Bullseye Turns Inward: Target layoffs 1,800 Jobs After a Decade of Expansion

After years of rapid growth and wide store expansion, Target Corporation is trimming its own ranks. Incoming CEO Michael Fiddelke announced plans to cut 1,800 corporate jobs as part of a broad restructuring.

The move marks the retailer’s first major workforce reduction in about a decade. It follows weak sales, margin pressure, and a drive to simplify decision-making across the company. Leaders say the changes are meant to speed decisions and restore profitability.

Understanding the Target Layoffs and What Led to It

Target (TGT) has long expanded its footprint and services. The last decade saw investments in stores, digital capabilities, and supply chains. That growth masked some internal complexity. Now, after repeated quarters of weak comparable sales, executives say the company needs to be leaner.

Rising inflation, shifting consumer spending, and tougher e-commerce competition also squeezed margins. The layoff affects about 8 percent of corporate staff and includes the closure of many open roles.

Why is Target making this move now? Management argues that too many layers slow down decisions and hurt execution.

Inside Target’s Corporate Restructuring Strategy

Under Fiddelke’s memo, the restructure aims to remove overlap, flatten reporting lines, and focus on core priorities. Cuts are concentrated at corporate centres, not stores or supply chain roles. The company will keep paying affected employees through early January and will offer severance packages.

Leadership frames this as a shift toward strategic efficiency and a return to stronger merchandise and inventory management. Bloomington headquarters and teams in Minneapolis are central to the changes, since much of corporate planning operates from those offices.

The restructuring also signals a push to reinvest in digital retail and supply chain upgrades.

How will this affect Target’s future growth? If the firm executes well, lower overhead should help margins and speed new initiatives. The risk is that cuts may weaken internal capabilities if not carefully redeployed.

What Analysts and Experts Say About the Target Layoffs

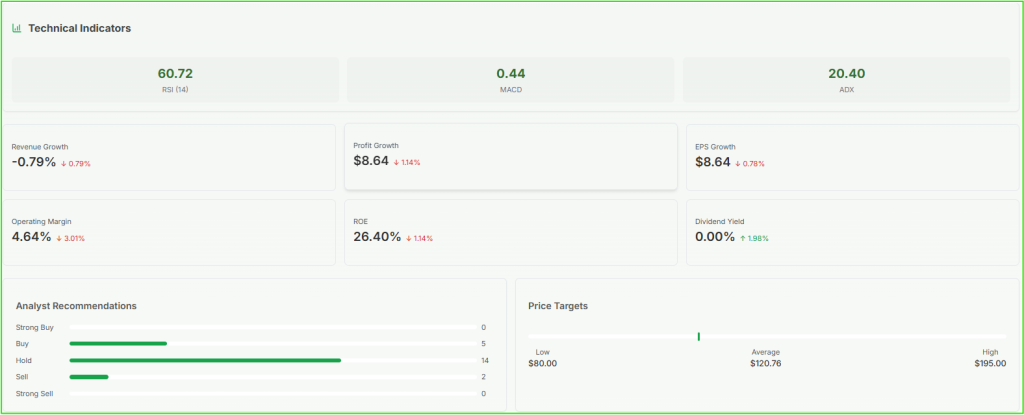

Market watchers quickly weighed in. Analysts noted that Target’s shares (TGT) have lagged rivals and its sales have been under pressure for months. Wall Street reacted to the memo with questions on execution and timing.

Media outlets such as Reuters, ABC News, and The Economic Times highlighted the scale and context of the cuts. Experts say the market will watch two things: whether savings hit the bottom line, and whether service and merchandising suffer. One analyst framed the move as a necessary, if painful, step to make the retailer more agile.

A LinkedIn News summary and industry posts echoed similar themes, noting that Target’s decision comes as investors press for clearer profit paths.

Social channels showed mixed reactions from journalists and analysts, with many pointing to a long runway of investments that must now yield returns.

Impact of the Target Layoffs on Employees and the Retail Sector

The human side of the cuts matters. Staff impacted will get pay and benefits through January and severance. Still, morale will likely dip in corporate teams as remaining employees absorb extra work.

Target (TGT) says store and fulfillment jobs are safe, which should limit direct hits to frontline hourly workers.

However, the move adds to an industry trend where big retailers streamline white collar roles while protecting store operations. Comparisons are inevitable with earlier layoffs at peers like Walmart and Amazon, which also trimmed corporate teams to cut costs or refocus strategy.

Will more retailers follow Target’s path? If consumer spending stays muted, other chains could tighten their corporate payrolls, especially where overhead rose during expansion years.

What Target’s Leadership Says About the Future

In his internal memo, Michael Fiddelke called the cuts a step toward building a faster, simpler Target. He wrote that overlapping roles and too many decision layers slowed the business. Leadership stressed the cuts will free resources to reinvent the supply chain, invest in technology, and sharpen the merchandise strategy.

The tone was firm but forward-looking: the company frames the changes as necessary for long-term sustainability and competitiveness in a tighter retail market. The message is that short-term pain is intended to create long-term gain.

How Investors and Customers Reacted to the Target Layoffs

Investors watched the stock for signs that the strategy could restore earnings. Early market reaction was cautious. Some traders welcomed decisive steps to cut costs, while others wanted clearer signs of revenue turnaround.

Social media showed mixed sentiment: customers expressed concern, employees shared solidarity posts, and analysts posted measured takes about execution risk. Coverage from major outlets tracked the share price movement and noted that Target’s share performance (TGT) had been behind peers this year, adding urgency to management’s moves.

Is Wall Street losing confidence in Target? Not necessarily, but confidence hinges on execution and signs of sales stabilization.

Conclusion: The Road Ahead for Target After the Target Layoffs

Target’s (TGT) decision to cut 1,800 corporate jobs closes a chapter of unchecked expansion and opens one of measured retrenchment. The move is a significant shift for a retailer that grew fast and leaned heavily on broad investments.

If Target can turn these savings into sharper operations and better merchandising, it may stabilize margins and regain investor trust. For employees and observers, the next few quarters will show whether the company can balance efficiency with growth. The Target layoffs are tough news, but leaders hope they set the stage for a stronger, more agile company in 2025.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”