Midwest Share Price Surges 10% on Strong D-Street Debut

On October 24, 2025, Midwest made a powerful entry into the Indian stock market with a strong listing on Dalal Street. The company’s shares opened 10% higher than the issue price, signaling strong investor demand and market confidence. The debut comes at a time when investors are showing renewed interest in quality IPOs after months of mixed market performance.

Midwest’s listing was one of the most awaited in recent weeks, driven by its solid business model and consistent financial growth. The stock’s early rally reflects optimism about the company’s future and the growing strength of its sector. Analysts believe the strong response was not just about market momentum; it was also about trust in the company’s fundamentals. For investors, Midwest’s debut stands as a reminder that sound businesses continue to attract attention, even in a cautious market environment.

Midwest Company Overview

Midwest Limited is a quartz-processing firm. It supplies processed quartz for solar glass and engineered stone. The company is a major producer and exporter in its niche. It serves domestic and overseas customers. Midwest has invested in capacity and energy integration. Recent years have shown steady revenue growth and improving margins. The firm positions itself as a supplier to fast-growing solar and construction markets.

IPO details

Midwest raised ₹451 crore through its public offering. The issue combined a fresh issue of ₹250 crore and an offer-for-sale of about ₹201 crore. The IPO price band was set at ₹1,014-₹1,065 per share. The retail lot size was 14 shares. Planned use of proceeds included capital expenditure for Phase II of a quartz plant, purchase of electric dump trucks, partial debt repayment, and general corporate purposes. These plans aim to expand capacity and cut freight and energy costs.

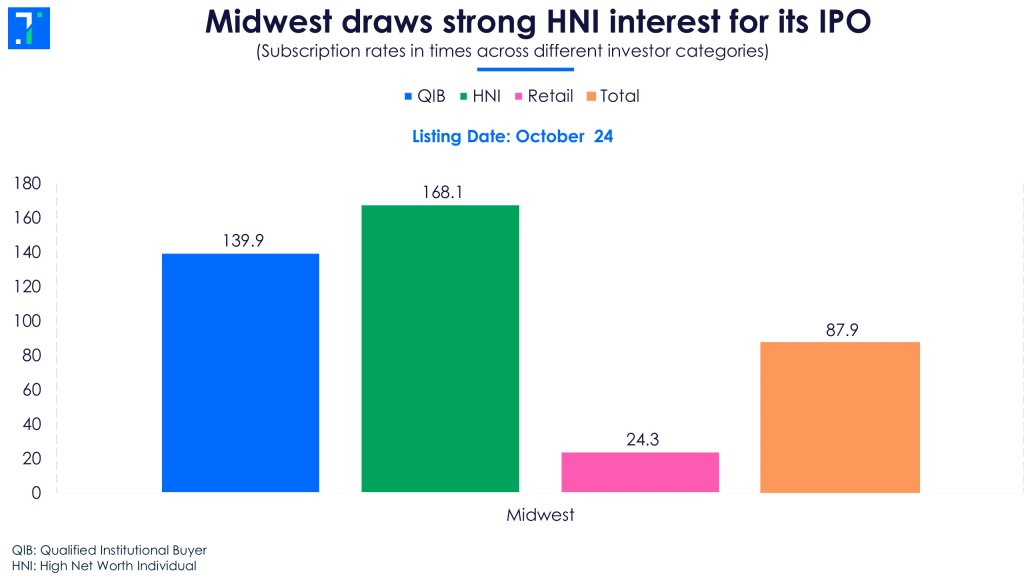

The IPO drew heavy demand. Overall, the subscription crossed about 92 times on the final tally. Strong bids came from institutional and non-institutional investors. Grey market signals showed a healthy premium ahead of listing. Those indicators set market expectations for a positive debut.

Listing Day Performance

On October 24, 2025, Midwest listed strongly on Dalal Street. The stock opened around ₹1,165 on both NSE and BSE. That figure represented roughly a 9-10% premium over the IPO upper price of ₹1,065. Intraday moves were modest after the pop, with some profit-taking seen soon after listing. Trading volumes were high in the initial minutes, then settled as investors digested the stock. Overall, the listing was in line with grey market expectations.

Why the Midwest IPO Debut was Strong?

Several factors drove the solid listing. First, demand for solar and engineered-stone inputs is rising. That tailwind makes the Midwest’s growth story easier to sell to investors. Second, the company’s near-term capital spend plans felt credible.

Investors liked that fresh capital would expand production and cut costs via electric vehicles and solar integration. Third, valuation at listing felt fair relative to expected earnings growth. Finally, the grey market premium had already signalled a likely listing gain, which drew momentum into the first trade. These elements combined to produce a strong debut.

Expert and Analyst Views on Midwest IPO

Brokerage notes called the listing a validation of the IPO price band. Analysts pointed to healthy order flows from construction and solar customers. Some viewed the near-term upside as limited after the initial pop. Others saw room for gains if the company reports steady volume growth and margin improvement. Short-term watchers advised caution on early volatility. Institutional commentary highlighted the balanced use of proceeds as a plus for corporate governance and cash flow planning.

Broader Market and IPO Trend Context

The Midwest listing comes amid a revival in India’s IPO calendar. Several mid-sized issues saw solid listings in the past months. That trend reflects renewed investor appetite for growth stories with clear cash-use plans.

Grey market pricing has become a reliable early indicator for listing performance this year. Market participants say selective listings are attracting fresh capital, while broader market volatility still tempers aggressive bets. In that context, Midwest’s debut is another signal that quality, sector-linked IPOs can still find demand.

Short-term Risks and Investor Considerations

Price momentum after listing can fade fast. Profit-taking is likely in the first few sessions. Investors should watch quarterly volumes and realisations. Execution risk for the Phase II capex must be monitored. Commodity input costs and export demand will affect margins. Currency swings could influence export revenue in the near term.

Also, macro volatility or a market correction could weigh on the stock despite good fundamentals. Some retail platforms used such an AI tool to quantify listing sentiment ahead of the debut.

Future Outlook for the Midwest

If Midwest can scale Phase II on time, revenue could rise meaningfully over the next 12–24 months. Improved energy sourcing and electric hauling can lower operating costs. The solar-glass segment shows steady demand due to renewable-energy targets.

For sustained gains, the Midwest needs stable realisations and steady order visibility from large buyers. Analysts may revise their targets as new quarterly data becomes available. Long-term upside will rely on execution and margin resilience amid raw-material cycles.

Wrap Up

Midwest’s October 24, 2025, listing was a clear market vote of confidence. The listing premium matched the narrative of rising demand in solar and engineered stone. Short-term volatility is likely, but the company’s capex plan and export footprint present a credible growth path. Investors should balance optimism with careful monitoring of execution, volumes, and margin trends.

Frequently Asked Questions (FAQs)

On October 24, 2025, Midwest listed at around ₹1,165 on NSE and BSE, about 10% higher than its IPO issue price of ₹1,065.

Midwest’s share price rose due to strong investor demand, solid IPO subscription, and growing confidence in the company’s future growth in the solar and quartz industries.

Experts suggest investors watch the Midwest’s earnings, expansion plans, and market trends before buying. The stock’s long-term value depends on steady growth and business execution.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.