TESLA Q3 Earnings Preview: What Wall Street Expects From Musk’s AI and Robotaxi Vision

As we approach the announcement of Tesla, Inc.’s Q3 results, investors and analysts alike are turning a keen eye toward more than just its traditional automotive business. The keyword at the moment is TESLA Q3 earnings, but what’s truly driving attention is CEO Elon Musk’s ambition in AI stocks, robotics, and the looming promise of a robotaxi-driven future.

What the Market Expects for Tesla Q3 Earnings

Analysts anticipate that TESLA Q3 earnings will reflect both opportunities and headwinds. According to multiple sources, Wall Street estimates revenue of approximately $26.5 billion, up about 4-6% year-over-year, with earnings per share (EPS) hovering near $0.55, a decline from the same quarter last year.

Key figures to watch:

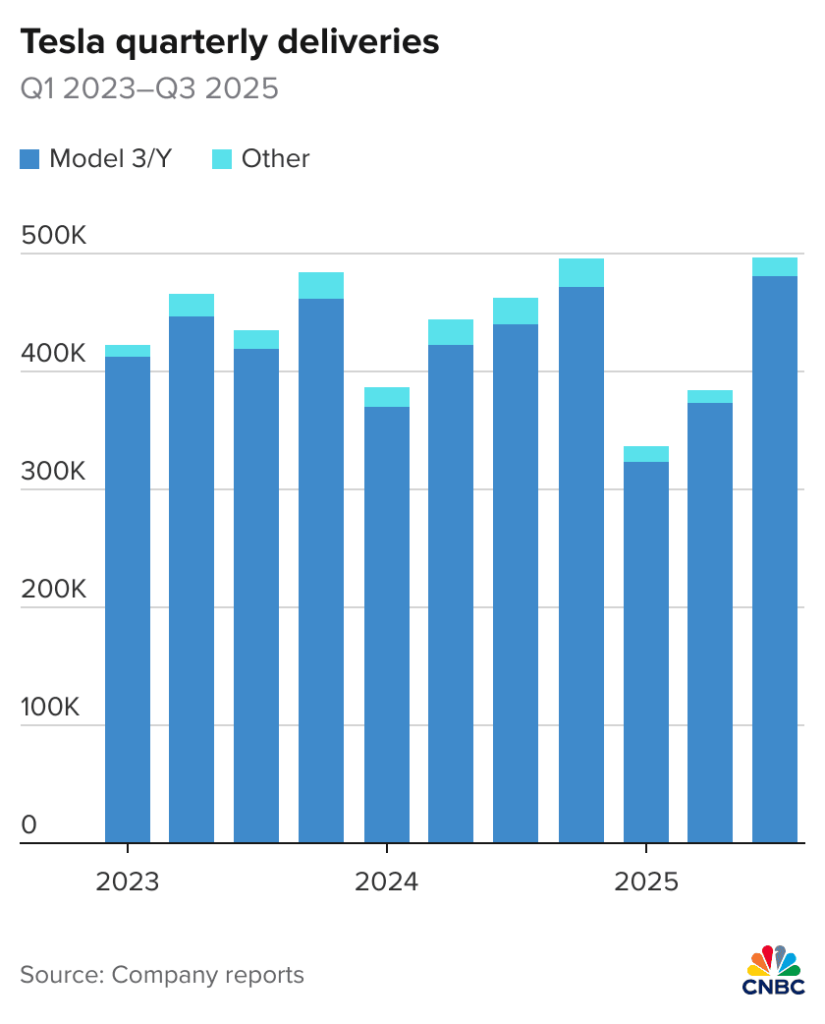

- Deliveries: Tesla reported a record 497,099 vehicles delivered in Q3.

- Automotive gross margin is predicted to sit around 15.9%.

- Free cash flow may approximate $1.1 billion.

These numbers point to moderated growth in the auto business, but they set the stage for Tesla’s next chapter. For those performing stock research, the nuance lies in how Tesla transitions beyond pure volume into higher-margin areas.

Why Tesla’s AI & Robotaxi Vision Matters

While TESLA Q3 earnings will obviously cover the current quarter’s performance, much of the market’s interest is oriented toward what comes next. Tesla has repeatedly signalled that its real upside lies in autonomous driving, AI computing, and eventually a robotaxi fleet.

AI & computing platform

Tesla is pushing its internal AI supercomputing efforts to support its Full Self-Driving (FSD) capability and broader robotics ambitions. The company claims this could become a major profit pool.

Robotaxi strategy

Analysts at firms like Morgan Stanley view Tesla’s “mobility” business (robotaxi / ride-hailing) as a long-term core profit engine. The idea: millions of autonomous Tesla vehicles generating revenue per mile.

Why it matters for investors

In the world of AI stocks and technology-driven automakers, Tesla stands out as a hybrid: part car maker, part robotics/AI company. For investors conducting stock research, this means the usual metrics (units delivered, margins, costs) are still relevant, but so too are variables like software/AI monetisation, fleet utilisation, and regulatory progress.

