Polymarket Hits $10B Valuation as Tokenized Prediction Markets Surge

The world of digital finance and event-prediction trading just took a big step forward. Polymarket, a leading platform for tokenized prediction markets, is preparing for a valuation of up to $10 billion amid renewed momentum, regulatory breakthroughs, and expansion plans. For those tracking emerging tech, financial innovation, or alternative venues of speculation, Polymarket’s rise offers a compelling case study, even if you’re more familiar with stock market dynamics and stock research than crypto-markets.

What’s Going On with Polymarket?

Polymarket has been in the spotlight recently for its ambitious funding efforts and strategic positioning. According to multiple reports, the platform is in discussions with investors that could value the company at nearly $10 billion, up from about a $1 billion valuation only a few months ago.

Some key developments:

- Polymarket recently acquired the U.S. derivatives exchange QCEX (a move that helps address regulatory constraints) and obtained a no-action letter from the Commodity Futures Trading Commission (CFTC), clearing a path toward U.S. market re-entry.

- The company has secured high-profile backing: for example, venture funds such as Founders Fund, led by Peter Thiel, and an investment from the firm of Donald Trump Jr. via his advisory board role.

- Polymarket also upgraded its technology infrastructure. For instance, it integrated Chainlink oracles to improve data reliability and settlement speed, helping to make prediction markets more efficient and trustworthy.

So why is this relevant to someone even slightly interested in the broader stock research world? Polymarket’s growth reflects how alternative markets, outside traditional equities, are maturing, drawing large institutional backing, and influencing how we think about AI stocks, tokenized finance, and liquidity in new asset classes.

Why the Big Valuation Jump?

Here are the primary drivers behind Polymarket’s surge:

1. Addressable Market Expansion

Prediction markets allow participants to wager on the outcomes of real-world events, politics, economics, sports, or pop culture. Polymarket’s ability to scale this globally and now potentially re-enter the U.S. opens up a much larger universe of users.

2. Regulation & Credibility

Historically, prediction markets faced regulatory headwinds. Polymarket’s acquisition of QCEX and its regulatory clearance mark a key inflection point. That reduces a major risk factor, greatly increasing investor confidence.

3. Technology Upgrades & Tokenized Infrastructure

By integrating Chainlink oracles and working on blockchain-native settlement, Polymarket is not just a novelty; it is positioning itself as a scalable platform with high-end tech infrastructure. That matters to investors who value infrastructure plays similar to how they look at AI stocks or tech platforms.

4. Strategic Backing

When high-profile funds and public figures join in, it signals credibility. Founders Fund’s involvement, plus the advisory role of Donald Trump Jr. via his firm, lends weight and helps open doors.

Potential Risks & What to Watch

Even with strong momentum, Polymarket faces several risks that anyone interested in this space should understand:

- Regulatory uncertainty persists: While the U.S. is part of the game now, prediction markets still fall into grey zones in many jurisdictions (gambling vs derivatives). A regulatory reversal could hamper growth.

- Competition & alternative platforms: Others like Kalshi are also scaling and could capture portions of the market share.

- Liquidity & volume model: Prediction markets rely on active trading and volume. If user acquisition slows or regulatory friction increases, the business model may struggle.

- Valuation expectations vs execution: A speculative valuation of $10 billion is bold; execution must follow. Similar to how stock research warns of “growth at any cost,” a mismatch between expectations and results can lead to corrections.

- Tokenization & crypto volatility: As a token-enabled platform, Polymarket is exposed to broader crypto market swings, which traditional equity investors may see as additional risk.

Implications for the Market & Investors

For those monitoring the stock market or doing stock research, Polymarket’s rise offers interesting lessons:

- New infrastructure plays: In the same way AI stocks offer infrastructure or platform plays, Polymarket represents infrastructure for event-driven finance and token markets.

- Cross-asset learning: Traditional equity investors can borrow ideas, e.g., network effects, regulatory moat, scalability, and data importance. Polymarket ticks many.

- Risk/Return balance: Valuation jumps always attract attention. It reminds investors of “bubbles” or hype cycles; as with AI stocks, the key is distinguishing real, sustainable growth from mere speculation.

- Data as asset: Prediction markets generate real-time data on sentiment and outcomes. This kind of data may influence traditional markets (company earnings expectations, elections, regulatory outcomes) sooner than many expect.

- Broader financial innovation: Platforms like Polymarket blur lines between investing, betting, and information aggregation. Investors comfortable with innovation should monitor such models alongside traditional equity plays.

What to Monitor in the Coming Months

If you are watching Polymarket specifically, or similar innovation-driven firms, here are key metrics and events to follow:

- Funding round finalization & terms: Will the valuation hit $10 billion or land lower? What dilution or partner commitments come along?

- U.S. operations rollout: How fast does Polymarket resume U.S. operations, scale users, and comply with regulatory demands?

- User growth, volume & revenue metrics: While token economies differ from traditional earnings statements, indicators like active markets, volume settled, and fee revenue will matter.

