XRP News Today: XRP Loses Steam, and Shiba Inu’s Evil Zero Haunts Traders Again

XRP has lost short-term momentum, moving from recent bullish setups into fresh bearish pressure. At the same time, Shiba Inu (SHIB) saw its Evil Zero pattern reappear, spooking traders and increasing volatility across crypto markets.

This article explains the price moves, key technical levels, and what traders should watch next, using the latest market analysis from TradingView and Bitget.

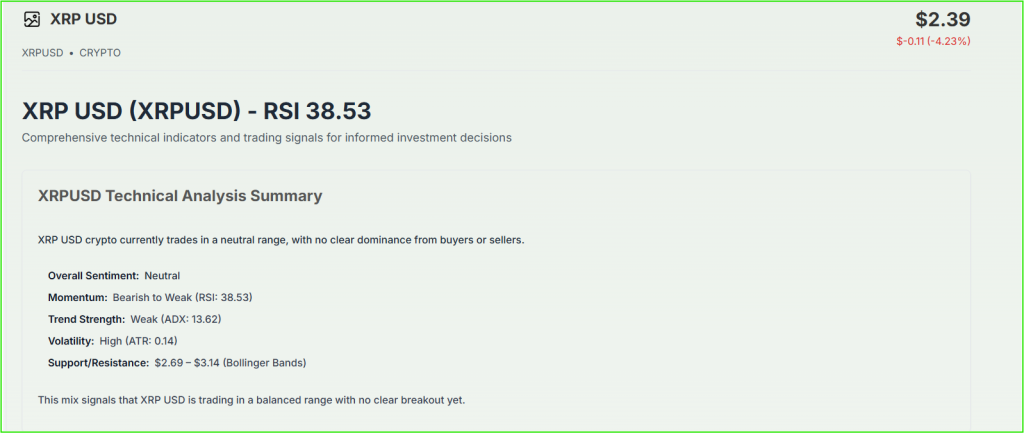

XRP Faces Market Pressure Amid Bearish Momentum

XRP reversed course after a brief recovery, showing renewed downside on daily charts. TradingView notes a drop of about 1.7% in the latest session, and the token failed to hold above key resistance levels around $2.50–$2.70.

Sellers regained control as XRP (XRPUSD) moved below important moving averages, signaling that bearish momentum may persist unless buyers step in.

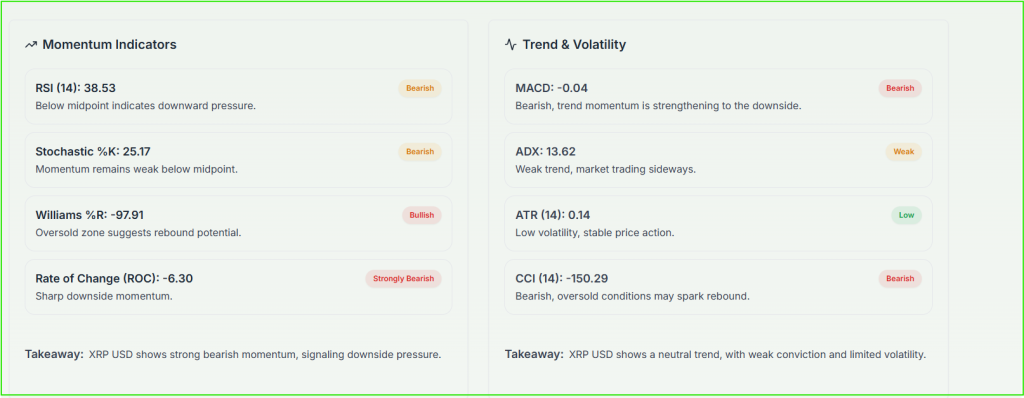

Why is XRP losing steam right now? Weak buying momentum and growing selling pressure. Technical indicators, including RSI and moving averages, point to limited upside until XRP reclaims higher resistance.

Key Technical Levels for XRP and Investor Sentiment

Chart analysts point to clear levels to watch. Resistance sits near the $2.70–$2.80 zone, while support zones appear at $2.20 and $2.00 on short-term tests. TradingView notes the token has slipped below the 200-day moving average, which often signals risk of deeper declines if not recovered.

Volume has trended higher on sell days, and the RSI is below neutral, showing a lack of buying conviction.

For short-term holders, the $0.50 psychological mark mentioned in some analysis is far lower than current prices but highlights long-term downside targets if the market weakens further.

Shiba Inu’s Evil Zero Returns to Haunt the Market

Shiba Inu (SHIB) briefly looked to be regaining momentum, but the Evil Zero phenomenon returned when price slipped below critical short-term thresholds. TradingView describes the loss of the $0.0000099 support and the descent toward $0.0000090, with lower support near $0.0000085.

