XRP News Today: XRP Price holds Steady near $2.50, 3 Key Factors that could Trigger a Major Breakout

As of October 20, 2025, the digital asset XRP (XRP) is hovering around the $2.50 mark. That’s significant because the price has found a floor here and appears steady after recent swings.

Behind this calm lies more than just numbers. On one hand, major regulatory shifts are stirring in the background. On the other hand, vendor partnerships and technical setups might finally be lining up for a breakout.

This moment matters. If these pieces fall into place, XRP could surprise many by moving out of its current range. In this article, we’ll explore three key factors that could trigger that breakout. Stay with me because what looks like a pause could be the calm before the storm.

Current XRP Price Overview

XRP has formed a tight trading range around $2.30-$2.60 in mid-October 2025. Daily swings remain notable, but price action looks more sideways than runaway. On many exchanges, XRP’s market cap places it among the top five crypto assets.

Traders note that recent volume spikes accompany test moves toward $2.50. That level now acts as a focal point for short-term buyers and sellers. Crypto markets broadly moved higher on October 20, but earlier in the week, XRP and other altcoins faced sharp drops tied to macro risk.

Factor 1: Regulatory Clarity and Ripple’s Legal Progress

Regulatory clarity stands as the single largest fundamental driver for XRP. The long period of legal uncertainty over Ripple’s status eased after a decisive settlement and clearer guidance in 2024-2025. That outcome reopened institutional doors and reduced some custody and listing barriers.

The market now prices in a landscape where banks and larger firms can more confidently work with XRP. Recent headlines also show new institutional vehicles forming with explicit XRP holdings, which could increase demand if approvals and listings progress as planned. These legal shifts reduce a major source of downside risk and improve long-term adoption prospects.

Factor 2: Expansion of Ripple’s Partnerships and Real Utility

Ripple’s push to grow RippleNet and On-Demand Liquidity (ODL) remains central to XRP’s real-world use case. Recent reports indicate growing ODL volumes and new corridor pilots in Asia, Latin America, and the Middle East. Banks and payment firms are testing or scaling XRP for instant cross-border settlements. This use case matters because it ties token demand to actual payment flows instead of pure speculation.

Increased on-chain activity, treasury adoption by Ripple-backed ventures, and pilot rollouts all create steady, organic demand. If large remittance corridors begin using ODL at scale, pricing pressure could shift strongly in XRP’s favor.

