Stablecoin Transactions Surge 83% Year-on-Year, Says TRM Labs Report

In a recent report published on October 22, 2025, TRM Labs revealed that stablecoin transactions surged by 83 % between July 2024 and July 2025. Within that time frame, the total transaction volume exceeded USD 4 trillion. Stablecoins now account for about 30 % of all on-chain crypto transactions.

This sharp rise signals more than just a market blip. It shows that digital assets pegged to stable values are becoming key tools for payments, global transfers, and financial access. Everyday users and institutions alike are turning to them for a blend of speed, simplicity, and stability.

Let’s explore what’s driving this growth, which stablecoins are leading the way, and how regulators are responding to this fast-moving trend.

What are Stablecoins and why do they matter?

Stablecoins are cryptocurrencies tied to stable assets. Most are pegged to the U.S. dollar. They aim to keep value steady. This makes them useful for payments, trading, and savings. Stablecoins move value on blockchains instantly. They cut the time and cost of cross-border transfers. Merchants, traders, and app developers use them for fast settlement. Their rise blurs the line between crypto and everyday finance.

Key Findings from the TRM Labs Report

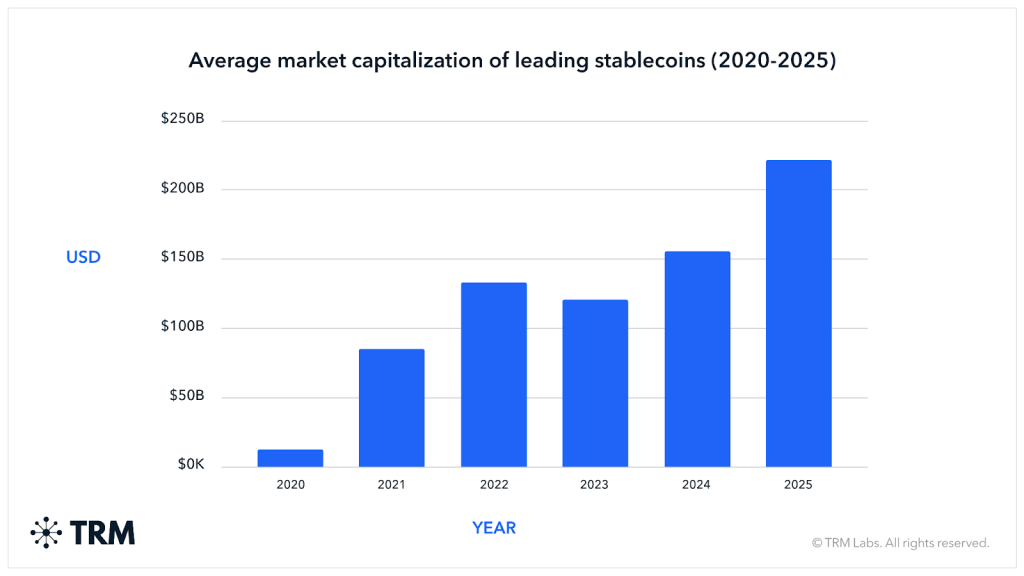

TRM Labs published the 2025 Crypto Adoption and Stablecoin Usage Report on October 22, 2025. The report found an 83% year-on-year rise in stablecoin transaction volume between July 2024 and July 2025. By August 2025, on-chain stablecoin volume exceeded USD 4 trillion for the year so far. Stablecoins now account for roughly 30% of all on-chain crypto transaction volume. The market remains highly dollar-centric and concentrated among a few issuers.

Drivers behind the Stablecoin Boom

Market volatility pushed many users to stablecoins. When prices swing, people often move into dollar-pegged tokens. Decentralized finance also increased demand. Stablecoins power lending, swaps, and liquidity pools. Cross-border payments are faster and cheaper with stablecoins than with many banks.

