

What the Funds Will Do?

The funding will finance a multi-gigawatt campus. Meta plans to scale the site to handle intense AI training and inference work. The money will cover land, grid upgrades, power contracts, water systems, cooling, and rack-level infrastructure.

Meta also expects to continue investing in internal AI tooling and chip design to reduce reliance on external suppliers. Public reports note the project could grow in stages through 2029 as demand rises.

Strategic Benefits for Meta

This financing gives Meta faster access to capital without heavy equity dilution. It also shifts long-term infrastructure cost and risk to institutional lenders and investors. The SPV model gives Meta the operational control needed for AI workloads while unlocking outside capital. For a company scaling petaflops and exaflops of compute, such leverage speeds deployment. Analysts say the move strengthens Meta’s position versus rivals that still buy capacity piecemeal from cloud providers.

Investor Motives and Market Signals

Large asset managers see real value in stable, long-term infrastructure cash flows. PIMCO’s debt backing suggests confidence in predictable revenue from long leases and service contracts. Blue Owl’s equity stake signals appetite for long-dated infrastructure returns. The deal also marks a broader trend: private credit is becoming central to financing capital-intensive AI builds. Traders and portfolio managers, some using an AI stock research analysis tool, flagged the package as a structural game changer for tech infrastructure markets.

Impact on the AI and Tech Ecosystem

The $29 billion package will accelerate data-center capacity for AI in the U.S. It raises the bar for competitors. Microsoft, Google, Amazon, and even newer entrants will face pressure to secure similar scale and terms. The deal also stimulates supply chains. Chipmakers, power providers, cooling specialists, and construction firms will see higher demand. The move could push up short-term prices for some inputs, while unlocking long-term economies of scale.

Technological and Business Uses

Meta will use the campus to train larger versions of Llama and related models. It will also run inference services for ads, content ranking, moderation, and new AI features across its apps.

The site may host third-party workloads or partner services under long contracts. That could create new revenue streams and lower per-unit compute costs for Meta’s internal teams. Reports also suggest parts of the campus could be built with the goal of energy efficiency and renewable sourcing.

Risks and Challenges

Huge capital does not guarantee success. The project faces cost overruns and construction risks typical of multi-year builds. Return on investment will depend on demand for compute and Meta’s ability to monetize new AI products.

Regulatory scrutiny is another factor. Data-handling rules, antitrust reviews, and local permitting can slow progress. Talent is scarce; hiring skilled engineers and operators remains a bottleneck. Finally, the macro environment and interest rates affect the cost of debt and appetite for long bonds.

Market Reaction and Expert Views

Initial market reaction was mixed. Some analysts called the deal a bold, necessary step to secure compute at scale. Others warned about the large capital commitment and payoff timeline. Credit markets showed interest because the bonds are backed by physical assets and long-term contracts.

Industry experts noted that off-balance financing is becoming a common tool for tech firms with steady cash flows. Media coverage in August 2025 framed the package as a milestone in private credit’s involvement in AI infrastructure.

What Startups and Enterprises Should Watch?

Startups should watch for new partnership or co-location opportunities near the campus. Enterprises will get more options for on-prem-like scale in leased formats. Vendors of cooling, power, and middleware should expect more RFPs. The deal also signals that infrastructure capital is available if projects present stable, long-term revenue models. That could reshape how AI platforms fund growth beyond equity rounds.

Final Words

Meta’s August 2025 $29 billion financing is a major step. It shows how the AI race now demands not only models and talent, but also vast, financed physical infrastructure. The SPV approach and private-credit backing may become a blueprint.

If the project scales as planned, it will reshape both Meta’s competitive edge and the broader market for AI infrastructure. If hurdles mount, the costs could be high. Either way, the deal marks a new chapter in how AI gets built at an industrial scale.

Frequently Asked Questions (FAQs)

In August 2025, Meta secured $29 billion to build large AI data centers, boost computing power, and stay competitive in the fast-growing artificial intelligence industry.

Meta will use the funds to build and expand AI data centers in Louisiana, upgrade infrastructure, develop AI models like Llama, and improve performance across its platforms.

This investment is risky because it costs a lot, but it may be smart long-term if AI demand keeps growing and Meta earns strong returns from new AI services

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.