Lloyds Bank Profit Slumps 36% as Car Finance Scandal Hits Earnings

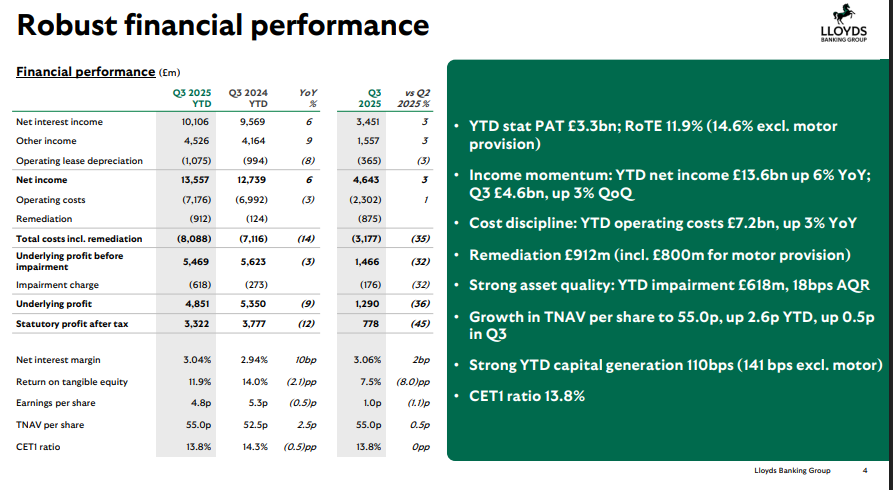

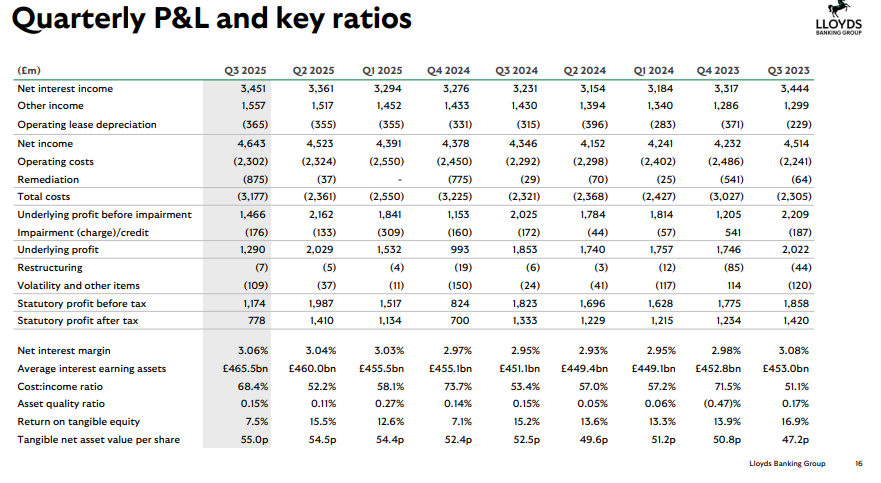

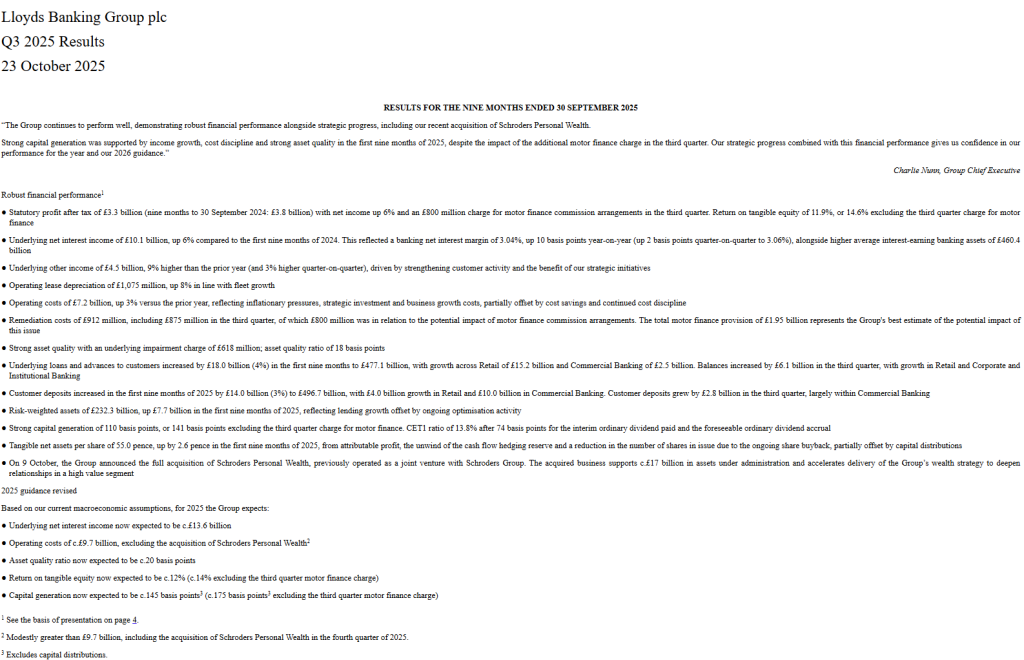

On 23 October 2025, Lloyds Bank Group revealed its third-quarter pre-tax profit had slumped by 36% to £1.17 billion. The main cause? A growing fallout from the UK car-finance scandal, in which customers may have been mis-sold loans through undisclosed dealer commissions.