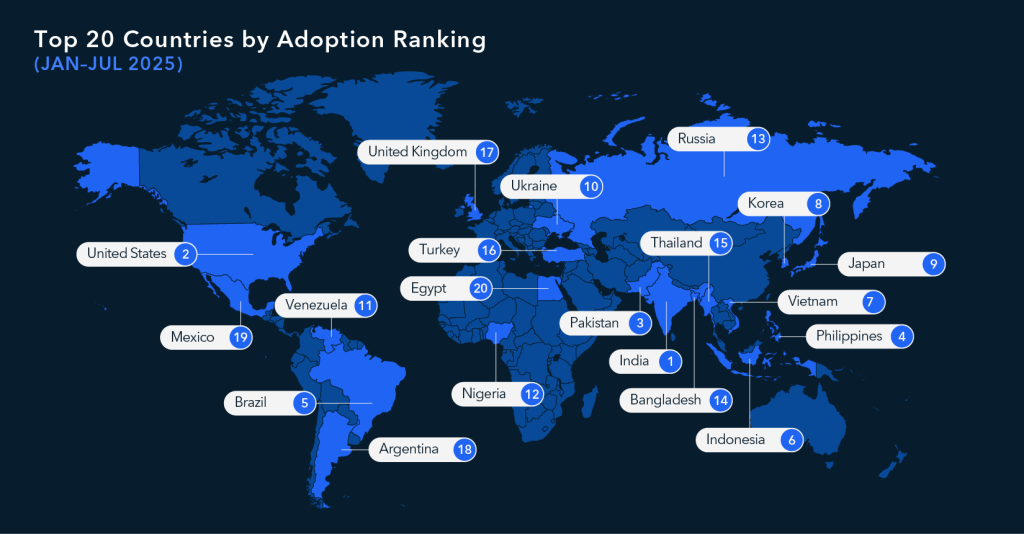

Emerging markets added big tailwinds. In places with weak local currencies, stablecoins act as a digital store of value. Institutional interest grew, too. Regulated issuers and on-ramp infrastructure made large players more comfortable. These forces combined to lift volumes sharply in 2025.

Market Leaders: Which Stablecoins Dominate?

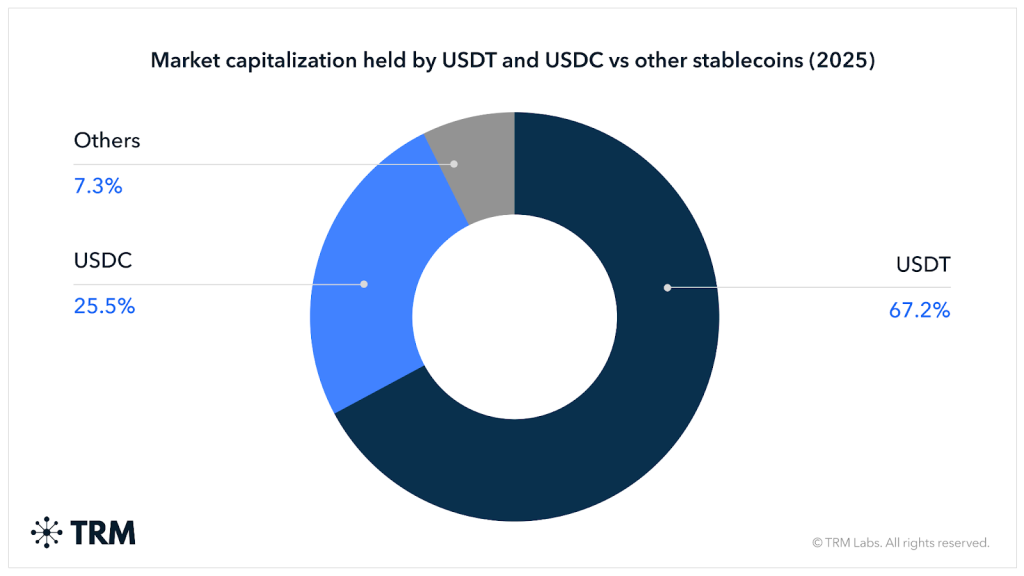

Tether’s USDT and Circle’s USDC remain the market leaders. Together, they hold the lion’s share of stablecoin market capitalization. TRM’s data shows these two issuers account for roughly 93% of total stablecoin capitalization.

Other names, such as DAI and Paxos, appear but on a much smaller scale. The dominance of USDT and USDC shapes liquidity and venue choice across exchanges and wallets. Issuer credibility and reserve practices now matter for traders and institutions.

Regulatory Spotlight: Governments Take Notice

Regulators stepped up scrutiny in 2025. Lawmakers and agencies in the U.S. debated clearer rules for stablecoin reserves and consumer protections. Europe advanced rules under MiCA-style frameworks. Some Asian jurisdictions struck a cautious and adaptive stance.