- Partnerships and integration: Does Polymarket tie into major exchanges, data feeds, blockchain protocols, or institutional platforms?

- Regulatory shifts: New rules in the U.S., EU, or Asia on prediction markets, derivatives, or crypto will affect the operating model.

- Competitive response: How do rivals respond? Will Kalshi or other platforms raise capital and challenge Polymarket’s leadership?

Conclusion

Polymarket’s trajectory, from a $1 billion valuation just months ago to talks of a $10 billion valuation today, underscores the changing nature of financial markets. Tokenized prediction platforms, leveraging blockchain, data, and global reach, are emerging as credible alternatives to traditional market infrastructures. The keyword Polymarket encapsulates a firm at the crossroads of finance, tech, regulation, and speculation.

For investors entrenched in the stock world, this story is a reminder: innovation isn’t just in AI stocks or traditional tech, it’s also in how we predict, trade, and interpret events. While Polymarket doesn’t trade like a public equity (yet), its evolution offers insight into what “next-wave” infrastructure might look like.

If you’re studying stock research, watching the stock market, or simply curious about where finance goes next, keep an eye on Polymarket and its peers. The valuation is bold, but if executed well, the platform may change the way markets interpret events, manage risk, and process information.

FAQs

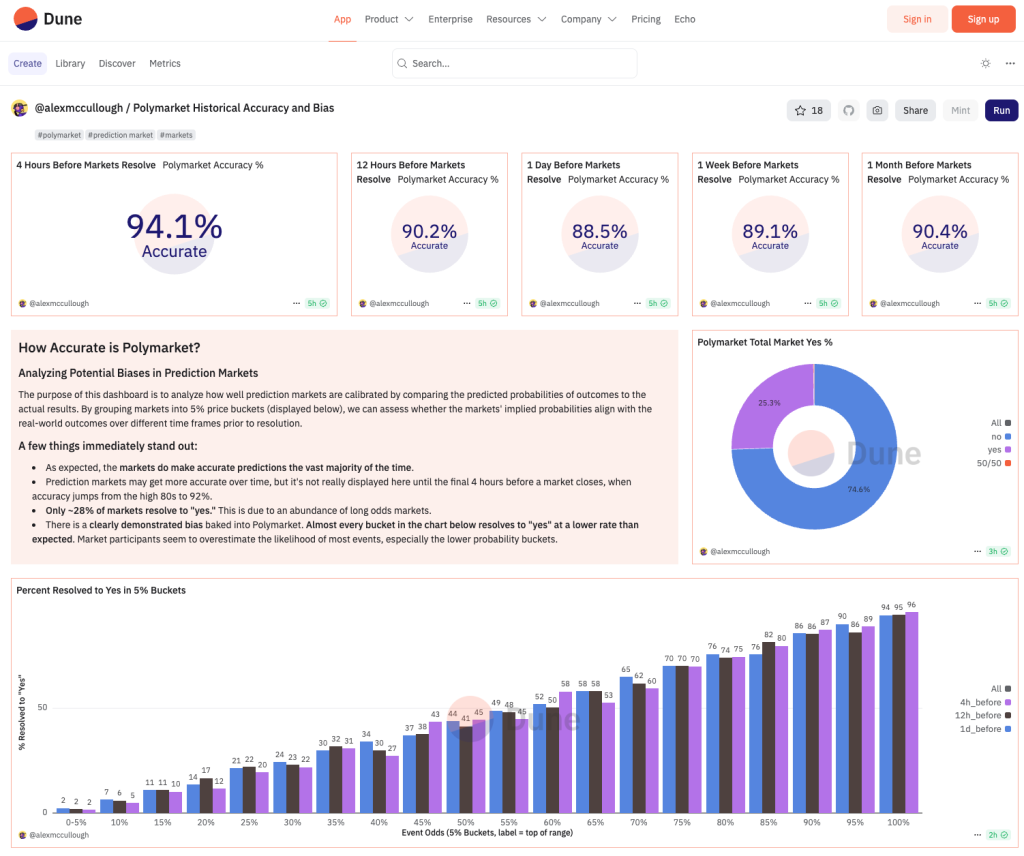

Polymarket is a blockchain-based platform where users can trade on outcomes of real-world events, political elections, economic indicators, and entertainment outcomes via tokenized contracts. The platform uses smart contracts and integrates blockchain infrastructure to enable decentralized prediction markets.

The valuation jump indicates strong investor confidence, driven by Polymarket’s regulatory progress (including U.S. approval), technology upgrades (e.g., Chainlink integration), and addressable market expansion. It signals that prediction markets are emerging from niche status toward mainstream financial infrastructure.

While Polymarket is not a publicly traded stock, its rise illustrates how innovative platforms can shift market dynamics. For investors doing stock research, the model shares traits with tech-infrastructure companies: network effects, data monetization, scalability, and regulatory risk. Understanding Polymarket helps one appreciate broader financial innovation beyond traditional equities.

Disclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.