Sikko Industries Stock Split Bonus Issue: Smallcap Stock Jumps Over 10%

On 18 October 2025, Sikko Industries Ltd.’s board approved a 1:10 stock split and a 1:1 bonus share issue. The market reacted fast. By 23 October 2025, the stock had jumped over 10% in a single day. For every one share you held at face value of ₹10, you’d now hold ten shares at ₹1 each and then get one extra share for each held. The move makes the stock more affordable and should boost its liquidity. Investors and traders are watching closely now.

Let’s unpack what these corporate actions mean, how they affect shareholders and market value, and why this has sent the small-cap stock into a strong rally.

Sikko Industries: Company Overview

Sikko Industries is a small-cap industrial firm with a base in Gujarat. The company makes specialty chemicals and related products. Its leadership team includes Ghanshyambhai Kumbhani as Executive Chairman and Jayantibhai Kumbhani as Managing Director. The firm has steadily expanded distribution across domestic and export markets over recent years.

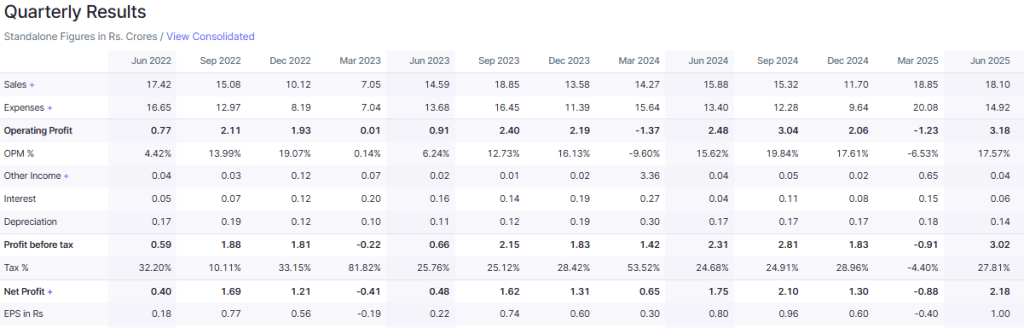

Financially, the company has posted recurring profits and rising sales in recent quarters, though margins and return ratios remain mixed. Market participants now view Sikko as a niche player with potential upside if it keeps growing sales and controls costs. Sources that track corporate filings and market data show the company has a modest market capitalisation relative to peers in its sector.

Details of the Sikko Industries Stock Split

On October 18, 2025, the board approved a stock split of one share of face value ₹10 into ten shares of face value ₹1 each. The split is designed to reduce the face value and make each share more affordable for retail investors.

The formal regulatory filing on the NSE lists the sub-division as a board recommendation, subject to shareholder approval at an extraordinary general meeting. The filing shows the company will increase its authorised and paid-up share counts once the split is executed. This is the company’s first stock split in its publicly available history. The NSE filing provides full details of the proposal.

Bonus Issue Announcement

Alongside the split, the board recommended a bonus issue in the ratio of 1:1. That means every existing share will earn one additional share as a bonus, subject to approval. The bonus will be capitalised from reserves and the securities premium account, according to the board resolution.

The company has scheduled an extraordinary general meeting on November 13, 2025, to seek shareholder consent for both items. If approved, an investor holding one share at ₹10 face value would end up holding twenty shares after the split and bonus are processed. The combination of split and bonus effectively doubles the share count for existing holders and lowers the per-share face value.

Market Reaction & Sikko Industries Price Movement

The market reacted sharply after the board’s October 18, 2025 announcement. The stock rallied in the sessions that followed. On October 23, 2025, Sikko Industries recorded intraday gains exceeding 10%. Some sources reported a three-day rise of about 27% from the pre-announcement level. Intraday highs reached around ₹122 on the NSE on October 23, 2025, according to live price feeds.

Trading volumes spiked as both retail and momentum traders piled in. Analysts note that corporate actions such as splits and bonuses often attract short-term interest from traders who expect greater liquidity and retail buying. The rapid price move reflects that dynamic.

Why the Company Chose This Route?