The “evil zero” refers to the fear that another zero will be added to the token’s price string, a psychological blow for retail traders holding meme coins.

What is Shiba Inu’s Evil Zero, and why does it matter? The Evil Zero is a retail fear pattern where SHIB loses a key digit in price notation; it matters because it reflects collapsing short-term confidence in meme assets and can trigger rapid sell-offs.

Ripple Effects on Bitcoin and Altcoins

The wider market moved lower as Bitcoin pared gains and pulled altcoins down. TradingView notes BTC’s reversal from near higher ranges, which amplified risk aversion and pressured altcoins like XRP (XRPUSD) and SHIB.

When Bitcoin weakens, liquidity tightens, and short-term traders often exit positions across the board.

This dynamic feeds into broader bearish setups across the crypto space.

AI Stock trading bots and sentiment algorithms have flagged increased short positions and higher sell volume, which can accelerate downside in thin markets.

Crypto Analysts Warn of Market Correction Risks

Bitget’s market notes point out that bearish forces are back in control after a short recovery. Analysts cite rising sell volumes, losses under major moving averages, and retreating momentum as indicators that the market may undergo a correction phase.

This view aligns with the recent technical reads showing RSI undershoot and sellers dominating daily sessions. Traders should treat current price action cautiously and watch for any swift liquidity vacuums.

How do experts see near-term risk? They warn that if XRP does not reclaim above $2.70–$2.80 with strong volume, downside toward the noted support zones becomes more likely, increasing correction risk across altcoins.

AI Stock Research tools are being used by desks to scan order flow and social sentiment in real time, helping to detect rapid shifts in trader positioning that can precede sharp moves. These models add speed to analysis but still require human judgment when markets move fast.

Comparing XRP’s Performance with Other Major Tokens

In recent sessions, XRP (XRPUSD) underperformed relative to top market leaders as sellers focused on mid-cap altcoins and meme tokens. Bitcoin’s correction is a primary driver; when BTC slips, altcoins typically follow.

Ethereum, Cardano, and Solana have also shown pressure, but XRP’s unique technical structure, descending channel, and failure above the 50-day moving average make it especially vulnerable.

Traders should assess macro cues, liquidity cycles, and order book depth when comparing trajectories. AI Stock Analysis techniques help quantify these relationships for trading models and risk teams.

Community Reactions and Social Media Sentiment

Online communities are split. The XRP community notes technical damage but still points to long-term use cases in cross-border payments.

The SHIB Army expressed frustration over the Evil Zero setback, yet some holders emphasize token burns and wallet outflows from exchanges as bullish longer-term signals.

Social sentiment metrics on exchanges show increased token withdrawals for SHIB, a factor analysts sometimes read as reduced immediate sell pressure, though that does not eliminate near-term volatility.

What Traders Should Watch Next

Key indicators to track this week:

- XRP resistance at $2.70–$2.80 and supports near $2.20 and $2.00.

- Bitcoin price action, since BTC weakness often drags altcoins lower.

- Exchange flows, including SHIB token withdrawals, may reduce short-term supply.

- Volume on both up-days and down-days, to confirm any reversal.

Could XRP bounce back soon? Yes, if buying volume returns and XRP reclaims its 50-day and 200-day moving averages. Until then, expect choppy action and wider intraday swings.

Conclusion: XRP’s Road Ahead in a Volatile Market

XRP is navigating a shift from short-term bullish setups to renewed bearish pressure, while Shiba Inu’s Evil Zero has heightened meme-coin fear. The larger crypto market’s health, led by Bitcoin, will largely determine whether XRP stabilizes or slides further.

Traders should watch technical levels, exchange flows, and macro liquidity cues. Despite the current setback, XRP remains a major altcoin to monitor, and data-driven tools continue to help traders manage risk through fast moves. Stay cautious, watch the charts, and use clear risk limits in this choppy environment.

FAQ’S

XRP is currently showing bearish momentum, with analysts noting a shift from earlier bullish trends due to weak trading volumes and broader crypto market pressure.

Experts say it’s highly unlikely in the near term. Shiba Inu’s large token supply and slow-burning rate make such a price target nearly impossible without a major supply reduction.

No, Elon Musk has denied owning Shiba Inu (SHIB). Although his tweets sometimes influence meme coins, there’s no evidence of his investment in SHIB.

Analysts suggest Bitcoin and Ethereum remain the strongest contenders, while XRP faces stiff competition. A 2025 poll shows Bitcoin leading investor confidence across major altcoins.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”