Factor 3: Market Dynamics and Technical Indicators

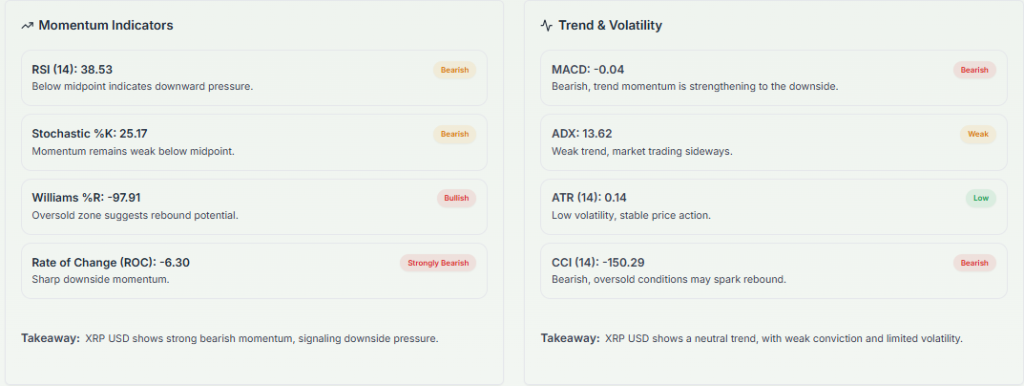

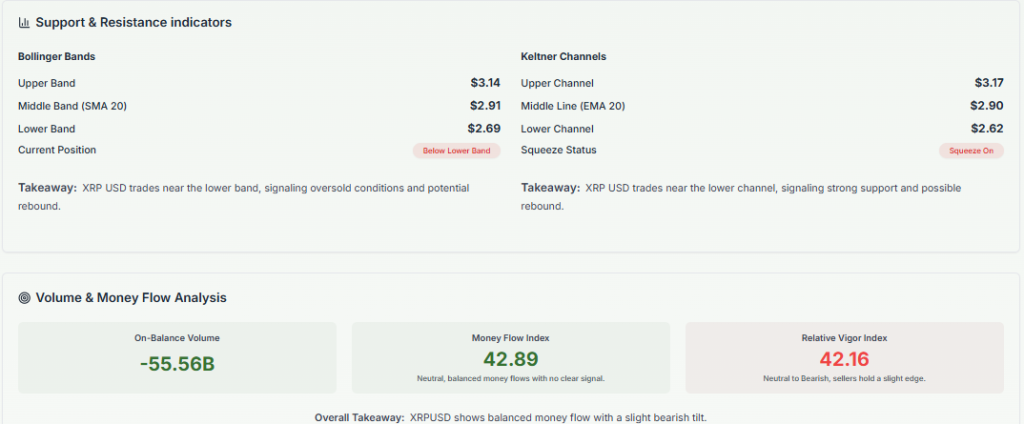

Technical charts show a clear short-term setup. Resistance clusters near $2.60-$2.70. Immediate support sits around $2.20-$2.30. Key momentum indicators, including RSI and moving averages, point to consolidation rather than exhaustion. A clean breakout above $2.70 on rising volume would validate bullish momentum and could trigger a move toward $3.00 and higher targets.

Conversely, a daily close below $2.00 would open room for deeper correction. Correlation with Bitcoin and Ethereum persists. When BTC rallies, altcoins like XRP often amplify gains. When BTC drops, XRP tends to bleed faster. Traders should watch volume and cross-market flows for confirmation.

Expert Signals and Market Positioning

Market commentators present mixed but constructive views. Some analysts point to institutional bids and treasury purchases as a fresh demand source. Others caution that macro shocks and liquidity drainage can still force volatile moves. Wall Street-style funds and new corporate entities planning to hold XRP publicly could tilt supply dynamics.

Reuters reported a Ripple-backed venture planning a large XRP treasury as of October 20, 2025. Such moves can create a concentrated buyer base that supports prices on dips. Analysts also debate timeframes. Some expect tests of $3 in the weeks after consolidation. Others advise waiting for volume-backed breakouts before taking large positions.

How Institutional Flows Could Change the Picture?

Large institutional flows work differently from retail trades. A coordinated treasury or ETF-like allocation changes the supply curve. Institutions tend to buy sizeable blocks and hold. This reduces the circulating float available to retail sellers.

If the market sees more institutional appetite, that dynamic could push prices higher with fewer transactions. Tools that model these scenarios, sometimes labeled as an AI stock research analysis tool in cross-market studies, can help investors visualize possible outcomes. Still, institutional interest must come with clear custody and regulatory safeguards to sustain inflows.

Risks and Market Uncertainties

Risks remain significant. Macro events, such as trade tensions or liquidity shocks, can reverse gains. The crypto sector has shown sudden reversals in October 2025. Regulatory reversals in major jurisdictions could also stall adoption. Another risk is concentration: if a few large holders control much of the tradable supply, sudden sales could create price cascades.

On the technical side, failure to hold key supports would likely drag the price below $2 and possibly toward the $1.60-$1.85 bands noted by many forecasters. Maintain clear stop rules and size positions to match risk tolerance.

Wrap Up

XRP’s price action near $2.50 reflects a market at a crossroads. Regulatory clarity, expanding utility through ODL and RippleNet, and the arrival of institutional buyers form three clear catalysts that could spark a major breakout. The path higher requires volume and macro stability. Failure to sustain support levels would keep the door open for deeper corrections.

Watch for a decisive move above $2.70 on strong volume as the clearest signal that a breakout is underway. Accurate and dated facts in this article reflect market data and reporting through October 20, 2025.

Frequently Asked Questions (FAQs)

As of October 20, 2025, XRP trades around $2.50 because the market is calm, investors wait for Ripple updates, and overall crypto trading stays balanced.

XRP might rise above $3 if Ripple adds new global partners, trading volume increases, and crypto investors show stronger interest after a clear price movement.

Ripple’s legal clarity in 2025 helps XRP gain trust from banks and investors, but market effects depend on future regulations and trading demand.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.