Bitcoin (BTCUSD) Today: Analysts predict $100K–$120K target amid Gold’s surge

Bitcoin (BTCUSD) is back in the headlines, as traders watch price action closely while gold climbs. The market mood is mixed, yet many analysts are optimistic. They point to strong technical levels, institutional flows, and the safe-haven interest in gold as reasons for a possible push to $100,000 to $120,000.

This article breaks down today’s price action, weekly signals, and the longer-term outlook, using verified market sources and forecasts.

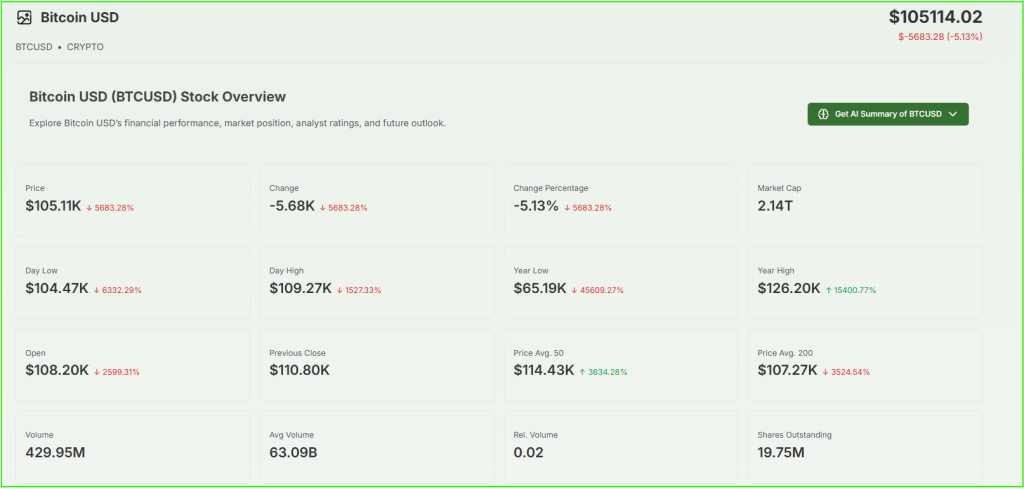

Bitcoin Price Analysis Today

Bitcoin (BTCUSD) is trading with higher intraday swings, as buyers and sellers test key zones. Recent analysis shows BTC stabilizing near a support cluster around $108,000 to $110,000, with immediate resistance in the $112,000 to $118,000 area.

If buyers clear these levels, momentum could pick up toward $120,000. These short-term levels and technical reads are highlighted in recent weekly reports.

What’s moving the price now? Short-term moves reflect market liquidity, ETF flows, and macro headlines. Some platforms are also using AI to scan order books and social sentiment, a trend borrowed from AI Stock research practices in equities.

Analysts Predict Bitcoin’s $100K–$120K Target

A growing number of analysts lay out a path to $100K and beyond. Coverage notes that Bitcoin’s next major psychological levels are $100,000 and $120,000, with debate focused on which will be hit first, depending on momentum and risk controls.

Analysts cite on-chain accumulation, lower exchange balances, and the potential for renewed ETF inflows as key drivers.

Why are analysts bullish amid gold’s rally? Gold’s rally signals rising demand for alternative stores of value. Investors seeking safety can push both gold and Bitcoin higher, since both are treated as hedges in some portfolios. In the current cycle, the digital gold comparison is discussed often, and many market players treat Bitcoin as a complementary hedge to gold.

This view ties into Bitcoin price forecast, crypto market trends, BTCUSD analysis, and other SEO relevant phrases that traders search for when looking for guidance.

Weekly Forecast for Bitcoin (BTCUSD)

What Trading Platforms show this week

Weekly charts from TradingView and price pages on Yahoo Finance point to a cautious but constructive short-term picture. The market is sitting on critical EMAs, and the 200-day average is acting as a demand floor. A weekly close above major resistance could increase the probability of testing the higher targets.

Key weekly levels to watch

- Support: $108,000, $105,500

- Resistance: $112,800, $118,200

- Indicator note: RSI and EMAs will decide the next leg.

Why is Bitcoin reacting this way? The market is balancing profit-taking and new flows. Weekly volume patterns show that large wallets are accumulating, while retail traders take profits near resistance. If the weekly momentum flips positive, the path to $120K becomes clearer.

