Bitcoin ETF Updates: Bitcoin Holds the Line at $111K as ETF Investors Pull $1.23B, London Eyes ETP Boom

Bitcoin’s price is holding firm above $111,000 this week, even as investors pulled out $1.23 billion from U.S.-listed Bitcoin ETFs, according to data from October 20, 2025. This surprising balance between price strength and fund outflows is catching global attention. Many expected Bitcoin to dip sharply after such a massive withdrawal, but it didn’t. Instead, the market stayed calm.

Analysts say this shows how much stronger Bitcoin has become since the early ETF days in January 2024. It’s not just ETF money driving the price anymore; long-term holders and global demand are stepping in. At the same time, London is seeing a new wave of excitement. The city’s stock exchange is preparing for a boom in Exchange-Traded Products (ETPs) tied to Bitcoin and Ethereum.

While U.S. investors are cashing out, Europe seems ready to buy in. This split signals a new phase for Bitcoin’s global journey, one that could reshape how institutions engage with digital assets.

Bitcoin’s Price Stability Amid ETF Outflows

Bitcoin traded near $111,000 on October 20-21, 2025. The price found support despite a big pullback from U.S. spot ETFs. Traders expected volatility after the redemptions. The market instead showed calm. Short-term sellers did push the price around. Long-term holders stepped in on dips. On-chain data pointed to accumulation by large wallets over the weekend. These factors helped keep Bitcoin from collapsing below key support.

The $1.23 Billion Bitcoin ETF Outflow Explained

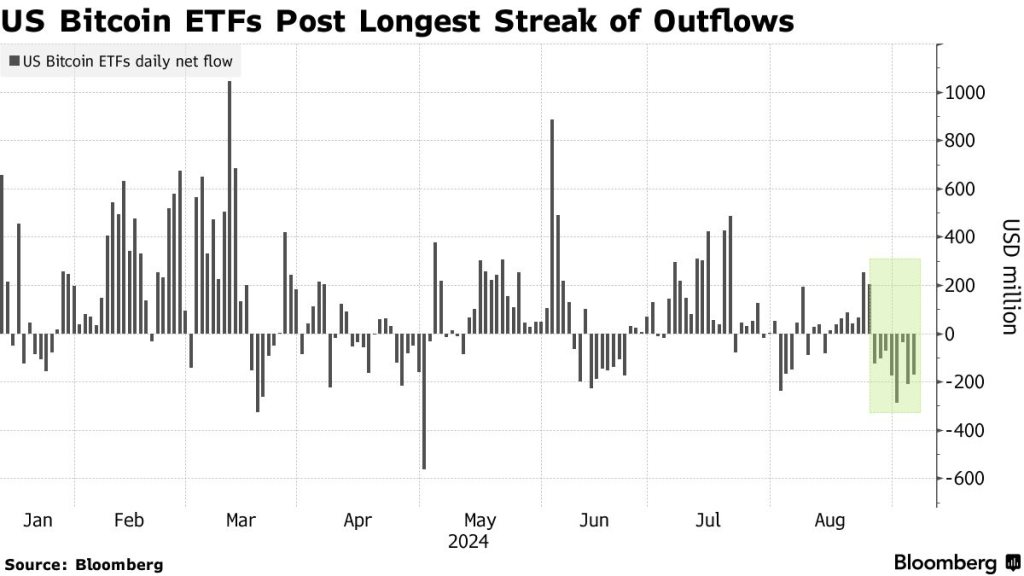

U.S.-listed spot Bitcoin ETFs recorded about $1.23 billion in weekly outflows for the trading week ending October 17, 2025. This was the second-largest weekly exit since the ETFs launched. The withdrawals came from multiple funds rather than a single issuer.

BlackRock’s IBIT, Fidelity’s FBTC, and other major funds all saw redemptions on heavy days. Data aggregators such as SoSoValue reported the net number and the timing. Market commentators tied the outflow to profit-taking after recent rallies. Others blamed broader market fears and a spike in liquidation activity.

Institutional and Retail Investor Behavior

Institutional traders acted fast during the reversal. Some large managers rebalanced portfolios. Others used ETFs to adjust exposure quickly. Retail traders reacted differently. The retail side showed more panic selling on margin calls and liquidations.

Yet, on-chain metrics showed whales buying some of those dips. That split created odd price dynamics. Spot market liquidity stayed decent because spot buyers filled sell orders. The net effect was range-bound action instead of a sharp crash.

London’s Rising Interest in Bitcoin ETPs

London moved quickly into the center stage on October 20, 2025. The UK’s Financial Conduct Authority eased retail access to regulated crypto ETPs. Several issuers listed new ETPs on the London Stock Exchange the same day. BlackRock, 21Shares, WisdomTree, Bitwise, and others launched physically backed products for Bitcoin and Ethereum.

The change opens UK retail accounts to ETPs that previously were restricted. European demand now offers an alternative flow to U.S. ETFs. This shift could attract capital that fled U.S.-listed funds.

Bitcoin ETF: Global Market Implications

Divergent flows mean the market faces regionalized liquidity drivers. U.S. ETF redemptions remove near-term buying pressure. At the same time, new London ETP listings could bring fresh buying from European retail and institutions.

If European demand scales, it may offset U.S. outflows. That would reduce global volatility. The change also affects trading desks and arbitrage strategies. Firms that track ETF-spot gaps must adapt. Data feeds and an AI stock research analysis tool already show how cross-listing can shift flows in hours.

Impact on Liquidity, Volatility, and Altcoins

Less ETF demand in the U.S. tends to raise short-term volatility. Liquidity in large sizes can dry up during heavy redemptions. This amplifies price moves on major orders. Conversely, European ETP inflows smooth liquidity if they arrive steadily.

Altcoins often follow Bitcoin’s lead. When Bitcoin wobbles, risk assets see sharper moves. Derivative desks will likely widen spreads. Options implied volatility may rise. Traders should watch funding rates and open interest for clues on where sentiment is headed.

Expert and Industry Reactions

Industry leaders gave mixed takes on events of October 20-21, 2025. Some analysts called the ETF outflow a short-term reset. They view it as profit-taking after a strong run. Others warned that macro uncertainty could prompt more outflows if risk-on appetite fades.

Issuers that are listed in London welcomed the FCA’s move. They argued that the change will deepen capital pools and let retail investors access regulated crypto products. Market strategists said the next week’s macro calendar could determine whether the pattern continues.

Conclusion: What to Watch Next?

Watch these indicators closely in the coming days: ETF weekly flows. London ETP volume and liquidity. On-chain whale activity and exchange reserves. Macro headlines on interest rates and geopolitics. Also track options skew and funding rates for short-term risk signals.

The market could calm if Europe supplies a steady demand. Or it could see more swings if U.S. outflows persist. Accurate dates matter; the flows and London listings happened around October 20, 2025. That timing frames the current story.

Frequently Asked Questions (FAQs)

On October 20, 2025, investors took profits after Bitcoin’s strong rise to $111K. Many sold ETF shares to lock in gains and reduce short-term risk.

On October 20, 2025, London allowed new Bitcoin and Ethereum ETPs. This change attracted both retail and institutional investors looking for safer, regulated crypto options.

As of October 21, 2025, Bitcoin stayed near $111K. Despite big ETF outflows, buyers and long-term holders kept the price steady across global markets

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.