Management framed the actions as measures to improve liquidity and broaden the shareholder base. A lower face value makes the stock more accessible to small investors. The bonus issue signals management’s willingness to reward long-term holders and to increase free float.

For a small-cap firm, both moves can lower the bid-ask friction. They can also draw attention from funds and retail platforms that prefer lower-priced, higher-float names. That said, these steps do not change the company’s cash or book value. They change share counts and the per-share arithmetic. The fundamental financials remain the primary gauge for long-term investors.

Investor Sentiment and Fundamentals

Investor sentiment turned upbeat after the announcement. Retail investors showed strong interest. Delivery volumes and active positions rose on the exchange. Institutional holding changes are still pending formal filings, so it is too early to claim a sustained shift in ownership.

On fundamentals, Sikko has reported consistent revenues, but profitability margins and return on equity need monitoring. Balance sheet metrics show low to moderate leverage. Market watchers will watch upcoming quarterly results and order book details to decide if the recent price rise has a fundamental basis. Advanced tools, including an AI stock research analysis tool, can help parse earnings, margin trends, and comparative valuations quickly.

Historical Corporate Actions and Precedents

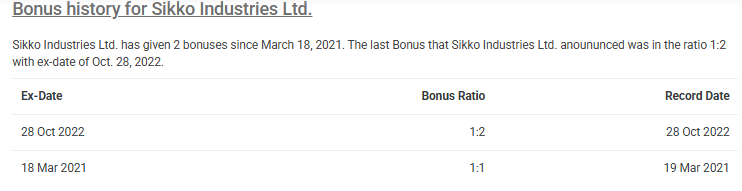

This is the first stock split recorded for Sikko in recent public archives. The company has used bonus issues in the past. When small caps announce both splits and bonus shares together, past cases show the immediate price reaction is often strong.

However, the medium-term performance varies by company. Some names that paired corporate actions with real earnings improvement continued to do well. Others saw profit booking once the initial excitement faded. Investors should check how Sikko’s historic performance in similar seasons has fared, and whether management follows through on growth plans.

Risks and What to Watch Next?

The first risk is valuation froth. A sharp price jump can invite profit booking. The second risk is operational. If sales growth slows, the elevated market price may correct. The third risk is liquidity assumptions. While a split increases share count, it does not guarantee a permanent rise in liquidity.

Key items to watch include the official record date when the company announces it, the outcome of the November 13, 2025, EGM, quarterly earnings, and any guidance from management on capacity or exports. Also monitor promoter holding patterns and any fresh disclosures filed with the exchanges. These signals will indicate if the move is backed by fundamentals or driven mainly by sentiment.

Technical and Trading Outlook of Sikko Industries

From a technical angle, the stock cleared short-term resistance after the announcements. The rise to a 52-week high indicates strong momentum. Traders should watch support near the pre-announcement price zones and new resistance at recent intraday highs.

Volume will be the deciding factor. If volumes remain elevated on up days and moderate on pullbacks, the trend can sustain. If volume dries up while price holds high levels, a reversal could follow. Short-term traders must use stop losses to manage risk. Long-term investors should focus on earnings and cash flows rather than purely on chart moves.

Final Words

The board’s October 18, 2025, decision to propose a 1:10 stock split and a 1:1 bonus issue changed the share math for Sikko Industries. The market rewarded the move with a fast and sharp rally by October 23, 2025.

The corporate actions can improve accessibility and potentially liquidity. They do not, however, change the underlying business. Future gains will depend on execution. Investors should watch the November 13, 2025, EGM outcome, the record date announcements, and the next earnings release. Careful analysis of fundamentals will tell whether the rally can last.

Frequently Asked Questions (FAQs)

On October 18, 2025, Sikko Industries approved a 1:10 stock split, changing the face value from ₹10 to ₹1 per share to improve share liquidity.

The record date for the 1:1 bonus issue has not been announced yet. It will be confirmed after the extraordinary general meeting on November 13, 2025.

The share price rose after the stock split and bonus issue announcement. Investors expect better liquidity, lower entry price, and improved trading activity after these corporate actions.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.