US Stock Market: Dow, S&P, Nasdaq Futures Fall as Tesla Results Weigh on Sentiment

The U.S. stock Market opened lower as investors digested a string of mixed earnings and caution ahead of major tech reports. Tesla’s weak Q3 results, which showed a sharp profit decline, set a risk-off tone.

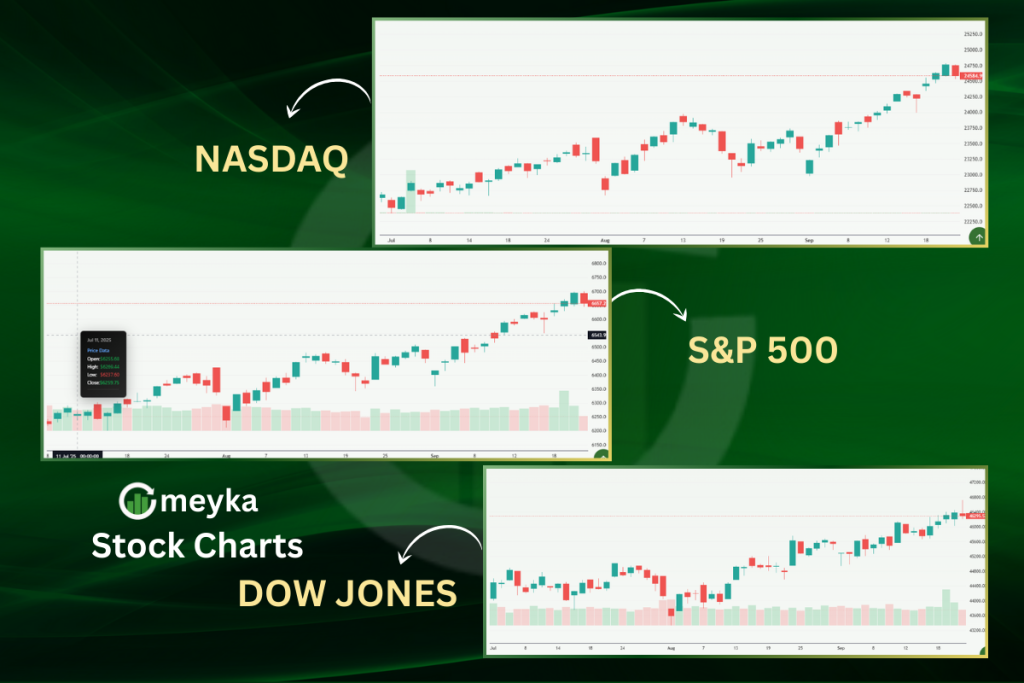

The Dow Jones, S&P 500, and Nasdaq futures all fell as traders rebalanced positions. Add in disappointing prints from other firms and a cautious Federal Reserve outlook, and markets turned defensive.

Why Is the US Stock Market Falling Today?

Markets dropped after several big names missed or raised concerns. Tesla’s (TSLA) profit plunge dominated headlines and rattled tech and growth stocks. Netflix (NFLX) and Texas Instruments also disappointed, and investors shifted away from high-valuation names.

- Dow Jones futures: down modestly.

- S&P 500 futures: down modestly.

- Nasdaq 100 futures: led declines, down more notably as tech earnings risks rose.

Why is that happening? Because Tesla’s margin squeeze raises questions about profit resilience across growth names, and earnings misses from other firms add to the worry that strong gains may be due for a pause.

Tesla’s Earnings Weigh Heavily on Market Mood

Tesla’s Q3 results were the day’s focal point. The company posted a large drop in profits, driven by aggressive price cuts that eroded margins despite record deliveries.

Wall Street reacted quickly, trimming exposure to EV and tech-linked names. The Wall Street Journal noted the steep profit pullback and heightened investor caution.

Is this a short-term dip or a longer concern? Analysts say the hit to margins looks like near-term pain tied to pricing strategy, but it could pressure tech-led indices while investors wait for clearer signs of margin recovery.

