Crude Oil Prices Jump as Trump’s Warning to Russian Giants Rattles Markets

On October 23, 2025, global oil prices shot up after U.S. President Donald Trump issued a strong warning to Russia’s biggest oil companies, Rosneft and Lukoil. His message was clear: stop funding the war in Ukraine or face tougher sanctions. Within hours, Brent crude rose nearly 4%, shaking markets from New York to Tokyo. Traders rushed to secure supply, fearing new limits on Russian exports, one of the world’s largest oil sources.

This sudden surge reminded everyone how fragile the energy market really is. One political statement can send prices climbing and economies reeling. For many countries, including oil importers like India and Pakistan, this means higher fuel costs and pressure on inflation.

The move also signals a new phase in Washington’s energy diplomacy under Trump. Markets now wait to see how Moscow and major buyers, such as China, will respond and whether the world is heading toward another oil shock.

What Happened: The Warning and the Sanctions?

On October 22-23, 2025, the U.S. Treasury moved to sanction Russia’s two biggest oil firms, Rosneft and Lukoil. The move was framed as pressure to force a ceasefire in Ukraine. The Treasury said the measures block U.S. assets of named entities and bar Americans from doing business with them.

How Markets Reacted after Trump’s Statement?

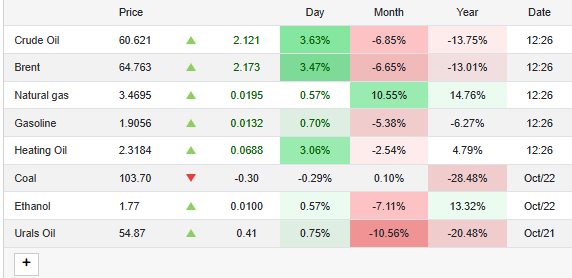

Oil prices jumped fast. Brent and U.S. crude gained several percent as traders priced in possible supply risks. Markets saw a quick rise in risk premiums. Some trading desks ran rapid checks with an AI Stock research analysis tool to flag positions tied to Russian flows. The surge reflected fear that sanctions could choke parts of the global supply, at least briefly.

Why does this Matter for Supply?

Rosneft and Lukoil account for a large slice of Russian output. Sanctions on them make buyers and insurers nervous. That can slow shipments. Some buyers may pause contracts. Others could try shadow routes or alternative traders. The net effect could be a lower visible supply and higher headline prices.

Policy and Geopolitical Reactions

Washington urged allies to follow suit. The Treasury statement tied the sanctions to Russia’s failure to end hostilities. Major buyers such as India and China face new pressure. New Delhi has publicly pushed back on claims it agreed to stop Russian purchases. Still, reports say some Indian buyers are reconsidering their deals after the U.S. steps. This tension will shape trade flows in the coming weeks.

Economic and Consumer Effects

Higher crude oil prices fuel prices at the pump. That feeds into inflation. Transport costs rise too. Importing nations will face bigger energy bills. Central banks could watch energy-driven inflation closely. For developing economies, the hit could squeeze budgets and slow growth. Consumers may feel price pain within days.

Market Volatility and Near-term Drivers

Volatility is the immediate result. Factors to watch include enforcement of sanctions, responses from Russian authorities, and choices by big buyers. OPEC+ decisions will matter. So will shipping, insurance coverage, and clandestine trading. If enforcement is strict, prices could climb further. If buyers adapt quickly, the spike may be short-lived.

Possible Scenarios Ahead

One path is containment. Buyers shift to other suppliers. Shadow shipments continue. Markets then calm. Another path is escalation. Tighter enforcement and buyer pullback deepen the supply gap. In that case, crude could push higher and stay there. A third path is demand weakness. Economic slowdown or efficiency gains could offset supply risks and cool prices. Each scenario has different implications for inflation and growth worldwide.

Wrap Up

The October 22-23, 2025, U.S. action against Rosneft and Lukoil changed market calculus overnight. Prices rose as traders added a geopolitical premium. The coming days will show whether the shock is temporary or the start of a longer supply squeeze. Close attention to buyer behaviour, enforcement, and OPEC+ moves will show which path the market takes.

Frequently Asked Questions (FAQs)

Oil prices rose on October 23, 2025, after Donald Trump warned Russian oil firms, creating fear of supply cuts and pushing global market prices higher.

Sanctions on Russia reduce oil exports by limiting trade and shipping. This causes supply worries, leading to higher prices and tighter global energy markets.

Oil prices may rise if sanctions stay and supply stays tight. But prices could fall if demand weakens or more countries boost production.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.