US Stock Market Today: Dow and Nasdaq futures flat ahead of results week

The US Stock Market opened quietly, with Dow and Nasdaq futures largely flat as traders wait for a busy results week. Investors are watching corporate earnings, inflation readings, and Treasury yields. Markets in New York show calm ahead of news that could change the tone fast.

Why the wait? Companies such as Apple, Tesla, Google, and Netflix will report results that may guide market direction for weeks.

Sources, including Investopedia and Investor’s Business Daily, note that modest moves reflect cautious positioning before big corporate updates.

US Stock Market Overview Today

The US Stock Market is pausing as investors prepare for earnings and economic data. Dow futures are nearly unchanged, while Nasdaq futures show little movement. Traders say liquidity is thin, and that keeps morning moves small.

This calm masks real risk: a single strong or weak earnings print could trigger bigger swings. Market commentary from CNN Markets and Forex coverage points to the same theme: steady futures but tense sentiment.

What’s the mood on Wall Street today? Cautious, with many traders in wait-and-see mode until key reports land.

Key economic cues to watch this week

- CPI and inflation reports that influence Fed expectations.

- Treasury yields, especially the 10-year, affect discount rates.

- Earnings from large caps can shift sector leadership.

These items shape the near-term view for the US Stock Market, and investors track them closely.

Key Movers and Company Highlights

Major tech names are top of mind. Apple and Alphabet remain bellwethers for market tone, while Tesla and Netflix carry big event risk for the Nasdaq.

Investors ask: Will tech earnings hold up? Expectations are mixed, and any guidance changes will matter. Investopedia notes that earnings season often adds volatility, and that appears likely this week.

What’s Driving the Market Flatness?

Investor sentiment and macro signals

The US Stock Market is flat because investors are balancing a few forces: hopes for better earnings, concerns about inflation, and an eye on Fed policy. Treasury yields have been steady, which helps keep futures calm. Still, markets price in risk from surprises, so many desks prefer to stay neutral.

Why is that happening? Because uncertainty is high and traders want clearer data before taking large bets. Coverage from Investor’s Business Daily highlights these exact tensions.

Global and Economic Factors Affecting the US Stock Market

International news and commodity moves also matter. Oil prices and the dollar affect energy and export names. Slower growth signals from parts of Europe and Asia can weigh on US cyclicals.

The Fed’s stance remains central: if inflation appears sticky, the path to rate cuts will be delayed, which can hurt high multiple stocks. Forex and Wall Street forecasts suggest traders are focused on the CPI release and corporate updates this week.

Will the CPI move markets? Yes, an inflation surprise could nudge the US Stock Market direction and yield curves.

Analyst Views and AI Stock Trends

Analysts say earnings will sort winners from losers this week. Some themes that analysts follow include revenue growth, margin trends, and forward guidance. In technology, new models and demand for compute remain key.

AI Stock Research shows investor interest in companies that power machine learning workloads, and some traders look to those names for growth signals.

At the same time, AI Stock Analysis highlights profit cycles and valuation risk across the sector. Separately, AI Stock buzz can lift certain software and chip stocks in short bursts when new data is positive.

What Investors Are Saying

Social feeds reflect the cautious mood. A trader thread noted that futures are flat, and the focus is on earnings.

See the sentiment captured by market watchers on X:

Other posts discuss how macro data and corporate news create a mixed picture, for example:

Retail voices also weigh in on company-specific odds:

These micro threads show a market watching every headline for a clue to the next move.

US Stock Market: Sector and Technical Notes

Energy and financial names often respond to bond yields and oil. Consumer discretionary firms react to spending signals. Tech leadership depends on revenue growth and margins.

On the technical side, market breadth will be key: a narrow rally in a few large names can leave the broader market fragile.

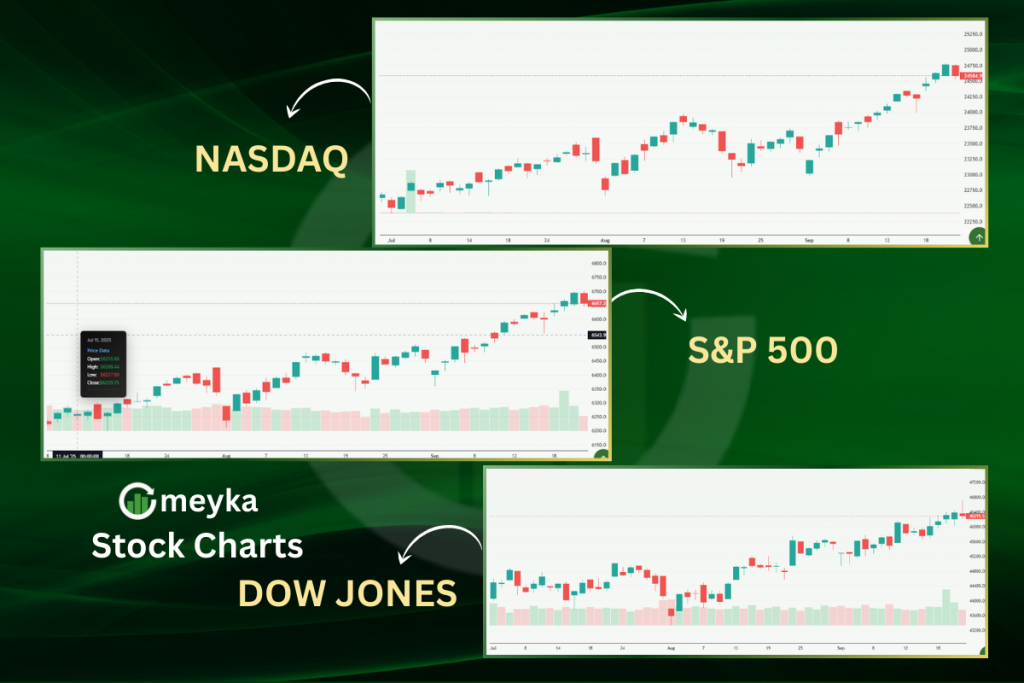

Traders tracking the S&P 500 and Dow Jones watch sector rotations closely during earnings season.

How should investors prepare? Keep positions sized for volatility, monitor earnings calendars, and watch CPI and Treasury yields.

Conclusion

The US Stock Market sits in a delicate place, with Dow and Nasdaq futures flat as traders await a packed week of earnings and inflation data. Tech names like Apple, Tesla, Alphabet, and Netflix could move markets with surprising results or cautious guidance. Global factors and bond yields add another layer of uncertainty.

For now, calm futures reflect caution, not confidence. Investors focused on the earnings calendar and macro releases will likely lead the next directional move.

Stay tuned: results week should provide clearer signals for who leads the market next, and how the US Stock Market will trade into year-end.

FAQ’S

The Dow dropped 700 points due to weak corporate earnings and renewed inflation fears. Rising Treasury yields and cautious investor sentiment also weighed heavily on the US Stock Market today.

The US Stock Market is mostly flat, with Dow and Nasdaq futures showing little movement. Traders are waiting for major earnings reports and economic data before making big moves.

The American stock market is down because investors are worried about slowing growth, higher interest rates, and mixed signals from corporate earnings. Inflation data and Fed policy remain key drivers.

The US Stock Market is expected to open steady, with futures showing limited activity. Investors are cautious ahead of earnings from major tech companies and the latest inflation report.

Disclaimer

This is for information only, not financial advice. Always do your research.