The upcoming Q3 earnings will likely include commentary on these initiatives, even if the current financials reflect mostly the legacy auto business. What management says about the timing and execution of the robotaxi vision may influence stock sentiment significantly.

Strengths and Risks Facing Tesla in Q3

Strengths

- Record deliveries: With 497,099 units delivered in Q3, Tesla beat consensus expectations, providing a strong delivery metric.

- Growing energy/storage business: While often overshadowed by the auto side, Tesla’s energy and storage segment has shown growth, which may slightly buffer EPS pressure.

- Compelling long-term narrative: The transition to a robotaxi and AI-enabled future gives Tesla a differentiated investment story among traditional automakers.

Risks

- Margin compression: Lower gross margin in the automotive unit is expected, as competitive pricing and rising costs squeeze profitability.

- Delayed monetisation of AI/robotaxi: Although the vision is ambitious, concrete revenue from autonomous taxi services or humanoid robots is still nascent, meaning future upside is somewhat speculative.

- External headwinds: Intensifying EV competition, chip supply chain issues, and regulatory or macro-economic pressures (interest rates, inflation) all pose risk to execution.

When viewing Tesla’s stock through the lens of stock market performance, the interplay of these strengths and risks is what drives the volatility and wide range of analyst opinions.

Key Metrics and What to Listen For During the Earnings Call

To get maximum value from the TESLA Q3 earnings release, here are the key metrics and commentary we’ll focus on:

- Vehicle deliveries: While already reported, any upward or downward revision is instructive.

- Automotive gross margin: The margin progression will indicate how well Tesla is managing cost pressures and pricing.

- Software/AI revenue and guidance: Look for updates on FSD subscriptions, robotaxi roll-out plans, and how software is contributing to revenue.

- Energy/storage segment performance: Include deployments and margin trends.

- Free cash flow and capex guidance: Important for evaluating the sustainability of growth investments.

- Management commentary on robotaxi and robotics: Specifically timing, geographic expansion, pricing and regulatory pathways.

- Pricing strategy and mix: Any shifts toward more affordable models or region-specific changes (e.g., China, Europe).

Implications for Investors and Stock Research

For those engaged in stock research, the upcoming TESLA Q3 earnings mark a pivotal moment. A strong quarter could reinforce confidence in Tesla’s auto business and its long-term AI/robotics narrative. Conversely, if results disappoint, the stock could face a sharp revaluation since a significant portion of Tesla’s valuation rests on future potential rather than current profitability.

Key implications:

- If Tesla demonstrates credible progress toward monetising AI/robotaxi, it could propel the company from “cheap EV play” to “disruptive mobility/AI leader”.

- Should Tesla fall short on margin or delivery metrics, the stock may be re-rated downward, especially among sceptical analysts.

- Given the broader market focus on AI stocks, Tesla’s announcement and narrative may influence sentiment not only for TSLA but for other technology-enabled automakers and mobility plays as well.

The Outlook: What Wall Street Wants to Hear

Wall Street is setting a modest baseline for TESLA Q3 earnings: a revenue rise of about 5% and a drop in EPS to ~$0.55.

With that in mind, what the market wants to hear includes:

- Confirmation that Tesla’s legacy vehicle business is stabilizing and margin pressure is being managed.

- Clear progress updates on the AI/robotaxi roadmap, even if revenue is limited now, tangible steps matter.

- Facts and figures around software revenue, fleet potential, and energy/storage growth.

- Guidance that illustrates a path beyond the current automotive cycle into the next frontier of mobility.

Management commentary aligning with these would likely spark a positive reaction. On the flip side, vague language about the future or weak delivery/margin numbers could trigger a pull-back.

Final Thoughts

In the context of TESLA Q3 earnings, the quarter is less about beating consensus and more about reinforcing a vision. Tesla is at the intersection of two powerful currents: the rise of electric vehicles and the shift into AI-driven autonomous mobility. For investors, that means the stock market valuation hinges not just on this quarter’s numbers but on the credibility of Tesla’s transition from carmaker to mobility-AI titan.

We will be watching every data point and nuance of commentary. For those doing stock research, Tesla remains a fascinating blend of current fundamentals and future ambition. Whether the company can deliver on both will have major implications — not only for TSLA’s share price, but for how the broader market values high-potential, technology-driven automakers.

FAQs

Tesla is expected to announce its Q3 results on October 22 (after market close in the U.S.).

Because while the vehicle business can grow incrementally, the robotaxi and AI/robotics initiatives represent potentially massive new revenue pools and shift Tesla into an entirely different valuation category.

In the near term, the quarter will still be anchored by vehicle deliveries, margins, and cash flow. However, the commentary and roadmap for AI/robotaxi will carry as much weight for future valuation as the current numbers.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.