RBL Bank Share Surges 5% to 52-Week High on Emirates NBD’s 60% Stake Plan

On October 2025, the RBL Bank share price shocked the market by jumping 5% in a single day, hitting a fresh 52-week high. The sudden rally was not random. It came after reports that Emirates NBD, one of the largest banks in the Middle East, is planning to buy up to 60% stake in RBL Bank. This potential deal could become one of the biggest foreign investments in an Indian private bank.

Investors reacted quickly because a strong global bank entering RBL could change its future. RBL Bank has seen ups and downs in recent years, but this news has brought back hope. A foreign partner can bring capital, technology, and trust, which RBL needs to grow.

The market is now asking big questions. Will the deal actually happen? How will regulators respond? And what does this mean for shareholders in the long run?

This article breaks down the story, the opportunities, and the risks behind this major development.

Company Profiles

RBL Bank began as Ratnakar Bank and grew into a full-service private lender. The bank built strength in retail cards, SME lending, and digital banking. It faced trouble in the past years. Asset-quality issues and management churn weighed on performance until the recent recovery. The latest business focus includes secured retail loans and expanding fee businesses.

Emirates NBD is a leading Dubai-based bank. It has a big regional footprint and strong digital banking skills. The bank is known for cross-border deals and large capital moves. Its entry into India would mark a major foreign strategic push.

Details of the 60% Stake Plan

Emirates NBD announced plans to buy a majority stake in RBL through a primary infusion of about $3 billion. The media release carrying this plan was published on 18 October 2025. The transaction structure includes a preferential share issue to raise fresh capital.

According to Reuters reporting on 20 October 2025, the preferential price mentioned was ₹280 per share. That pricing sits below some market quotes at the time of reporting, which makes the structure notable for both valuation and control dynamics.

The deal is expected to unfold in phases. Early filings and manager announcements pointed to an open offer and regulatory steps that could take several months. Market timelines indicate the first funding tranche may arrive within 5-7 months after approvals.

RBL Bank Share: Market Reaction

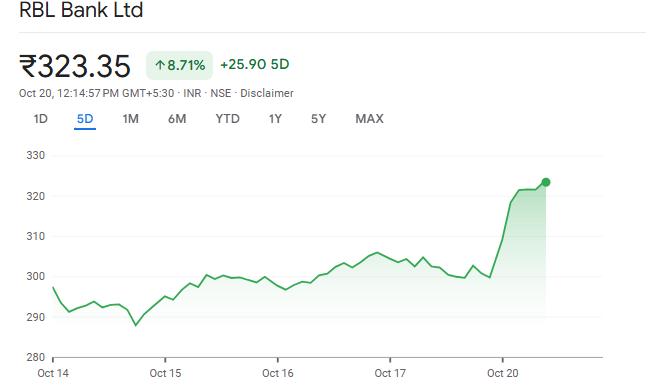

Markets reacted fast. On 20 October 2025, RBL shares jumped and hit fresh multi-year highs. Intraday moves ranged around a 5% surge in some reports, with several outlets noting larger intraday spikes as speculation intensified. Trading volumes also rose sharply.

The stock’s climb in 2025 had already been strong. Year-to-date performance showed a large rebound from earlier lows. The Emirates NBD news acted as a catalyst. Brokers flagged the move as a confidence booster for investors.

Why Emirates NBD is interested?

India is a fast-growing banking market. RBL offers a wide retail and SME footprint. That access is attractive to a Gulf lender seeking growth outside traditional markets. RBL’s digital and card payments book also aligns with Emirates NBD’s tech and payments strategy.

Valuation is another reason. RBL’s shares had been beaten down in earlier years. A fresh capital infusion provides a way to buy scale while funding future growth. Finally, the transaction gives Emirates NBD a listed Indian subsidiary, which helps in local operations and distribution.

Strategic Benefits for RBL Bank

The capital will strengthen the balance sheet. Reports suggest RBL’s net worth could jump from about $1.82 billion to roughly $5.12 billion after the deal. That increase would free room for lending and provisioning.

Strategic partners bring governance upgrades. Emirates NBD can add risk controls and digital capabilities. That could improve asset quality over time. Funding at scale also enables expansion in wealth, cards, and secured retail loans. Several analysts expect the bank to pursue a larger wealth business after the infusion.

Regulatory and Structural Challenges

India allows up to 74% foreign ownership in private banks. However, a single foreign investor typically must follow RBI conditions. Any stake above standard thresholds will need formal Reserve Bank of India approval. Reports indicate informal engagement with the RBI, but formal clearance is still required. Expect a detailed regulatory review and possible conditions.

Open offers, preferential allotments, and potential merger mechanics will all attract scrutiny. Timing may stretch into months. Until approvals are official, the deal remains subject to change.

Analyst and Broker Views

Several brokerages described the deal as transformative. CLSA called it a “landmark deal.” Emkay Global, Citi, and other firms noted the potential to rebuild investor confidence and lift long-term growth prospects. Analysts raised price targets in light of the capital boost and strategic partnership.

Some analysts also tempered optimism. They highlighted integration risks, valuation premiums embedded in preferential pricing, and dependency on regulatory timelines. The consensus view leaned positive but cautious.

Potential Risks and Concerns

Deal certainty is the first risk. Announcements and terms can change. Regulatory delays or new conditions can alter economics. Valuation risk is next. Preferential pricing below market levels can create friction among existing shareholders. Integration risk follows. Cultural and systems integration takes time.

Macro risks also matter. Economic slowdowns or credit shocks would test even a well-capitalised bank. Investors should weigh these risks against the upside. An AI stock research analysis tool may help model scenarios and stress tests.

What does it mean for Investors?

Short term, expect volatility around filings and approval milestones. Speculative trading may continue. Long term, successful execution could change RBL’s profile. The bank could shift from a mid-sized challenger to a larger, well-capitalised player.

Investors should check official filings, track open offer documents, and follow RBI commentary. Focus on capital adequacy, asset quality trends, and management succession plans as the story unfolds.

Final Words

The Emirates NBD plan for a 60% stake in RBL is a high-impact development. The $3 billion infusion and preferential issue announced in mid-October 2025 could reshape RBL’s future. Markets reacted with sharp gains and renewed investor interest. Regulatory approval and careful execution remain the keys to success. Keep watching the official filings and regulator statements for firm dates and the next milestones.

Frequently Asked Questions (FAQs)

RBL Bank stock rose about 5% on 20 October 2025 after reports said Emirates NBD may buy a large stake. This increased investor confidence and market interest.

As of October 2025, reports suggest Emirates NBD plans to buy up to 60% of RBL Bank, but the deal still needs official confirmation and regulatory approval.

If the deal happens, RBL Bank may gain fresh capital, better technology, and stronger global support, which could help long-term growth, but risks remain.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.