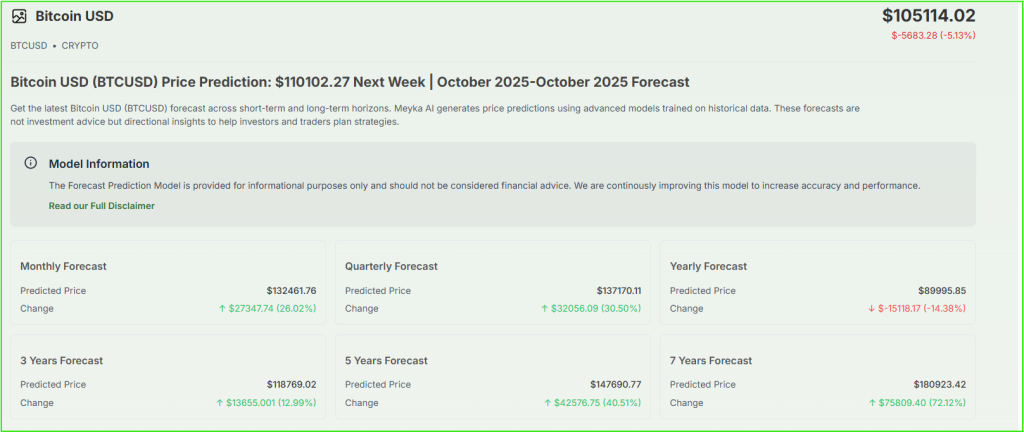

Monthly and Yearly Bitcoin Forecast

Outlook for 1 month, 6 months, and 12 months

Longer-term forecasts from Meyka use AI models and historical data to set a range of likely outcomes. Their estimates show possible monthly upside targets above $130,000 in bullish scenarios, while medium-term paths can include corrective windows before higher highs.

These model outputs help form a practical view of where BTC (BTCUSD) might be in six and twelve months.

Six-month perspective

Meyka highlights scenarios where macro factors, such as inflation and ETF flows, support renewed demand, lifting BTC (BTCUSD) into a higher bracket.

One-year perspective

Over 12 months, models show wide bands, with an upside case toward the mid six figures if institutional buying continues, but a conservative case with deeper pullbacks is also plausible. This is why traders pair technical signals with macro watchlists.

In this section, it is common to read model outputs alongside analyst notes. That blend resembles AI Stock Analysis approaches used in equity research, adapted here for crypto.

Correlation Between Bitcoin and Gold Prices

Gold’s rally is a central part of today’s story. When gold moves higher, investors often reassess risk allocations. That can lift Bitcoin as part of a broader move into alternative assets. Analysts note that while Bitcoin (BTCUSD) and gold do not always track perfectly, episodes of macro uncertainty can push both up together as safe-haven or hedge bids rise.

Social signal

Crypto media and data aggregators often report real-time sentiment on social platforms. For example, a recent post from Decrypt highlighted market shifts and sentiment flips during a pullback, showing how social commentary echoes price moves.

Can gold push Bitcoin to $120K? Gold alone will not make Bitcoin (BTCUSD) break higher. It helps the narrative and attracts attention. The price move will need confirmation from flows, technical breakouts, and steady demand from larger holders.

Expert Opinions and Market Insights

Analysts from mainstream outlets and specialist crypto desks outline a few common themes. They see institutional accumulation, lower exchange inventories, ETF-driven demand, and macro uncertainty as bullish.

At the same time, they warn about overbought technical signals, possible regulatory shocks, and fast deleveraging in futures markets.

Institutional buyers and liquidity

Data shows that regulated trading venues and large funds are becoming important price makers. That stability can help the market handle flows toward the $100K–$120K area. Market liquidity remains the variable to monitor when positions scale up.

Trading phases and risk

Traders should watch entry zones and use stop discipline. The market can swing quickly. On balance, expert views suggest a staged approach to buying and selling, and a focus on proven technical levels.

In this section, we mention AI Stock once more to reflect how machine learning research methods have migrated into crypto analysis, while still stressing human oversight.

Conclusion: Will Bitcoin Hit $120K?

Bitcoin has momentum on its side, and the case for $100,000 to $120,000 rests on a mix of technical reclaim, continued institutional flows, and supportive macro conditions highlighted by gold’s rally. Weekly signals from TradingView and Yahoo Finance set the near-term playbook, while Meyka’s forecasts sketch the wider possibilities.

Bottom line

A clean breakout above $118,000 with volume would make the $120K target realistic. Conversely, a loss of the $108K base could push BTC (BTCUSD) into a consolidation phase. Investors should combine technical checks, macro awareness, and careful position sizing.

As markets evolve, Bitcoin’s story continues to unfold, and today’s mix of gold strength and crypto flows creates a compelling narrative. Stay informed, follow verified sources, and keep risk controls in place.

FAQs About Bitcoin (BTCUSD) and Its $100K–$120K Prediction

Analysts cite strong institutional buying, growing ETF demand, and gold’s rally as key factors pushing Bitcoin toward the six-figure mark. Momentum and limited supply support this bullish outlook.

Gold’s rise increases investor confidence in alternative stores of value. As investors diversify, Bitcoin (BTCUSD) often benefits from the same “safe-haven” sentiment.

Current weekly charts show Bitcoin trading between $108K and $118K, with resistance near $120K. A breakout above that zone could open a path to higher levels if volume confirms the move.

Meyka’s AI-driven forecast suggests Bitcoin could reach around $132K in the short term and potentially over $147K by 2030, depending on macroeconomic and institutional factors.

Disclaimer

This is for information only, not financial advice. Always do your research.