Broader US Stock Market Trends: Wall Street Turns Defensive

Other earnings added to the cautious mood. Netflix posted slower subscriber trends, and Texas Instruments offered guidance that disappointed some investors. The Economic Times pointed out that Netflix’s struggles and TI’s cautious talk weighed on sector sentiment. A few names brightened the tape, like Intuitive Surgical, but those gains were not enough to offset broad weakness.

Gold and Silver Retreat After Recent Rally

Commodities also moved as traders rebalanced. After a recent run, gold and silver saw modest pullbacks as risk-off flows and profit-taking took hold.

- Gold: eased from highs, trading near recent range.

- Silver: also pulled back after the rally.

Traders booked gains and shifted cash into short-term liquidity, which contributed to softer commodity prices.

Economic Data and the Fed Outlook

Beyond earnings, markets are watching macro cues. Investors await fresh signals from the Federal Reserve on the path of rates and the timing of cuts. The Yahoo Finance live coverage noted that mixed economic readings and Fed commentary are keeping traders cautious as earnings season unfolds. Uncertainty on policy timing adds to choppy markets.

What does this mean for the market ahead?

Expect continued volatility. Traders will react to incoming earnings and any new Fed comments about inflation and rates.

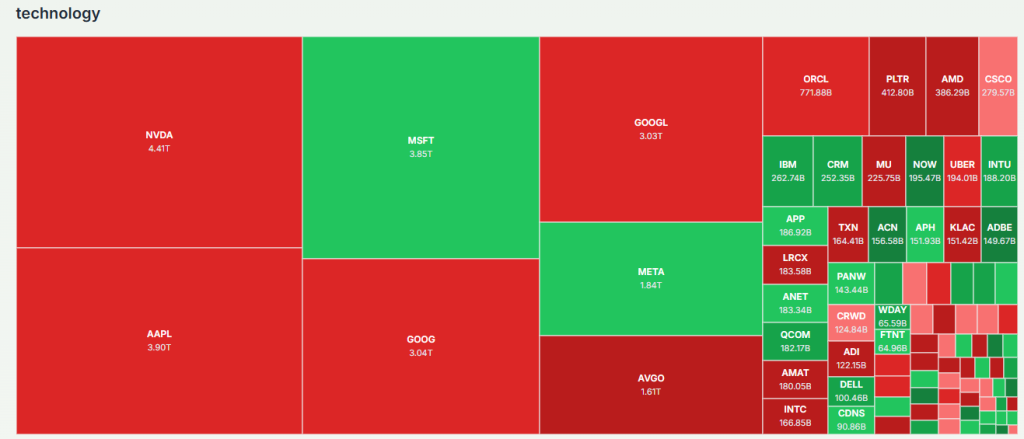

Sector-Wise Performance and Key Movers

How did sectors behave during the sell-off?

- Tech: Led the declines, hit by Tesla, Netflix, and broader growth concerns.

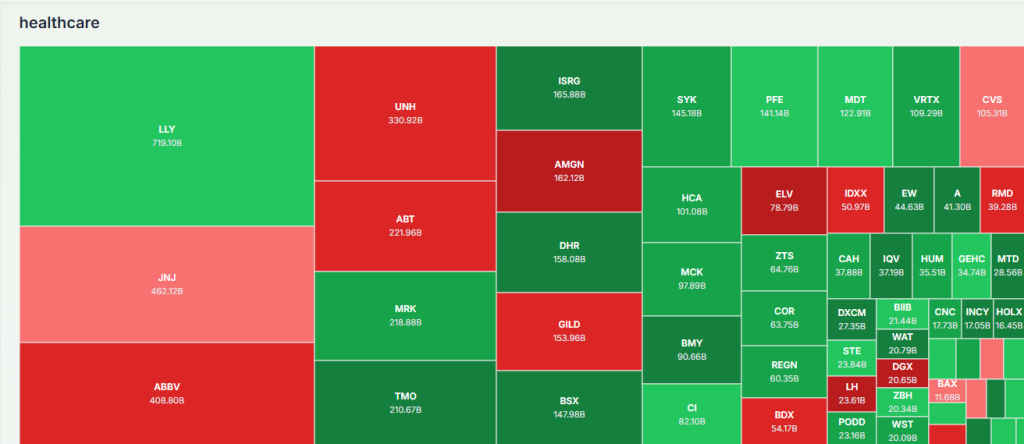

- Healthcare: Mixed, with Intuitive Surgical outperforming on better results.

