ICICI Bank Share Falls 2% After Q2 Earnings; Analysts Split on Outlook

Investors kept a close watch on ICICI Bank on October 19, 2025, when the stock slipped nearly 2% right after the bank released its Q2 FY26 earnings. ICICI Bank is one of India’s top private lenders, so any change in its performance often influences the entire banking sector. The results were a mix of strong loan growth and steady profit, but some key numbers did not meet market expectations. This created instant confusion and triggered selling pressure.

What makes the situation more interesting is that analysts are not on the same page. Some believe the bank still has strong fundamentals and long-term growth potential. Others worry about margin pressure, rising costs, and increasing competition from peers like HDFC Bank and SBI. As a result, the stock’s drop has sparked a bigger debate: Is this a buying opportunity or an early warning sign?

Let’s explore what drove the share price fall, what the results really mean, and why expert opinions are sharply divided.

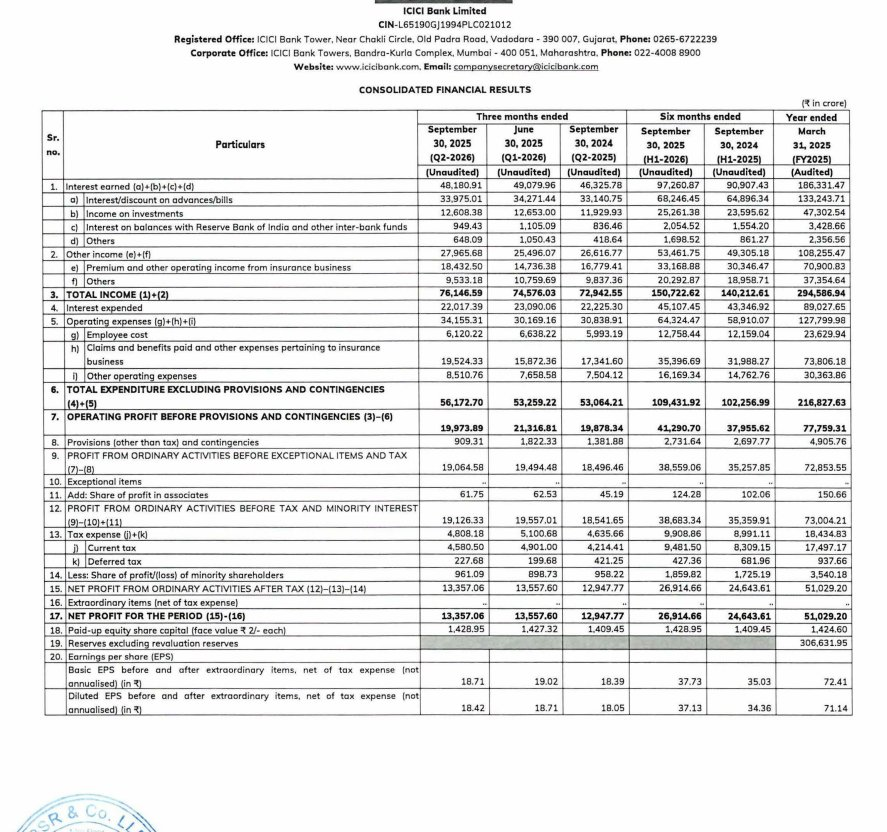

Q2 Performance and Key Numbers

ICICI Bank released its Q2 FY26 results on October 18, 2025. The bank reported a standalone profit after tax of ₹12,359 crore, up about 5% year-on-year. Net interest income rose to ₹21,529 crore, and net interest margin held near 4.30% for the quarter. Fee income also grew, driven by retail and business banking. Asset quality showed improvement as gross NPA eased versus the year-ago quarter.

Why did the Stock fall despite a Profit Beat?

The stock slipped roughly 2% in early trade after the results. Investors focused on growth pace and near-term margins. Loan and deposit growth were healthy but not spectacular. Some numbers fell short of the street’s higher expectations. That gap pushed some traders to sell first and ask questions later.

Strong Points in the Report

Retail lending showed steady momentum. NII growth and stable NIM signalled pricing resilience. Provisions declined versus last year, which helped reported profit. Capital ratios and liquidity remained comfortable. These points underline that core operations stayed solid in Q2.

Market Concerns and Downside Risks

Margin pressure is a top worry. Cost of funds ticked up broadly for the system. Competition in retail lending remains intense. Some investors flagged slower sequential loan growth in certain segments. The bank’s near-term guidance did not fully remove those concerns.

