SBI Bank Raises ₹7,500 crore via Basel III bonds at 6.93% Coupon Rate

On October 17, 2025, India’s largest bank, State Bank of India (SBI), raised ₹7,500 crore through Basel III Tier II bonds. The coupon rate was 6.93%. It showed strong investor confidence in SBI’s stability and growth.

This move helps the bank strengthen its capital base and meet regulatory rules. In simple words, SBI has built a stronger financial cushion. For investors, it offers a safe and long-term investment from a trusted name.

The raised funds will support SBI’s lending growth and daily operations. The low rate also shows good market demand and favorable conditions. In current banking situations, where strong capital is vital, SBI’s step looks smart, timely, and reassuring.

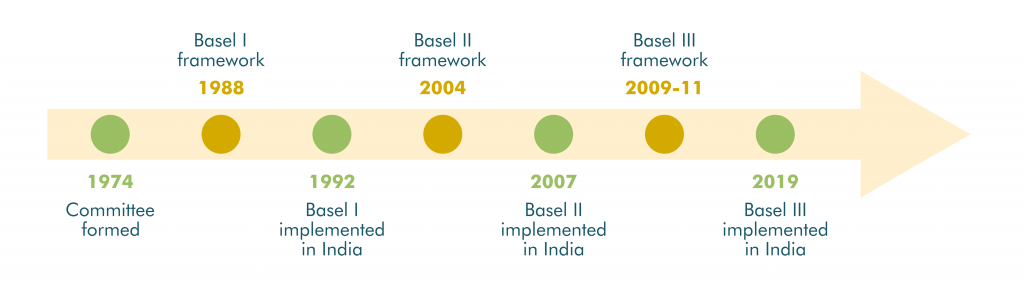

About Basel III bonds

Basel III rules aim to make banks safer. They require lenders to keep enough capital to absorb shocks. Tier II bonds are part of that capital mix. These bonds rank below deposits but above equity in case of trouble. They count toward a bank’s regulatory capital. Basel III-compliant Tier II bonds let banks shore up buffers. This makes lending safer for the wider economy.

Regulators in India have been pushing banks to strengthen capital since the global crisis. Investors treat these bonds as hybrid instruments. They carry higher yields than sovereign debt. But they also carry more risk than bank deposits. Clear rules on tenure, call options, and loss-absorption help investors judge that risk.

Details of the Fundraise SBI Bank

On October 17, 2025, State Bank of India completed a Tier II Basel III bond sale. The bank accepted ₹7,500 crore at a coupon of 6.93%. The bonds have a 10-year tenor with a call option after five years and on each anniversary thereafter. The issue was rated AAA with a stable outlook by domestic agencies.

The sale was executed on an electronic book platform and drew strong bids. The accepted size exceeded the base amount that had been marketed earlier. These features make the issue attractive to long-term institutional buyers.

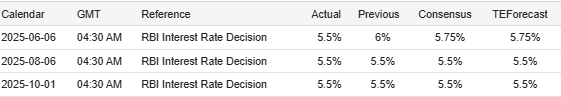

Market and Economic Context

Interest rates in India have been moderating versus the peak months. Inflation has shown signs of cooling, though the central bank remains cautious. Against this backdrop, fixed income yields fell from the highs seen earlier in the year. Banks moved to tap that window. SBI’s timing helped it secure a relatively low coupon for a subordinated instrument.

Demand also reflected investor search for spread over government bonds while still preferring high-quality issuers. The global backdrop mattered too. Foreign central banks and markets have tightened and eased at different times, making cross-border flows volatile. Domestic inflows from insurers and mutual funds remained strong, supporting demand for bank capital instruments.

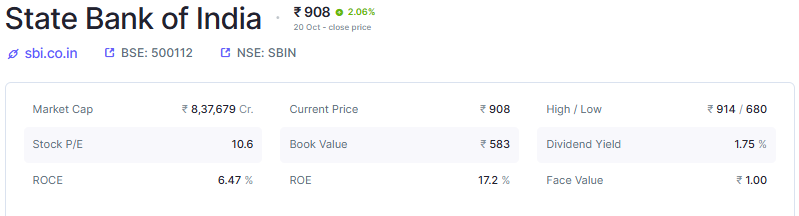

Impact on SBI’s Financial Position

This ₹7,500 crore injection strengthens SBI’s Tier II capital. It improves the bank’s capital adequacy and boosts leverage headroom. That allows SBI to support more lending without diluting shareholders. The raised capital also serves as a cushion against credit stress.

For a lender the size of SBI, incremental capital of this scale helps manage large corporate and retail loan books. Credit rating agencies and investors often focus on such moves when assessing resilience. A well-priced Tier II issue lowers the bank’s longer-term funding cost and supports strategic growth plans.

SBI Bank: Investor Perspective

Institutional investors typically led this sale. Pension funds, insurance companies, and mutual funds favour high-quality bank paper with decent yields. The 6.93% coupon compares favourably with some corporate bonds of similar tenor. The issue’s AAA rating and SBI’s state-backed stature reassured buyers. Still, Tier II bonds are subordinated.

Investors must accept that these instruments sit behind depositors in a stress event. Liquidity in this segment is thinner than in government bonds. For yield-seeking institutions, these bonds strike a balance between extra return and acceptable safety. Retail participation in such issues is usually low, since ticket sizes and risk profiles suit institutional portfolios more.

Comparison with Previous Issues

SBI has accessed capital markets multiple times over the last two years. Earlier issues carried higher coupons when yields were elevated. Over time, the bank’s ability to borrow at tighter spreads has improved. That reflects both strong earnings and investor confidence. By accepting 6.93%, this tranche sits at the lower end of recent Tier II pricing for large Indian banks.

The trend suggests that markets currently price quality and scale. It also highlights the narrowing of spreads between strong public sector banks and top private lenders. Past issues with longer call schedules or higher coupons acted as benchmarks for investors when pricing this deal.

Broader Implications for the Banking Sector

This successful sale signals that the market still backs India’s largest lenders. It may encourage other public and private banks to plan capital raises. Strong participation in such deals helps keep systemic funding costs in check. Regulators watch these moves, because stable capital makes the financial system safer.

For businesses and retail borrowers, healthier bank balance sheets mean more consistent credit flow. The issuance also shows that investors are willing to accept subordinated bank debt when returns and credit quality align. That is a positive for overall market depth.

Wrap Up

The October 17, 2025 Tier II issuance gives SBI a meaningful capital boost. The 6.93% coupon reflects current market comfort with high-quality bank debt. The funds will help the bank sustain lending and absorb future shocks. For investors, the bonds offer steady yield with a caveat on subordination. The deal underscores resilience in India’s banking capital markets. It also shows that disciplined timing can lower funding costs for even the largest lenders.

Frequently Asked Questions (FAQs)

On October 17, 2025, SBI issued Basel III Tier II bonds worth ₹7,500 crore at a 6.93% coupon rate, showing strong investor trust and stable market demand.

The ₹7,500 crore raised will boost SBI’s Tier II capital, improve its capital adequacy ratio, and strengthen lending ability while meeting Basel III regulatory requirements.

Basel III Tier II bonds are long-term debt instruments that help banks increase capital strength and absorb losses during financial stress, making the banking system more stable.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.