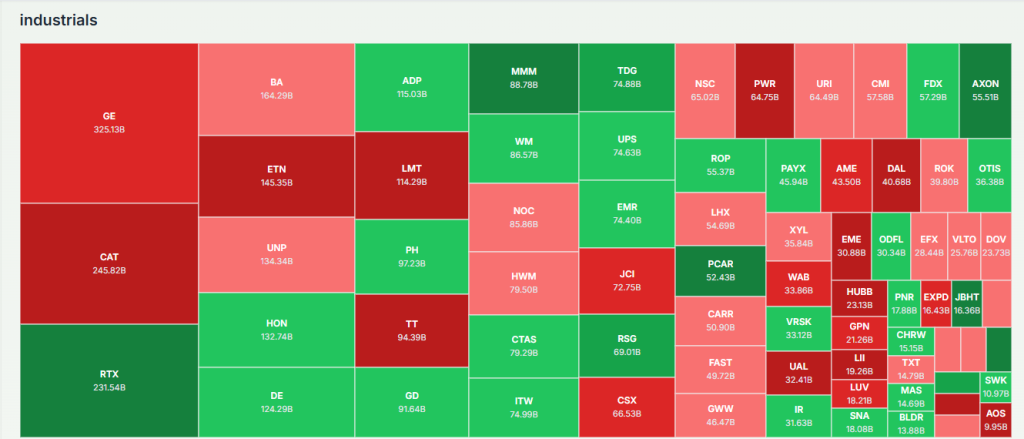

- Industrials: Performed defensively as investors sought steady earnings profiles.

- Energy: Mixed, as oil prices hovered and demand signals remained uneven.

WSJ live coverage highlighted how the rotation into safety and the pullback in big tech set the tone for the market.

Market Sentiment: Investors Remain Cautious

Trading volumes were muted as many investors waited for clearer signals from upcoming mega-cap earnings. The US Stock Market showed a defensive tilt: money moved to cash and bonds, and traders reduced long-risk positions. Caution is high until the next round of results clarifies how sustainable corporate profits will be.

Analyst Reactions: What Experts Are Saying

Market strategists framed the pullback as a “healthy correction” after significant gains earlier in the year. Some analysts see this as an opportunity to reassess positions and buy quality names at better levels, while others warn that more downside is possible if earnings trends worsen.

The Economic Times and Yahoo pieces emphasize the importance of earnings cadence and Fed guidance in shaping the near-term outlook.

What Investors Should Watch Next

Key items to monitor in the coming days:

- Upcoming mega-cap earnings: Alphabet (GOOG), Amazon (AMZN), and Meta (META) could reset sentiment.

- Federal Reserve commentary: Any change in the Fed’s tone will move markets.

- Economic data: Inflation, payrolls, and consumer readings will shape rate expectations.

- Global developments: China and Europe data may influence risk appetite globally.

What should investors do now? Experts suggest a balanced approach: maintain diversification, keep stop-loss discipline, and avoid emotional trading during volatile sessions.

Conclusion: Tesla Sets the Tone as Wall Street Stays on Edge

The US Stock Market fell as Tesla’s Q3 results and several other earnings dampened sentiment. The move reflects caution, not panic, as markets reassess growth expectations and await clearer signals from both companies and the Fed.

For now, investors watch earnings calendars and macro data closely, hoping next week’s reports provide the clarity the market needs to regain momentum.

FAQ’S

Yes, Tesla stock reportedly fell nearly 14% after Elon Musk’s public clash with former President Trump added political uncertainty to already weak post-earnings sentiment.

Tesla shares are declining due to disappointing Q3 earnings, shrinking profit margins, and concerns over slowing EV demand and rising competition in China.

Tesla’s stock reaction after earnings is volatile, it often swings sharply depending on delivery numbers, profit margins, and CEO commentary.

Netflix shares fell as subscriber growth slowed and revenue guidance came in below market expectations, leading investors to trim positions after recent gains.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”