Lloyds has now set aside about £1.95 billion in provisions to cover potential claims. As the country’s largest motor-finance lender, it finds itself squarely in the regulator’s spotlight. This sharp profit drop signals trouble not only for the bank but also for the wider consumer-finance landscape in the UK.

What happened with Lloyds Banking Group?

On 23 October 2025, Lloyds Banking Group reported a sharp fall in third-quarter pre-tax profit. Profit dropped by 36% to £1.17 billion. The bank said the decline was driven mainly by a fresh charge linked to the UK car-finance scandal. Lloyds added an extra £800 million to its motor finance provision in October. That brought its total set aside for redress to about £1.95 billion. The moves forced Lloyds to lower its 2025 return-on-tangible-equity forecast from roughly 13.5% to about 12%.

What is the Car Finance Scandal about?

The scandal focuses on historic motor loans where dealer commissions were not clearly disclosed to customers. Regulators and consumer groups say that, in many cases, customers paid higher costs because dealers steered them into finance deals that paid the dealer a hidden commission.

The Financial Conduct Authority (FCA) opened a consultation on a wide redress scheme in 2025. The FCA’s early estimates suggest an industry exposure that could reach billions and affect millions of contracts. Lloyds, through its Black Horse motor finance arm, is one of the largest lenders implicated.

Financial Damage to Lloyds Bank

The direct cost so far is material. Lloyds’ extra £800 million charge in mid-October raised total provisions to about £1.95 billion. That hit reduced reported profit sharply in Q3. The bank also trimmed its medium-term returns guidance because the payouts will weigh on capital generation.

Some analysts warn that legal and remediation costs could grow further if the FCA’s final scheme is broader than banks expect. Despite the charge, core banking income showed resilience, helped by higher net interest income across the first nine months of 2025.

How is Lloyds responding?

Lloyds has publicly said it will cooperate with the FCA. At the same time, senior executives have argued that the regulator’s proposed redress calculations may overstate true customer harm. The bank insists it will compensate customers who were genuinely harmed. But Lloyds has warned that the scale and method of the FCA proposal could be disproportionate.

Company leaders have left the door open to legal challenges if the final scheme departs from precedent. The bank also highlighted continued operational strengths, including steady retail deposits and growth in fee businesses.

Impact on Shareholders and the Market

Markets reacted with mixed signals. The initial profit hit put pressure on investor sentiment. However, some investors took comfort in Lloyds’ strong core results and its ability to generate capital. On the day of the announcement, shares showed limited downside as analysts parsed the size of the charge against ongoing earnings momentum.

The downgrade in return forecasts does increase scrutiny of the bank’s medium-term targets. Rating agencies and equity analysts will likely revise models to account for higher remediation risk. Financial commentators have employed data feeds and even an AI tool to stress-test different compensation scenarios.

What does this mean for Customers?

Customers who took out car finance deals in the past years should check their paperwork. The FCA’s consultation suggests many older agreements could be eligible for review. That does not mean every customer will receive compensation. Lloyds has said it will focus on cases where evidence shows actual detriment.

People who suspect they were mis-sold a deal should gather contract documents, dealer paperwork, and any evidence of undisclosed commissions. If the FCA moves forward with a scheme, banks will publish guidance on how customers can claim refunds.

Wider Industry Implications

The FCA has suggested the problem is industry-wide. Its consultation noted a possible universe of more than 14 million car finance agreements dating back to 2007. The regulator’s proposed approach could require a multi-billion-pound redress pot across lenders.

Smaller motor lenders and niche providers are under particular pressure, as they may lack the capital buffers of the big banks. The scandal could prompt deeper changes in how dealer commissions are disclosed and how consumer credit is priced. Banks may also accelerate shifts toward fee-based income to reduce future reliance on potentially contentious lending channels.

What’s Next for Lloyds and Regulators?

The FCA consultation remained open through October 2025 and could lead to a final package in the coming months. Lloyds’ next steps will include more detailed scenario testing and ongoing engagement with the regulator. The bank must also update investors and possibly revise guidance further if final redress rules are tougher than current assumptions.

For the wider market, attention will focus on whether other major lenders must lift provisions and how consumer protections will change. The ultimate cost and legal fallout hinge on how the FCA frames eligibility, the time window covered, and whether the courts are asked to weigh in.

Wrap Up

The motor finance scandal has delivered a clear and immediate hit to Lloyds’ reported earnings. The extra £800 million provision in October 2025 underscores how regulatory action can reshape bank profit profiles quickly. The situation remains fluid. Customers, investors, and the regulator will all shape the outcome. The bank’s ability to recover reputation and meet targets will depend on the scale of claims and the clarity of the FCA’s final rules

Frequently Asked Questions (FAQs)

On 23 October 2025, Lloyds Banking Group reported a 36% drop in pre-tax profit. It took an extra £800 million charge for the car-finance scandal.

Customers who took out regulated motor-finance agreements between 6 April 2007 and 1 November 2024 may be eligible. The case involves undisclosed dealer commissions.

Lloyds has set aside about £1.95 billion so far. The industry-wide redress scheme may cost billions more.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.