Analysts are Split on the Outlook

Brokerages reacted unevenly. Several houses kept a buy stance and raised medium-term targets. Others turned cautious, citing valuation and short-term headwinds. For example, some firms still see room for upside to targets near ₹1,700, while a few set more modest targets near ₹1,440. The split reflects confidence in long-term franchise strength versus doubts about near-term margins.

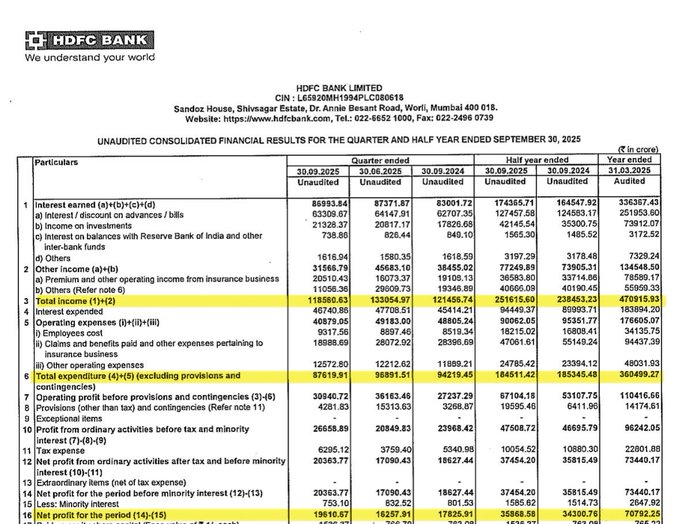

How ICICI Stacks up to Peers?

HDFC Bank reported stronger profit growth in the same quarter. That result lifted sector sentiment. State Bank of India and Axis Bank showed mixed prints. Relative to peers, ICICI’s margin and asset quality are competitive. But investors compare growth trajectories closely now. Outperformance by any peer can change capital flows quickly.

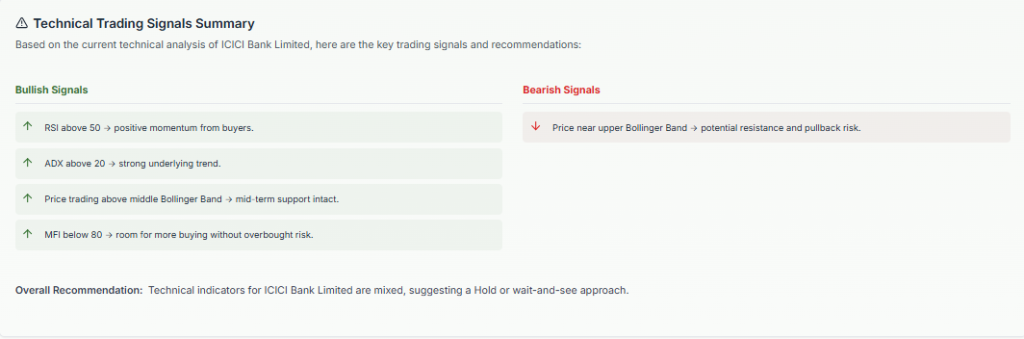

Technical and Market Reaction

Short-term traders watched support near recent intraday lows. Volume spiked on the day of the release, showing active repositioning. Foreign institutional flows and derivatives positioning hinted at both fresh selling and selective buying by long-term funds. Such mixed flows deepen day-to-day volatility.

What to Watch Next?

Investors should track loan growth trends in retail and corporate segments. Margins through the rest of FY26 will matter most. Watch quarterly guidance, deposit costs, and treasury gains. Monitor broker updates and changes in target prices. Using an AI stock research analysis tool could help scan broker reports and highlight changes quickly.

Balanced Takeaway

The quarter showed steady core performance. The fall in the stock reflects a few missed expectations and a nervous market. Long-term investors who focus on franchise strength may treat the dip as an entry point. Short-term traders should respect technical levels and analyst guidance. Keep the date October 18, 2025, in mind when comparing future quarters to this print.

Frequently Asked Questions (FAQs)

ICICI Bank stock fell 2% on October 19, 2025, because some Q2 FY26 numbers missed market expectations, causing investors to worry about margins and short-term growth.

Buying depends on your goal. The bank has strong fundamentals, but short-term risks remain. It is better to study recent results and wait for clearer guidance.

Analysts are divided. Some expect steady profit and loan growth in 2026, while others see margin pressure and tougher competition. Watching future quarterly results is important.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.