Authorities focus on reserve transparency, AML/KYC, and systemic risk. The rise in stablecoin volume attracted special attention because fast, large transfers could affect financial stability. TRM highlighted compliance as a key factor for broader adoption.

Illicit Use and Compliance Challenges

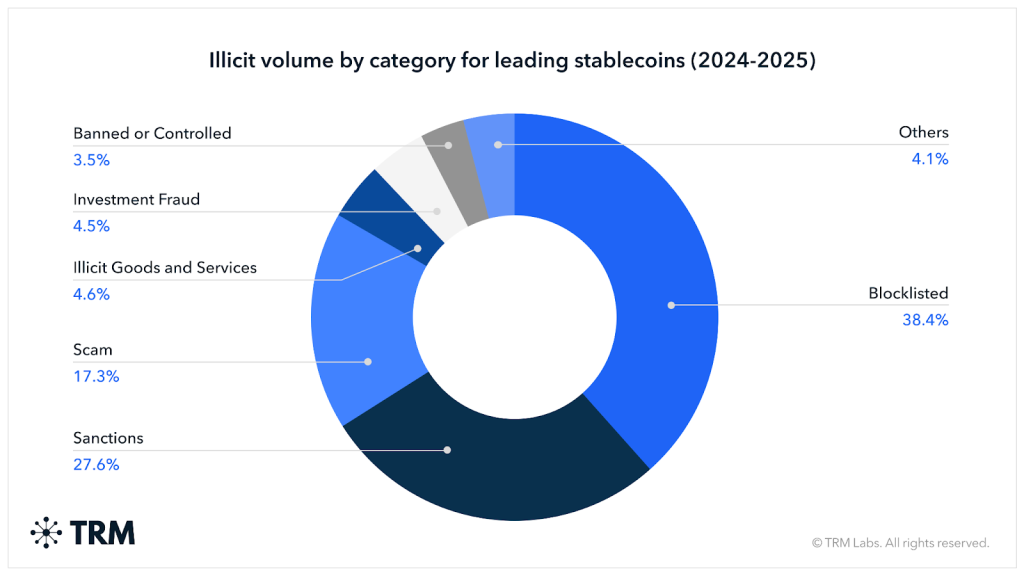

Most stablecoin flows are lawful. TRM reported that about 99% of stablecoin activity is legitimate. Still, a meaningful share of illicit crypto flows involves stablecoins. Some analyses show a high share of suspicious on-chain activity uses dollar-pegged tokens, given their speed and low fees.

That reality pushed exchanges and wallet providers to strengthen transaction monitoring. Blockchain analytics and enforcement partnerships expanded after 2024. The tension is clear: broad legitimate use sits beside a need for stronger controls to deter abuse.

Future Outlook: The Next Phase for Stablecoins

Stablecoins likely stay central to crypto for the next few years. Expect deeper integration with payment rails and tokenized finance. Central bank digital currencies (CBDCs) may coexist with private stablecoins in some payment rails. Large tech firms and banks could test stablecoin settlement for cross-border flows.

Institutional adoption may increase if reserve rules and audits become standard. Analysts using an AI stock research analysis tool also note that clearer regulation could unlock new institutional money. Still, challenges remain: reserve transparency, regulatory alignment across borders, and public trust.

Wrap Up

The TRM Labs data from October 22, 2025, marks a turning point. An 83% rise and USD 4 trillion in volume show stablecoins are more than a niche. They now sit at the center of payments, trading, and cross-border flows.

How regulators and issuers respond will shape whether stablecoins become a safe bridge between crypto and traditional finance or remain a source of friction and concern. The next year will be pivotal for trust, rules, and real-world applications.

Frequently Asked Questions (FAQs)

Stablecoin use grew rapidly in 2025 because people sought faster, cheaper, and more stable digital payments. TRM Labs reported an 83% rise in transactions on October 22, 2025.

Tether (USDT) leads the market in 2025, followed by USD Coin (USDC). Together, they hold most of the stablecoin trading volume, according to TRM Labs data.

The TRM Labs report on October 22, 2025, showed stablecoin transactions reached about $4 trillion. It also found growing global use and rising interest from financial institutions.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.